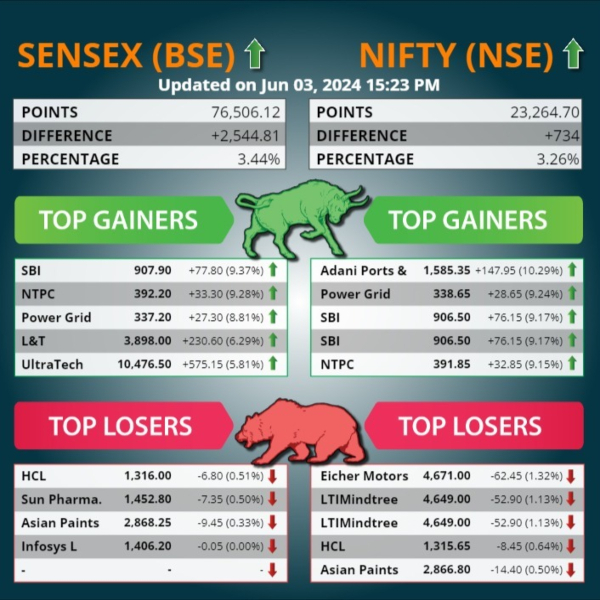

Sensex ended the day with a gain of 2,507 points to 76,468 and Nifty skyrocketed 733 points to 23,264 on Monday, June, 3, 2024. Nifty Bank rallied 1996 points to 50,978 and Nifty Midcap zoomed 1648 points to 53,353.

Banking, Infrastructure stocks witnessed a rally in trade today. Shares of SBI, NTPC emerged as the top gainers of the day.

On Monday, the State Bank of India (SBI) proudly ascended to the prestigious league of stocks boasting a market capitalization of Rs 8 trillion. This remarkable feat marked the first instance of the country's largest public sector bank achieving such a milestone. The bank's market capitalization crossed this significant threshold today, buoyed by an impressive 8.4 percent surge in its share price. Touching a new pinnacle of Rs 899.55 on the BSE during intraday trading, SBI demonstrated its robust performance and solid investor confidence.

Earlier today, Sensex touched a lifetime high of 76,738.89, while Nifty 50 skyrocketed to hit new historic high of 23,338.70. The bullish trend was driven by massive buying in banking stocks.

BSE Bankex zoomed 3%. Nifty Bank also gained by 2.7%. All sectoral indices saw huge rally with gains ranging from 1% to 5%. PSU, defence, railway, PSU banks, oil and gas stocks were among top gainers.

In the early trade, Gift Nifty surged as high as 771.5 points, hitting a new 52-week high of 23,519. While Asian shares also traded in green in the early trade.

Lok Sabha Election 2024 which kick started on April 19, 2024, concluded its last poll on January 1, 2024. The outcomes of voting will be declared on June 4, and majority of consensus is a comeback of PM Modi-led government.

Auto stocks such as Hero MotoCorp, Tata Motors, Maruti Suzuki India, TVS Motor, Mahindra & Mahindra, Ashok Leyland, Eicher Motors, and Escorts Kubota will be in focus due to their May month sales figure. While defence, railway, energy and power stocks will also be trending as they're expected to be biggest beneficiary of a saffron party return in power.

Additionally, RBI's June policy outcomes will also have an influence on market sentiments.

Bernstein sees see a higher probability of around 330-350 seats, which is more of a scenario that will drive some rally in the markets post-election results (or heading into it).

LIVE Feed

Jun 03, 2024, 3:40 pm IST

Top 5 Gainers And Losers Today.

Stock Market Live Updates

Jun 03, 2024, 3:19 pm IST

"SBI's Market Cap Surpasses ₹8 Trillion; Shares Approach ₹900 Level"

On Monday, State Bank of India Ltd., the largest lender in India, surpassed ₹8 trillion in market capitalization, reaching a new record high of ₹898 during the session. Notably, the stock had initially breached the ₹7 trillion mark on March 7 of this year. Since the beginning of the year, the stock has witnessed an increase of over ₹3 trillion in market capitalization.

Jun 03, 2024, 2:56 pm IST

"Government Plans Disinvestment In IDBI Bank For PSU Stake Sale"

Speculations are rife about the agenda for the initial 100 days of the newly elected government, with exit polls suggesting a probable re-election of Prime Minister Narendra Modi's administration. The government, holding a 63.75% stake in Shipping Corporation of India (SCI), is reportedly considering selling its shares. Sources indicate that bids may be solicited for SCI in the initial phase. Previously, SCI's land assets entity underwent demerger and was separately listed on the exchanges.

Jun 03, 2024, 2:34 pm IST

"Shriram Finance Surges 7% After Securing 8M In Syndicated Term Loan Deal"

Shriram Finance Ltd., the leading entity of the Shriram Group, experienced a surge of up to 7% in its shares on Monday following the announcement of securing a multi-currency social loan totaling 5 million and €40 million through a syndicated term loan transaction. This significant milestone represents the largest syndicated loan transaction for a private non-banking financial company (NBFC) in Shriram Finance's history, as stated in an exchange filing by the company.

Jun 03, 2024, 2:16 pm IST

Aurobindo Pharma Jumps 4% Following Subsidiary's Pact with MSD

Shares of Aurobindo Pharma climbed nearly 4% on June 3 after its wholly-owned subsidiary, TheraNym Biologics, signed a master service agreement with Merck Sharpe & Dohme Singapore for the contract manufacturing of biologicals.

Jun 03, 2024, 1:11 pm IST

BSE Completes Acquisition Of Asia Index, Now Sole Owner

India's oldest stock exchange, BSE, has successfully acquired the entire equity stake of S&P Dow Jones Indices (S&P DJI) in Asia Index Private Limited (AIPL), making AIPL a wholly-owned subsidiary of BSE. Despite the ownership change, AIPL will continue to offer its services to clients subscribed to its indices and data products. Originally a joint venture between S&P DJI and BSE, AIPL is renowned for calculating and maintaining the popular Sensex index.

Jun 03, 2024, 12:06 pm IST

Weekly Global Market Outlook From Alex Volkov, Market Analyst At VT Markets

Week ahead: Wall Street sees declines as treasury yields rise

Wall Street endured a tough week, marked by significant declines driven by rising Treasury yields and hawkish comments from Federal Reserve officials. The market sentiment was further dampened by higher-than-expected inflation data from Germany and Australia, escalating global inflation concerns.

As the market braces for the key US personal consumption expenditures (PCE) inflation data, divided opinions persist on whether the Federal Reserve will initiate the first rate cut in September. The upcoming week promises to provide crucial insights into inflation trends and economic stability.

China this week: Recent economic data from China has been mixed, with strong first-quarter GDP and trade activities contrasted by weak domestic demand. The official PMI numbers for May were disappointing, with the manufacturing PMI falling to 49.5 and the services PMI also weaker than expected. Expectations for the Caixin manufacturing PMI, which will be released on 3 June 2024 at 1:45 AM GMT, point to a slight increase to 51.5 from 51.4.

The manufacturing sector, a vital component of China's economic health, has shown signs of contraction. This is reminiscent of the slowdown seen in 2015 when similar PMI figures preceded a period of economic restructuring and stabilization.

Traders are keenly watching for any signs of recovery in the services sector, with the services PMI due on 5 June 2024. The services sector has become increasingly important in offsetting manufacturing weaknesses.

Europe outlook: During the April policy meeting, the European Central Bank (ECB) displayed confidence in controlling inflation and hinted at a potential rate cut. A 25 basis point rate cut is highly probable, with markets pricing a 97% chance.

Traders will be focused on the upcoming guidance and fresh economic projections for growth and inflation, with the interest rate decision announcement scheduled for 6 June 2024.

The ECB's potential rate cut comes at a critical juncture, drawing parallels to the 2014 period when the ECB implemented negative interest rates to combat deflationary pressures and stimulate growth. The market will be watching closely to see if the ECB's measures can successfully navigate the current economic landscape marked by persistent inflation and sluggish growth.

In April, the US economy added 175,000 jobs, with the unemployment rate rising to 3.9%. Federal Reserve officials have suggested that further rate hikes might be necessary, but a weakening labor market could prompt quicker rate cuts.

Expectations for May include an addition of 180,000 jobs, a stable unemployment rate at 3.9%, and unchanged participation and hourly earnings rates, with the data to be released on 7 June 2024.

This employment data will be closely scrutinised, similar to the post-2009 recovery period when job creation and labor market dynamics played pivotal roles in shaping monetary policy. The labor market's performance will be a key indicator of economic resilience and will influence the Federal Reserve's decisions on future rate adjustments.

Jun 03, 2024, 11:55 am IST

Amul Hikes Milk Prices By Rs 1 To Rs 3 Per Litre; Cites Rising Production Costs

The Gujarat Cooperative Milk Marketing Federation (GCMMF), which markets its dairy products under the brand name Amul, announced a price hike for its packed milk products. Effective from June 3, 2024, the prices of Amul's milk products have increased by Rs 2 per litre on average. This price adjustment applies to all segments of Amul's fresh pouch milk, including popular variants such as Amul Gold, Amul Taaza, and Amul Buffalo Milk.

Amul Gold: The half-litre pouch price has increased from Rs 33 to ₹34, while the one-litre pouch now costs Rs 68, up from Rs 66.

Amul Cow Milk: The half-litre pouch will now be available at Rs 29, up from Rs 28. The one-litre pouch will be sold at Rs 57, instead of the previous Rs 56.

Amul Taaza: Consumers will now pay Rs 28 for a half-litre pouch, up from Rs 27, and Rs 56 for a one-litre pack, up from Rs 54.

Amul Slim n Trim: The price for a half-litre pouch has increased to Rs 25 from Rs 24, and the one-litre pouch to Rs 49 from Rs 48.

Amul Buffalo Milk: The half-litre pouch price has jumped from Rs 35 to Rs 37, and the one-litre pouch from Rs 70 to Rs 73.

Sagar Skimmed Milk: Prices remain unchanged, with half-litre pouches at Rs 20 and one-litre pouches at Rs 40.

Jun 03, 2024, 11:43 am IST

Sensex Today: Alok Jain, smallcase manager and founder, Weekend Investing

A big move is always expected around big events. Elections are the biggest event for India markets every 5 years. This time it was even more interesting given that a strong leader is contesting for a third term fighting anti-incumbency and only once in the past 75 years has this feat been achieved of three consecutive terms. However the markets have been extremely positive. The indices in the past 6 months in the anticipation of the new govt offering continuity in reform risen nearly 20%. The exit polls over the weekend have bolstered the expectation of the current govt sweeping the polls again.

In the history of past election day moves, in 2009 the markets hit upper circuit on a surprise win, in 2014 markets ran up nearly 10% before election result day and in 2019 also a few days of good run post results ensued. This time the markets ran up from Nov to Feb but consolidated largely since then. If there is an outcome of continuation which the market is sensing on Monday a lot of funds sitting on the sidelines can continue to pour in, tremendously large FII short positions that have been built can over time be unwound and expectations of new measures in the first 100 days can keep the ball rolling.

Jun 03, 2024, 11:16 am IST

Sensex Today: Vikram Kasat, Head - Advisory, Prabhudas Lilladher

“I have witnessed bulls being slaughtered and taken to the cleaners in 2008 and 2009. This time around, a similar fate could await the bears. Most on the street were pessimistic about Modi Ji's chances or were sitting on the sidelines. Now, very few will have the courage to participate on the upside. People will continue to clamor for a correction, but I believe every dip will be bought into. The month of June could be a defining one for the Bulls, so one should make the most of this opportunity and stay a bit greedy. Last month, I kept saying "BUY THE DIP"; this month's slogan is going to be "RIDE THE WAVE." More power to Modi Ji !!!

Jun 03, 2024, 11:01 am IST

IRFC Shares At Record High: Multibagger PSU Stock Surges 100% In 2024; Declares Dividend

Indian Railways Finance Corporation (IRFC) Ltd shares reached a new record high on Monday, with a gain of 13% in early trading. The stock climbed to Rs 200, surpassing its previous high of Rs 192.8 set on January 23, 2023. This latest surge reflects a stunning 100% increase in 2024 alone.

IRFC's stock performance in 2024 has been nothing short of phenomenal. In January 2024, the stock recorded the best month on record for IRFC, with the stock price surging over 75%. Despite a lull in February and March, the stock rebounded strongly, gaining 10% in April and 13% in May. This sustained growth has propelled the stock to new heights, rewarding investors with significant returns.

Jun 03, 2024, 9:39 am IST

Crude Oil Outlook

Rahul Kalantri, VP Commodities, Mehta Equities: Crude oil prices experienced significant volatility over the past week, dropping ahead of the upcoming OPEC+ meeting and a surprising decline in U.S. gasoline demand. According to the U.S. Energy Information Administration (EIA), U.S. crude oil inventories fell by 4.2 million barrels last week, surpassing the expected decline of 1.6 million barrels. Despite the peak summer driving season, gasoline demand unexpectedly decreased by about 2% from the previous week to 9.15 million barrels per day. This drop in demand led to U.S. gasoline futures hitting three-month lows. Crude oil prices also declined in anticipation of the OPEC+ meeting scheduled for Monday. A recovery in the dollar index contributed to the decrease in oil prices. However, easing inflation in the U.S. and a potential rise in demand during the peak summer driving season could provide support for oil prices at lower levels. We expect crude oil prices to remain volatile in today’s session. Crude oil has support at .60–76.10 and resistance at .90-78.70 in today’s session. In INR, crude oil has support at Rs 6,370-6,310 and resistance at Rs 6,510-6,590.

Jun 03, 2024, 9:37 am IST

Banking Stocks Lead Strong Bullish Trend

Ahead of election poll results, Bank Nifty index touched a new 52-week high of 50,990, while BSE Bankex also skyrocketed to hit its own record high of 58,029.90. Nifty Private Bank index zoomed to new high of 25,187.95, and Nifty PSU Bank also rallied to lifetime high of 7,784. There were no banking stocks in red. Bank of Baroda, SBI, IndusInd Bank, Axis Bank and PNB were top gainers.

Jun 03, 2024, 9:37 am IST

Historic High For Nifty

The 50-scrip benchmark opened at23,337.90, and in a matter of seconds surged to touch a new historic high of 23,338.70. At the time of writing, the benchmark was at 23,141.35 points or 610.65 points or 2.71%.

Jun 03, 2024, 9:37 am IST

Sensex In Record Rally

Sensex opened at 76,583.29, to rally at new lifetime high of 76,738.89. Overall, the benchmark surged by 2,777.58 points before correcting slightly. The benchmark traded at 75,971.78, up by 2010.47 points or 2.72% at the time of writing.

Jun 03, 2024, 9:26 am IST

Market Opens At Record High

The Indian stock market indices surged to new record highs on June 3, driven by exit polls predicting a decisive victory for the NDA. The Sensex climbed 2,082.17 points, or 2.82%, to reach 76,043.48, while the Nifty rose 628.60 points, or 2.79%, to 23,159.30.

Jun 03, 2024, 9:24 am IST

Indian Rupee Touches 3-Month High Ahead Of Poll Results

The Indian rupee crossed 83 mark to open at 83.11 against US dollar ahead of election poll results. The market consensus is a majority win by PM Modi-led government in 2024 Lok Sabha Election. A third tenure of the current government indicates policies continuity and stable macro-economic environment. Also, rupee's performance comes amidst record high rally in domestic equities.

Jun 03, 2024, 9:20 am IST

Market On Monday

Prashanth Tapse, Senior VP (Research), Mehta Equities: Dalal Street is poised for a strong start to June, with Gift Nifty indicating a gap-up (+602, 23343) as bulls eye Nifty’s all-time high of 23,111, driven by optimistic exit poll results predicting a significant win for the BJP-led NDA. Key catalysts include India’s GDP exceeding estimates at 8.2% for FY24, a surge in Dow Jones by 574 points, increased odds of a September rate cut, early monsoon advancement, and a 10% rise in GST collections to Rs 1.73 lakh crore in May. With both FIIs and DIIs being net buyers, Nifty and Bank Nifty are set to climb, with targets of 23,111 and 50,000+ respectively. Bullish stocks to watch include ADANI PORTS, SUZLON, JUPITER WAGON, GMR INFRA, and HDFC AMC. Suzlon (CMP 47) is recommended for accumulation with long-term targets at 53/59 and an aggressive target of 75.

Jun 03, 2024, 8:43 am IST

Europe Outlook This Week

Alex Volkov, Market Analyst at VT: During the April policy meeting, the European Central Bank (ECB) displayed confidence in controlling inflation and hinted at a potential rate cut. A 25 basis point rate cut is highly probable, with markets pricing a 97% chance. Traders will be focused on the upcoming guidance and fresh economic projections for growth and inflation, with the interest rate decision announcement scheduled for 6 June 2024.

The ECB's potential rate cut comes at a critical juncture, drawing parallels to the 2014 period when the ECB implemented negative interest rates to combat deflationary pressures and stimulate growth. The market will be watching closely to see if the ECB's measures can successfully navigate the current economic landscape marked by persistent inflation and sluggish growth.

Jun 03, 2024, 8:42 am IST

China This Week

Alex Volkov, Market Analyst at VT: Recent economic data from China has been mixed, with strong first-quarter GDP and trade activities contrasted by weak domestic demand. The official PMI numbers for May were disappointing, with the manufacturing PMI falling to 49.5 and the services PMI also weaker than expected. Expectations for the Caixin manufacturing PMI, which will be released on 3 June 2024 at 1:45 AM GMT, point to a slight increase to 51.5 from 51.4. The manufacturing sector, a vital component of China's economic health, has shown signs of contraction. This is reminiscent of the slowdown seen in 2015 when similar PMI figures preceded a period of economic restructuring and stabilization. Traders are keenly watching for any signs of recovery in the services sector, with the services PMI due on 5 June 2024. The services sector has become increasingly important in offsetting manufacturing weaknesses.

Jun 03, 2024, 8:42 am IST

Wall Street This Week

Alex Volkov, Market Analyst at VT : Wall Street endured a tough week, marked by significant declines driven by rising Treasury yields and hawkish comments from Federal Reserve officials. The market sentiment was further dampened by higher-than-expected inflation data from Germany and Australia, escalating global inflation concerns. As the market braces for the key US personal consumption expenditures (PCE) inflation data, divided opinions persist on whether the Federal Reserve will initiate the first rate cut in September. The upcoming week promises to provide crucial insights into inflation trends and economic stability.

Jun 03, 2024, 8:18 am IST

Weekly Market Outlook:

Vinod Nair, Head of Research, Geojit Financial Services: Due to a lack of positive triggers, the bulls faced resistance at higher levels, leading to profit booking across the sector. The caution ahead of the exit poll results and the fear of any knee-jerk reaction prompted market participants to sideline riskier assets. However, investors are adjusting their portfolios to align with fundamentally strong sectors and stocks, as robust Q4 FY24 earnings and better-than-expected Q4FY24 GDP growth will continue to provide a buffer on valuation in the medium term. Weak global cues have further dampened market sentiments, and higher core inflation in the Eurozone may lead the ECB to maintain the status quo on rates. The short-term direction will hinge on the general election results. However, the release of major economic indicators such as RBI policy, PMI data, and auto sales numbers will provide investors with a more comprehensive perspective on the market.

Jun 03, 2024, 8:17 am IST

Gift Nifty Strong Rally

Gift Nifty witnessed a massive rally on Monday's early trade. The exchange traded at 23,504, rising by 756.50 points or 3.33% after touching a new 52-week high of 23,519 ahead of Lok Sabha Election results. By end of May 2024, the exchange held 22,747.50 levels.

Jun 03, 2024, 8:15 am IST

Nifty May Performance

Nifty holds 22,530.70 levels by end of May month. The benchmark rose by at least 54.85 points or 0.24% in May 2024 ahead of election poll results.

Jun 03, 2024, 8:15 am IST

SENSEX May Performance

Sensex exited May month at 73,961.31. Overall, in the month, the 30-scrip benchmark surged by 83.16 points or 0.11%.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Monday, June 3, 2024, 8:13 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications