The Indian stock market concluded on a positive trajectory, with the Nifty index surpassing the 22,100 mark, signaling optimism among investors. Noteworthy gainers on the Nifty included Reliance Industries, Maruti Suzuki, Bajaj Auto, Bajaj Finance, and Titan Company, driving positive sentiment. Conversely, Hero MotoCorp, Tata Consumer Products, Coal India, ONGC, and Wipro experienced declines, contributing to the mixed performance across sectors.

In sectoral performance, the auto, capital goods, power, realty, and telecom sectors witnessed gains ranging from 0.5 to 1 percent, reflecting broad-based strength. However, the metal, IT, and media sectors faced marginal declines of 0.5 percent each, adding a touch of volatility to the market dynamics.

While the BSE Midcap index remained relatively stable, ending on a flat note, the Smallcap index displayed resilience, rising by 0.7 percent, indicating positive momentum among smaller companies.

In currency markets, the Indian rupee concluded the session marginally weaker, ending 8 paise lower at 83.37 against the US dollar compared to the previous close of 83.29. This slight depreciation reflects the currency's response to the day's market dynamics and global economic factors.

LIVE Feed

Mar 27, 2024, 3:37 pm IST

Market Ends With Gains; Nifty Holds 22,100

The Indian stock market concluded on a positive trajectory, with the Nifty index surpassing the 22,100 mark, signaling optimism among investors. Noteworthy gainers on the Nifty included Reliance Industries, Maruti Suzuki, Bajaj Auto, Bajaj Finance, and Titan Company, driving positive sentiment. Conversely, Hero MotoCorp, Tata Consumer Products, Coal India, ONGC, and Wipro experienced declines, contributing to the mixed performance across sectors.

Mar 27, 2024, 3:23 pm IST

Welspun Corp's Subsidiary Secures Investment For Expansion Across Multiple States

Welspun Corp, a leading player in the manufacturing sector, has announced a significant move towards expanding its operations across several states. The company's wholly owned subsidiary, Sintex–BAPL Limited, has finalized an investment totaling up to approximately Rs 2,355 crore. This investment is earmarked for establishing manufacturing units in Telangana, Odisha, Madhya Pradesh, and Jammu & Kashmir. The initiative will be spearheaded by Welspun Corp's wholly owned step-down subsidiary, Sintex Advance Plastics Limited (SAPL).

Over the next two financial years, commencing from FY25 to FY26, the investment will be deployed to drive growth and establish a robust presence in these states. The projects slated for development will be funded through a combination of debt and equity, ensuring a sustainable financial approach to fueling expansion and operational activities.

Mar 27, 2024, 2:42 pm IST

PC Jeweller Secures Approval From Axis Bank for One-Time Settlement

PC Jeweller has attained the green light from Axis Bank for its one-time settlement proposal. Opting for this approach, PC Jeweller aims to resolve its outstanding dues with the bank.

Mar 27, 2024, 2:16 pm IST

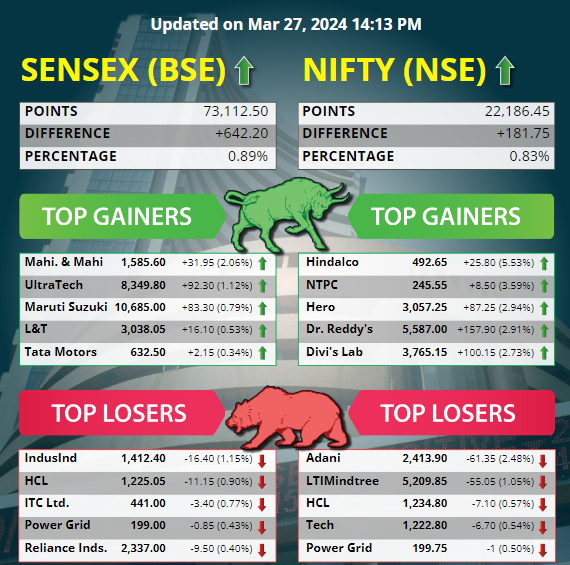

Top 5 Gainers and Losers Today

Stock Market Live Updates

Mar 27, 2024, 2:10 pm IST

lpca Laboratories & Omexa Formulary Partner For Biosimilar Technology Transfer Agreement

lpca Laboratories has recently forged a significant partnership with Omexa Formulary Pvt. Ltd. (Omexa), sealing a Technology Transfer Agreement aimed at advancing biosimilar development and global market access. This agreement encompasses the transfer of technology, process development, and knowledge sharing for a biosimilar clone.

Through this collaboration, lpca Laboratories will extend to Omexa a non-exclusive license, empowering them to conduct research, develop, manufacture, and market an anti-cancer biosimilar for the worldwide market. This strategic alliance underscores both companies' commitment to advancing healthcare solutions and expanding access to critical medications on a global scale.

Mar 27, 2024, 1:35 pm IST

CCI Greenlights Adani Power's Full Acquisition Of Lanco Amarkantak Power

The Competition Commission of India (CCI) has granted its approval for Adani Power to acquire 100% ownership of Lanco Amarkantak Power. Lanco Amarkantak Power, which belongs to the Lanco Group and operates as a thermal power generation company, is presently undergoing the corporate insolvency resolution process (CIRP) as per the provisions of the Insolvency and Bankruptcy Code (IBC).

Mar 27, 2024, 12:54 pm IST

Maruti Suzuki Shares Hit Record High, Market Capitalization Exceeds Rs 4 Lakh Crore

Shares of Maruti Suzuki India Ltd, the country's leading passenger car manufacturer, surged to an all-time high on Wednesday. Peaking at Rs 12,724 per share, the stock's market capitalization soared past the Rs 4 lakh crore mark.

With a 12% increase in March alone, Maruti Suzuki's stock has demonstrated strong momentum. Notably, for the January-March period, the stock has surged by 23%, marking its most robust quarter since the April-June period of 2020, during which it registered a remarkable 36% gain.

Mar 27, 2024, 11:15 am IST

Adani Energy Stocks

Adani Energy, Adani Power shares rally after Adani Group, under the visionary leadership of billionaire Gautam Adani, announced that it is embarking on a transformative journey towards sustainable energy solutions. With an unwavering commitment to combating climate change and fostering environmental stewardship, the conglomerate is poised to redefine the global energy landscape through its ambitious renewable energy initiatives.

Mar 27, 2024, 11:01 am IST

L&T Construction Wins Orders For Buildings & Factories Business

Larsen & Toubro Construction's (L&T) Buildings & Factories (B&F) vertical has received several orders from the domestic and international markets. The Sultanate of Oman's Ministry of Health has awarded the company a contract to build the Al Namaa General Hospital. The construction of a 165-bed hospital facility (G+4), along with a basement and ancillary structures like substations and STP, is included in the scope of work. The project, which includes civil structures, finishes, MEP services, medical equipment, and exterior development including landscaping, is scheduled to be completed in 30 months. The Assam PWD awarded the company a contract on a design-build turnkey basis for the "Construction of Maa Kamakhya Temple Access Corridor, Assam" in the domestic market. The project's scope included the construction of a Multi Utility Building, Pilgrim Management Block, Chinnamasta Block, Siddheshwar Block, and a temple access corridor. The remaining scope of work includes external development on the site's premises as well as finishing and related MEP services. Additionally, a subsidiary of a well-known paint manufacturing company gave the business an order to build a polymer production facility in Gujarat. The scope includes external development activities in addition to civil, structural, and architectural works. Ultimately, the company received an order for a solar glass manufacturing plant located in Gujarat. Civil, structural, and architectural works are included in the purview.

Mar 27, 2024, 9:43 am IST

Rupee Opens At 83.31 Vs US Dollar

Indian Rupee begins at Rs 83.31 against the US dollar on Wednesday. Rupee Closed at 83.28 against the dollar on Tuesday. At 104.38, the dollar index gained 0.14% momentum.

Mar 27, 2024, 9:33 am IST

Gold tempered as dollar firmed and investors looked for further Fed signals

A stronger dollar caused gold prices to slightly decline on Wednesday, but bullion only moved within a small range as investors remained cautious in anticipation of further clues regarding U.S. Federal Reserve policy.

At 0310 GMT, the spot price of gold was down 0.1% at ,176.29 per ounce. The price of U.S. gold futures decreased by 0.1% to ,175.20.

For holders of other currencies, gold became more expensive as the dollar index appreciated 0.2% against its competitors.

Mar 27, 2024, 9:00 am IST

Yen drops to 34-year low before a crucial US inflation test

On Wednesday, the dollar appreciated on further robust U.S. economic statistics, pushing the Japanese yen down to a 34-year low and into the territory that may prompt official market intervention in 2022.

In the Asia session, the yen was trading at 151.97 per dollar, down 0.2% from the peak of 151.94 in October 2022—the weakest level since the middle of 1990—when Japanese officials intervened to buy the currency.

The yen is the worst-performing major currency for the quarter that ends later this week, down more than 7% against the dollar despite Japan's removal from negative interest rates last week.

Mar 27, 2024, 8:40 am IST

FII and DII data

On March 26, provisional data from the NSE revealed that domestic institutional investors (DIIs) bought stocks worth Rs 5,024.36 crore, while foreign institutional investors (FIIs) net bought shares of Rs 10.13 crore.

Mar 27, 2024, 8:33 am IST

Marketbuzz Podcast: Aster DM, CDSL, and the Nifty at 22,000

The Indian markets are off to a quiet day, according to the GIFT Nifty. Be wary of stocks such as Wockhardt, Aster DM, and CDSL.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Wednesday, March 27, 2024, 8:18 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications