Gold Rates In India Alert: Will 1% GST Rate Cut In Gems & Jewellery Make Gold Cheaper? Calculation Here!

The GST council is expected to hold the 56th meeting in the first week of September, and hopes for rate cuts and benefits on various goods and services are once again making the rounds. Prime Minister Narendra Modi has announced the proposal of a significant revamp in GST norms, which will focus on structural reforms and rate rationalization and enable ease of living for the common man. For the gems and jewellery sector, experts are predicting a 0.5% to 1% GST rate cut on gold, bars, coins, biscuits and jewelry.

If the government trims GST rates on gold, it will boost demand and likely lower gold prices, which is a key positive ahead of festive season, especially Diwali.

"Given gold jewellery is usually bought on milestone occasions or as an investment, even a small cut in GST will largely help alleviate consumers' cost burden," said Aksha Kamboj, Vice President, India Bullion & Jewellers Association (IBJA) and Executive Chairperson, Aspect Global Ventures, to GoodReturns.

Let's understand the GST rate dynamic on gold, jewelleries and other gold-related instruments.

GST Rate On Gold Purchase In India:

The current GST rate on the value of gold is 3%, which is a combination of 1.5% CGST and 1.5% SGST. This is applicable to all types of gold, such as jewellery, coins, and bars.

When the government implemented the Goods & Services Tax (GST) in July 2016, a 3% GST rate on gold replaced the 1% Value Added Tax (VAT) and 1% service tax which were part of indirect taxes in pre-GST era.

Calculate the 3% GST Rate On Gold:

Gold Buy Value: Rs 1,00,000

3% GST Rate: 3%

GST Amount On Gold: Rs 3,000 (Rs 100,000 X 3/100).

GST Rate On Gold Making Charges:

There is an even higher GST rate on gold jewellery making charges to the tune of 5%. Additionally, there is a separate 3% GST rate imposed on custom-made jewelleries.

Calculation:Customers brought their own gold worth Rs 1,00,000 for custome-made jewellery and the making charges is around Rs 15,0

GST on gold: Rs 3,000 (3% of Rs 1,00,000)

GST on making charges: Rs 750 (5% of Rs 15,000)

Moreover, there is a separate 5% GST rate on repairing jewelleries.

"The existing GST rate is 3% for gold jewellery, along with 5% on making charges, and a reduction of 1 percentage point will quite sensibly bring down the cost for consumers," Kamboj added.

However, the expert also highlighted that while rate cuts can strengthen demand and spur consumption, policymakers will need to balance them against possible revenue shortfalls, particularly in the context of larger GST reforms meant for fiscal rationalization and consumption-led growth.

How Will A 1% GST Rate Cut On Gold Make Gold Prices Cheaper?

If the GST council cuts the rate by 1%, the new GST rate on gold would become 2%.

So, if you buy gold for Rs 100,000, the GST amount will be around Rs 2,000, which will be a reduction of Rs 1,000 and this will eventually lower the prices.

Gold Prices Peformance In August 2025:

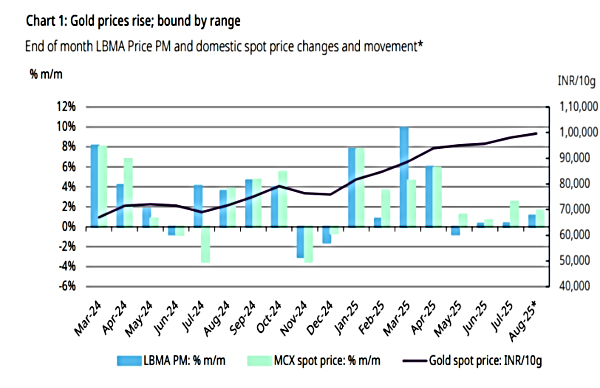

Despite correction in the past few days, gold prices across 24 carats, 22 carats, and 18 carats are up by 2% in August 2025 so far.

24 carat gold price touched a new all-time high of Rs 1,03,310 per 10 grams on August 8, 2025, and has corrected since then.

" A combination of factors, including a weaker US dollar, expectations of a Fed rate cut, rising inflation expectations, and ongoing tariff developments has driven the recent price movement," said Kavita Chacko, Research Head India at World Gold Council.

However, Chacko added, "overall price movement has remained range-bound. Despite short-term fluctuations, gold continues to outperform in 2025, delivering a 28% return in US dollar terms yearto-date."

Gold Jewellery Market Awaits Festive Season:

The demand for precious metals in the upcoming festive and wedding season is expected to be stable.

"Signs of demand revival are emerging as the gold jewellery market gears up for the upcoming festive and wedding season (from early August to year-end). Anecdotal reports from industry stakeholders suggest a positive outlook. This optimism was evident at the recent India International Jewellery Show (IIJS), the country's largest jewellery trade fair," said Chacko.

"As per anecdotal reports from the event, many manufacturers reported stronger-than-expected buying interest and a noticeable pickup in orders from both large chain stores and independent retailers. Retailers who had been cautious about their inventories in recent months due to lacklustre demand reported active restocking in anticipation of improved festive sales. And gold price stability also reportedly supported buyer sentiment," WGC's expert said.

Lastly, the WGC expect added, " Furthermore, to appeal to pricesensitive customers and to drive volumes, manufacturers are focusing on lighter- weight jewellery. Meanwhile, market reports suggest that investment demand for physical gold, i.e. bars and coins, remains healthy"

Disclaimer: The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications