US Market Is Expensive As Ever: Magnificent 7 Stocks Beats China's GDP; What Should Investors Do Next?

Under a ruler who has unprecedented power to entangle the global environment, the US stock market and businesses are thriving to the point they are more expensive than ever! When US President Donald Trump shifted his gear back to the same old chant 'America First,' he led an orchestra of reciprocal tariffs, forcing countries to negotiate trade deals, getting NATO to hike defence funds to a peak, taming illegal immigration, and being a referee of modern wars. What was the US market's response to his stubborn 'Make America Great Again' agenda?

The US market jazzed by accelerating extremely high, surpassing the dot-com bubble and pre-great depression levels!

"The latest US stock market highs, which have seen them reach the highest valuations in history, have been largely fuelled by huge gains in mega-cap tech stocks, investor optimism surrounding artificial intelligence, and the expectation of interest rate cuts by the Federal Reserve later this year," said Ross Maxwell, Global Strategy Lead at VT Markets, to GoodReturns.

"Record share buybacks and strong corporate earnings in sectors like cloud computing, semiconductors, and software have also helped push valuations higher," he added.

Is that good news? Surely, record-high stock indexes have their perks! But there is also two sides to the coin!

In general terms, amidst a bull market, it is not surprising for stock indexes to hit record highs. But then comes the question of whether you're investing in an overheated market. In simple words, are you entering an overpriced market?

An overpriced market leads to consolidation phases and eventually cracks when its time comes! And many would argue that the extraordinary bull run is most likely a bubble, ready to burst!

In that case, for investors, it is important to understand how expensive a market or stock is compared to their revenue or earnings!

How expensive is US stock market?

Morningstar who cited the data of SG Securities revealed the following:

US stock market is currently is expensive by 24 times forecast per-share earnings for 2025. This is against the other emerging markets who are selling for 15 times. This super performance is not just limited to the AI push led by Magnificent 7 tech stocks like Nvidia, Meta, Microsoft, APPLE, or Amazon. There is more to an eye that meets!

The SG data also revealed that U.S. materials companies will sell 22 times their expected earnings in 2025, while their rivals in emerging markets will sell 16 times. The U.S. consumer discretionary stocks are more than 31 times those in other emerging markets, which sell for 19 times their earnings. America's energy companies are trading at nearly 17 times earnings, while other emerging markets are just at 12 times.

If that is not enough, then the US real estate sector is booming, earning 38 times its earnings, compared to other emerging markets, which just have 14 times. Even US utilities are more expensive than ever-20 times their earnings-compared to 12 times in other emerging markets.

According to data tracked by Yale economics professor and Nobel laureate Robert Shiller, the U.S. market is now more expensive in relation to underlying fundamentals than at any time in history apart from the peak of the great bubble in 1999 to 2000, as per a Morningstar report.

When Trump kickstarted the month of August with new tariffs and future tariff threats, along with focusing on the Russia-Ukraine war and taking a jibe at US Federal Reserve for not cutting key interest rates, the mainboard indices Dow Jones, S&P 500 and Nasdaq Composite were moving to hit all-time record highs.

The latest to hit a new high is the Dow Jones on August 22 to 45,757.84. However, S&P 500 touched its new record high of 6,481.34 on August 15, and the Nasdaq Composite hit its new lifetime high of 21,803.75 on August 13.

"The S&P 500 is now trading at 3.15x sales, its highest valuation in history," said Charlie Bilello, chief market strategist of Creative Planning.

The Barchat showed, "U.S. Stock Market hits its most expensive valuation in history, surpassing the Dot Com Bubble and the run-up to the Great Depression."

Global brokerages like UBS, Citigroup, HSBC and Jefferies have already started to raise their target for markets. Jefferies is predicting a 6,600 mark for the S&P 500; that is a new high!

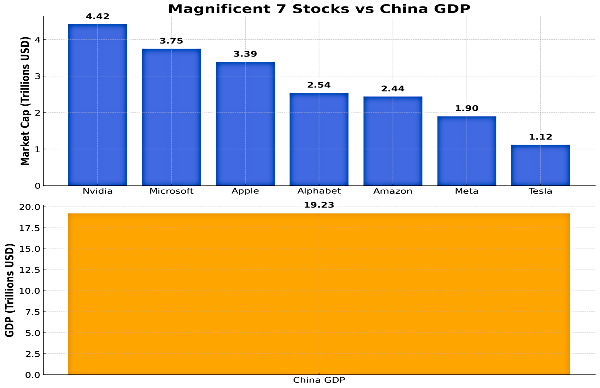

The Magnificent 7 Stocks Are Together Bigger Than China's GDP:

The 7 magnificent stocks are - Nvidia, Microsoft, Apple, Google's parent Alphabet, Amazon, Meta and Tesla. Of these 7 stocks, six of them are the world's top 6 most valued companies, with the exception of Elon Musk's Tesla, which is currently the 9th largest company. Their total market valuation is around $19.558 trillion, which is higher than the IMF's 2025 GDP estimate for China of $19.231 trillion.

What should investors do when US market is expensive?

"In the short term, momentum may keep markets elevated, especially if economic data remains resilient and earnings continue to surprise to the upside. However, the risk of correction is growing, as rising real yields, sticky inflation, and geopolitical uncertainty could pressure high valuations," Maxwell told GoodReturns.

For investors, he added, "this environment demands caution."

He lastly said, while staying invested in quality growth names has merit, there's growing value in diversifying across sectors and geographincally. Rotating some exposure into value stocks, holding cash reserves, and adopting hedging strategies can help manage downside risk.

Click it and Unblock the Notifications

Click it and Unblock the Notifications