Indian equity markets are experiencing a challenging start to the January series expiry week, with just four trading sessions remaining before the Union Budget on February 1. The Nifty 50 index has dropped over 200 points, falling below the 23,000 mark for the first time since June 7. This decline has brought the index to a six-month low.

The broader markets are feeling the impact more acutely. The Nifty Smallcap index fell over 4% on Monday, extending its decline to 15% from its peak on September 6 last year. Similarly, the Nifty Midcap index is down nearly 3%, or about 1,500 points. On Monday, 93 stocks in the Midcap index and 98 stocks in the Smallcap index were trading at losses.

Global Market Weakness

The fall in broader markets has resulted in a loss of ₹8 lakh crore in investor wealth within just two hours of trading. One contributing factor is global market weakness. Indian equities entered this week following a weak handover from Wall Street. While Wall Street benchmarks saw modest profit booking after a four-day rally, futures indicated a sharp drop.

As of 3:30 PM, Nasdaq futures had fallen nearly 750 points due to concerns surrounding a Chinese AI start-up called DeepSeek. This development has jeopardised the entire US AI rally.

LIVE Feed

Jan 27, 2025, 3:52 pm IST

Nifty Target Adjustments

On January 21st, brokerage firm InCred reduced its Nifty 50 target by 8%, assigning a bear case target close to levels around 21,000 due to growth slowdown concerns and recent EPS cuts.

Jan 27, 2025, 2:28 pm IST

Sensex Takes a Dive of 800 Points, Nifty Sinks to 22,840 Amidst Market Decline

The Sensex experienced a significant drop, plunging over 800 points to reach a low of 75,348.06, while the Nifty dipped below the 23,000 threshold. This downturn in the market was influenced by a mix of international and local issues that have been affecting the confidence of investors. The Sensex, which began the day at 75,700.43 following its previous close at 76,190.46, saw a sharp decrease of 818.36 points, settling at 75,372.10. Concurrently, the NSE Nifty50 witnessed a decline of 250 points, ending at 22,841 by 2:24 AM. These movements underscore the volatile nature of financial markets, driven by various factors that impact investor sentiment.

Jan 27, 2025, 1:59 pm IST

Which Indices Are Dragging Nifty?

Nifty Midcap 100 and Nifty Smallcap 100 were down by 2-4%. All sectoral indices were in red. Nifty Healthcare, Nifty Consumer Durables, Nifty Pharma, Nifty IT, Nifty Metal, and Nifty Oil & Gas stocks plunged by 2% to 2.5%. Nifty Media plummeted by nearly 4%. Also, Nifty Auto was down 1%.

Jan 27, 2025, 12:07 pm IST

UltraTech Cement's Potential Acquisition of HeidelbergCement India

UltraTech Cement, part of the Aditya Birla Group, is in advanced discussions to acquire HeidelbergCement India Ltd. This move follows a meeting between top executives from UltraTech and Heidelberg's global management. Heidelberg currently holds a 69.39% stake in its Indian business, valued at approximately Rs 3,381 crore as of January 24.

HeidelbergCement India has been on the radar of major Indian cement players like Adani Group and JSW Cement. The Economic Times reported that Adani had initiated talks with Heidelberg for its Indian assets. A sale of the controlling stake would necessitate an open offer under SEBI regulations to acquire an additional 26% from public shareholders

Jan 27, 2025, 11:54 am IST

Indian equity markets saw a decline by midday

At 11:35 AM on January 27, the Sensex had decreased by 690 points or 0.9 percent to reach 75,500. Meanwhile, the Nifty was down by 220 points or 0.9 percent at 22,872. In terms of stock movements, about 387 shares advanced while a substantial number of shares—3,151—declined; another 104 shares remained unchanged.

Jan 27, 2025, 11:48 am IST

Nifty Smallcap 100 Faces Worst Decline Since March 2020

The Nifty Smallcap 100 index has experienced a significant decline, dropping over 12% this month. This marks the worst performance since March 2020 when the market was hit by Covid-induced panic selling. Despite this, historical data shows that the index rebounded in subsequent months, ending 2020 with a gain of over 21%. Over the past five years, excluding 2022, the index has consistently delivered double-digit positive returns.

Jan 27, 2025, 11:32 am IST

Motilal Oswal's Daily Fundamental Picks

1) Max Healthcare - Target - 1380

2) IPCA Labs - Target - 1980

3) HCL Tech - Target - 2300

4) SBI - Target - 950

5) M&M - Target- 3515

Jan 27, 2025, 10:55 am IST

HDFC Securities Commodity Weekly Recommendations

Sell Gold Apr Fut around 80700–80750 TGT 80150/79900 Keep Stop Loss 81100

Sell Silver Mar Fut at 91350-91400 TGT 89900/89050 SL 92700.

Buy Crude Oil Feb Fut at 6350 TGT 6500/6580 SL 6200.

Sell Natural Gas Feb Fut at 297 TGT 280/274 SL 306.

Buy Copper Feb Fut at 824 TGT 839/845 SL 816.

Sell Zinc Feb Fut at 273.50 TGT, 269/267 SL 277.0

Jan 27, 2025, 10:48 am IST

Global Market Influence on Indian Stocks

International factors have played a crucial role in shaping the current state of the Indian stock market. Recent developments in global economies have led to increased volatility and uncertainty. As a result, investors are exercising caution and reassessing their portfolios to mitigate potential risks.

The ripple effect of these global cues has been felt across various sectors within the Indian market. Companies with significant exposure to international markets have been particularly affected. This has led to a reassessment of investment strategies among traders and investors alike.

Jan 27, 2025, 10:48 am IST

Nifty below 22,900 level

The Indian stock market experienced a significant downturn, with the Sensex dropping by 650 points. The Nifty index also fell below the 22,900 mark. This decline was largely influenced by global market trends, which have been unfavourable recently.

Broader markets were not spared from this downward trend, experiencing a plunge of up to 3.5%. Investors are becoming increasingly cautious as they navigate these turbulent times. The impact of international market cues has been profound, affecting investor sentiment across the board.

Jan 27, 2025, 10:31 am IST

Gold Falls, Focusses on Fed Decision

Gold fell below ,760 per ounce on Monday as investors prepared for the US Federal Reserve's policy decision later this week. The central bank is widely expected to keep interest rates steady, signalling the first pause in the rate-cutting cycle that began in September. However, the market will most likely be focused on how the Fed responds to President Donald Trump's comments calling for further interest rate cuts. While gold has traditionally been viewed as a hedge against inflation, Trump's policies are seen as inflationary, which may lead the Fed to keep interest rates higher for longer, reducing gold's appeal. In addition, the precious metal is under pressure from a rebound in the US dollar, as Trump announced plans to impose tariffs and sanctions on Colombia after the country refused to allow US military planes carrying deported migrants to land.

Jan 27, 2025, 10:16 am IST

Nifty Slides Below 23,000 as Small and Midcap Indices Plunge

The banking and IT sectors faced declines, while FMCG experienced slight gains. By 10 AM, Sensex had dropped 385 points or 0.5% to 75,804, and Nifty was down 120 points or 0.5% at 22,972.

In the broader market, the BSE Midcap index fell by 1.5%, while the Smallcap index tumbled over 2%. Approximately 550 shares advanced, whereas 2,695 shares declined, with 155 shares remaining unchanged. This reflects a challenging environment for investors amidst ongoing uncertainties.

Jan 27, 2025, 10:09 am IST

FinMin Seeks Candidates for SEBI Leadership

The Government of India is currently seeking candidates to assume the position of Chairperson at the Securities and Exchange Board of India (SEBI), as the current chair, Madhabi Puri Buch, is set to conclude her term on February 28, 2025. Buch, who became the SEBI chairperson on March 2, 2022, will have completed a three-year tenure by the end of February. This announcement was made by the Ministry of Finance, highlighting the approaching vacancy and the need for a successor by February 17.

Jan 27, 2025, 9:59 am IST

Result Update: NTPC | 3QFY25: Impacted by softness in demand and muted execution

“NTPC reported just 2% growth in generation as was expected due to moderate energy/ peak power demand during 3QFY25. The thermal PLF remained flat at 75.98% vs. 75.95% in 3QFY24. Hence overall performance during 3QFY25 is soft with revenue of INR 450bn, 5%/ 0%/ -3% YoY/ JMFe/ Cons. The EBITDA came in at INR 137bn, 20%/ 14%/ 25% YoY/ JMFe/ Cons driven by lower other expenses (-21% YoY). Adj. PAT for the quarter was INR 52bn, - 1%/ +4%/ +1% YoY/ JMFe/ Cons. RE capacity addition too remained below expectations (640 MW during 9MFY25); however management continues to maintain its guidance of 3/5/8 GW RE addition for FY25 / FY26 / FY27. The ordering for thermal projects is progressing; however with bunching of projects we remain cautious on capacity addition in FY25 and FY26. We maintain our BUY rating on the stock with a revised TP of INR 359 (earlier TP of 471) valuing at 2.3x Dec’26 Regulated Equity of thermal business and 14x Dec’26 EBITDA of RE business,” said Sudhanshu Bansal of JM Financial Institutional Securities Limited.

Jan 27, 2025, 9:46 am IST

Opening Bell

On Monday, January 27, despite mixed global cues, the Indian benchmark saw a severe sell-off pressure ahead of the monthly expiry week and the approaching Budget 2025. The Sensex began 550 points down and the Nifty opened below 23,000.

Jan 27, 2025, 9:27 am IST

Result Update: ICICI Bank | 3QFY25 Result Update: Asset quality on a firm footing; growth steady

“ICICI Bank reported a steady, in-line performance with PAT at INR 117.9 (+14.8% YoY) and robust return metrics (RoA/RoE at 2.36%/17.8%). Margins (calc.) witnessed a slight contraction to 4.08% (-6bps QoQ) primarily driven by seasonal slippages in the KCC portfolio and a marginal inch up in CoD (+3bps QoQ). As the sector contends with increasing delinquencies in unsecured portfolios, ICICIB continues to navigate these headwinds with credit costs remaining at benign levels of 0.38% (vs 0.39% QoQ). Mgmt. acknowledged that asset quality challenges in the unsecured segment are impacting the bank as well, however, their proactive measures such as tightening underwriting filters, focusing on ETB customers (~60% of the portfolio), and moderating growth in higher-risk segments (PL -1.3% QoQ, CC +2.8% QoQ) have been instrumental in preserving asset quality. Gross slippages saw a slight uptick sequentially to 1.88% (vs 2.02% YoY) driven by seasonality in the KCC portfolio (INR 7.14bnn vs 6.17bn YoY). Loan growth remained steady at (+13.9% YoY, +2.9% QoQ), however, deposit growth mirrored broader industry trends, growing (+1.5% QoQ, 14.1% YoY) as sector-wide deposit accretion remains a challenge. Despite an industry-wide slowdown, ICICI Bank continues to demonstrate strong resilience and remains one of our top picks in the banking sector. Bank’s performance in 3QFY25 underscores its premium valuations, as it continues to outperform peers, even amidst the systemic concerns surrounding the unsecured segment and the broader liquidity crunch. We expect RoA/ROE of 2.25%/17.2% by FY27E. Maintain BUY with an SOTP based TP of INR 1,420 (valuing the core bank at 2.3x FY27E BVPS),” said Sameer Bhise of JM Financial Institutional Securities Ltd.

Jan 27, 2025, 9:20 am IST

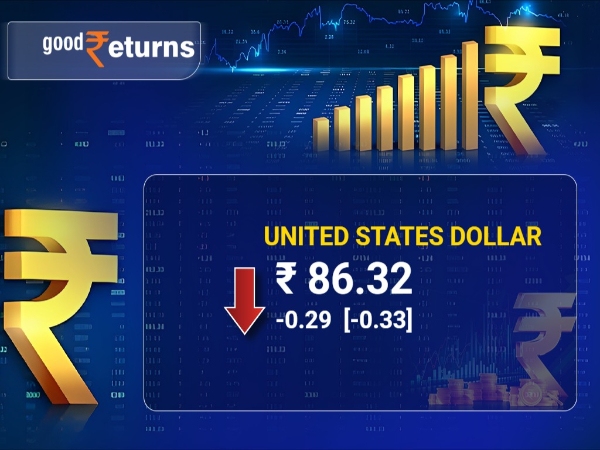

Rupee Vs Dollar

The Indian rupee commenced Monday at 86.35 per dollar, 15 paise lower than its closing of 86.20 on Friday.

Jan 27, 2025, 9:06 am IST

Stock Market Outlook Today By Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services

The market sentiment has turned weak. Sustained FPI selling (Rs 69000 crores in January, so far) is impacting the market. Despite DII buying of Rs 67000 crores in January, so far, the market is under pressure. A major concern is that President Trump is coming up with new threats like the 25 % tariff on Columbia for its refusal to take back deported illegal immigrants. The threatened 25% tariff on Canada and Mexico might be implemented from February 1st onwards. Therefore, will Trump walk his talk on other threats including tariffs on China and other countries, is a question that is being asked in economic and market circles now. These concerns are weighing on the markets.

This 6-day week is likely to be highly volatile with other major events like the Fed decision and the Budget in India. The market is looking forward to fiscal stimulus through income tax cuts in the Budget. If the expectations are met, there can be a relief rally in the market. But if a rally is to sustain, we need data indicating growth and earnings revival.

Jan 27, 2025, 8:53 am IST

Nifty Outlook Today By Anand James, Chief Market Strategist, Geojit Financial Services

On Friday, about 50% of NSE 500 stocks pulled back atleast 2% from the day’s high, pointing to a sharp withdrawal in risk appetite. We would require an equally dramatic push higher today to negate the emergent downtrend, that is poised for 22260-22000 now on the Nifty. The fight back in the last hour of Friday was encouraging towards this end, but we would require a push above 23211 to signal strength. Else, look for 22800-500 on the first leg.

Jan 27, 2025, 8:42 am IST

Bank Nifty Options Market Insights

“The derivatives market exhibited a bearish tilt, with call writers dominating put writers. Open interest at the 49,000-strike call rose to 19.75 lakh contracts, solidifying it as a formidable resistance zone. Conversely, the 47,500-strike put saw an increase of 18.61 lakh contracts, marking it as a significant support level. Robust call-writing activity in the 48,500–49,000 range adds to the resistance overhead, while unwinding of puts at higher strikes reflects caution among traders. The Put-Call Ratio (PCR) held steady at 0.54, maintaining a bearish undertone. Additionally, the “max pain” level at 49,200 serves as a critical pivot point for the near-term price trajectory,” said Mr. Dhupesh Dhameja, Derivatives Analyst, SAMCO Securities.

Jan 27, 2025, 8:23 am IST

Nifty Options Market Dynamics

“In the derivatives arena, uncertainty reigned as balanced participation in calls and puts highlighted trader indecision. Open interest at the 23,500-strike call surged to 75.29 lakh contracts, marking this level as a robust resistance. On the flip side, the 23,000-strike put saw a notable addition of 65.13 lakh contracts, cementing it as a firm support level. Intense call-writing activity in the 23,200–23,500 range solidifies resistance overhead, while unwinding of put positions at higher strikes points to caution among market participants. The Put-Call Ratio (PCR) slipped to 0.75 from 1.05, signaling cautious optimism in the market. Meanwhile, the “max pain” level at 23,350 suggests limited downside risk in the short term,” said Mr. Dhupesh Dhameja, Derivatives Analyst, SAMCO Securities.

Jan 27, 2025, 8:11 am IST

Market Outlook By Rajesh Bhosale, Technical Analyst, Angel One Ltd - Angel One

Throughout the week, bulls made several attempts to bounce back, but the overall sentiment remained weak as Nifty slipped for the third consecutive week. While the broader markets were under pressure, the sell-off in the benchmark index showed signs of slowing down. This could be a precursor as we approach the budget week, a key event that often sets the market tone, either continuing the current trend or signaling a reversal. Technically, prices have corrected over 12% and are approaching a crucial point. On the weekly chart, the price action since September resembles a ‘Falling Wedge’ pattern, with the lower boundary coinciding with the 127% reciprocal retracement of the November bounce, around 22900-22800. This zone may act as a key support for the bulls during the event week, supported by a positive divergence in the RSI, which is currently in the oversold zone. However, if the event fails to inspire confidence amid volatility, we may see the sell-off extend, with the next support level around 22500. From January 13th, prices have been trading within a range, with any bounce towards 23400 facing resistance. For the bulls to gain momentum, this level needs to be breached, coinciding with the 20-day exponential moving average. A breakout above this level could signal a further extension of the bounce. While it's premature to call for a bullish scenario, a breakout above the upper boundary of the falling wedge, currently near 24000 and above major moving averages, would be crucial to trigger sustained bullish momentum.

After two weeks of range-bound activity, heightened volatility is expected in the markets. Traders should closely monitor these levels and adjust their strategies accordingly. In the midcap space, we saw mixed performance, with some days experiencing sharp sell-offs and others seeing strong rallies. Such volatile movements and themes are likely to continue, so traders need to remain agile in their stock selection.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Monday, January 27, 2025, 8:08 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications