Walmart To Keep Prices As Low As Possible Amid Trump’s Tariffs

Walmart will keep their prices as low as possible for as long as possible. The retailer's statement comes after it alerted customers about increased prices in Walmart stores from May or June, citing Trump's tariffs as the main reason.

"We have always worked to keep our prices as low as possible, and we won't stop," said, Meggan Kring, spokesperson for Walmart International, in a response to GoodReturns.

"We'll keep prices as low as we can for as long as possible given the reality of small retail margins," Kring added.

When asked about what parameters Walmart takes into consideration when revising prices, the spokesperson did not reply. Also, how much the prices of products will be hiked --- was not revealed.

With China agreeing to a 90-day window, Trump lowered the tariff rate to 30% on Chinese goods from 145%.

Despite the 90-day truce, St. Louis Federal Reserve President Alberto Musalem warns about the short-term impact on inflation both directly and through import prices, which as a result could push prices of domestic goods and services.

In 2024 Walmart's net profit margin was just 2.9%, and it imported almost $50 billion worth of goods from China, highlighted Joshua Brown, CEO at Ritholtz Wealth Management in a LinkedIn post.

"At a 30% tariff rate, you're talking about a hit of more than $15 billion," Brown's post said for Walmart.

So Walmart's choices could be either negative second-half earnings at the largest retailer in America, higher costs to the consumer, or another beautiful deal exempting Walmart and the things they sell, as per Brown.

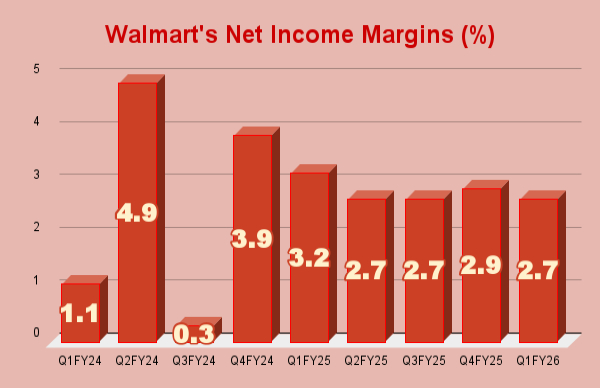

In Q1FY26, Walmart's net income margin declined 50 basis points to 2.7%, compared with a 3.2% margin in the same quarter last year. Also, the retailer's adjusted EBITDA margin is unchanged at 6.4%.

However, Walmart's net income margins have been volatile since FY25, ranging broadly from 3.2% to 2.7%. It has contracted by 120 points by the end of Q1FY26, from a 3.9% margin during Q4FY24.

Last week, Walmart's Chief Financial Officer John David Rainey told media agencies that there is a limit that a retailer like Walmart can bear, or any retailer.

Although Rainey acknowledged the Trump administration's tariffs, he believes they are too high.

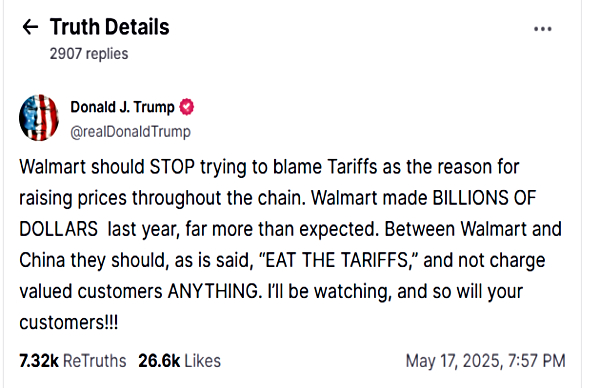

Following this, Trump lashed out at Walmart for blaming tariffs as the reason for the price hike.

Through his Truth Social account, over the weekend, Trump said, "Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain. Walmart made BILLIONS OF DOLLARS last year, far more than expected. Between Walmart and China, they should, as is said, "EAT THE TARIFFS," and not charge valued customers ANYTHING. I'll be watching, and so will your customers!!!."

During Liberation Day, April 2, Trump announced a 10% tariff as a baseline on the majority of imported goods, while taking a jibe at countries like China, India, Japan and South Korea with reciprocal tariffs.

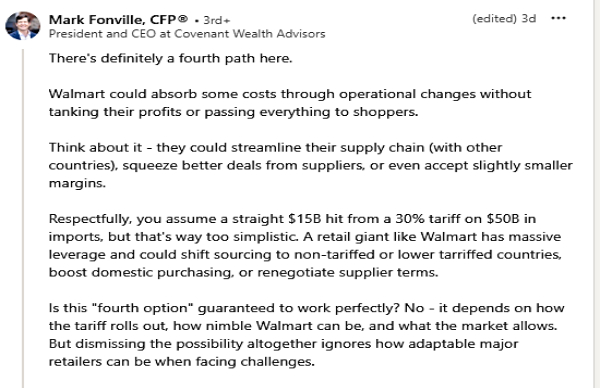

Some do believe Walmart can absorb the tariffs.

In his LinkedIn post Mark Fonville, president and CEO at Covenant Wealth Advisors, believes Walmart could absorb some costs through operational changes without tanking their profits or passing everything to shoppers.

Explaining in detail, Fonville said, "Think about it - they could streamline their supply chain (with other countries), squeeze better deals from suppliers, or even accept slightly smaller margins."

"it depends on how the tariff rolls out, how nimble Walmart can be, and what the market allows. But dismissing the possibility altogether ignores how adaptable major retailers can be when facing challenges," Fonville wrote lastly.

During Q1FY26, Walmart recorded a revenue of $165.6 billion, up 2.5%, or 4.0% (cc), including ~100 bps headwind from lapping leap day. Net sales from the US surged by 3.2% to $112.2 billion in Q1FY26 year-on-year. However, its net sales from international markets dropped marginally by 0.3% YoY to $29.8 billion.

From the market outside the US, Walmart's growth came from China, Flipkart, and Walmex in terms of constant currency. Net sales in the Chinese market surged by 22.5% YoY to $6.7 billion, but the growth scale was slower than the 23.1% growth in Q4FY25.

For the second quarter, Walmart expects net sales constant currency growth in the range of 3.5% to 4.5%, including approximately 20 bps tailwind from the acquisition of VIZIO. For the entire FY26, the company predicts 3% to 4% growth, while adjusted operating income is predicted to range from 3.5% to 5.5%.

"Given the dynamic nature of the backdrop and the range of near-term outcomes being exceedingly wide and difficult to predict, we felt it best to hold from providing a specific range of guidance for operating income growth and EPS for the second quarter. With a longer view into the full year, we believe we can navigate well and achieve our full-year guidance," said Rainey in the financial report.

The impact of the tariff on Walmart's earnings for the second quarter will be keenly watched.

At Walmart, each week, approximately 270 million customers and members visit more than 10,750 stores and numerous eCommerce websites in 19 countries. With fiscal year 2025 revenue of $681 billion, Walmart employs approximately 2.1 million associates worldwide.

Currently, Walmart's stock price is at $97.80 apiece. Since April 2, Walmart stock is up by 8.9% on the NYSE.

Click it and Unblock the Notifications

Click it and Unblock the Notifications