GoodReturns Poll: Will Jerome Powell Submit To Trump's Whims On September 17? 4-5 Rate Cuts Seen Till Mar 2026

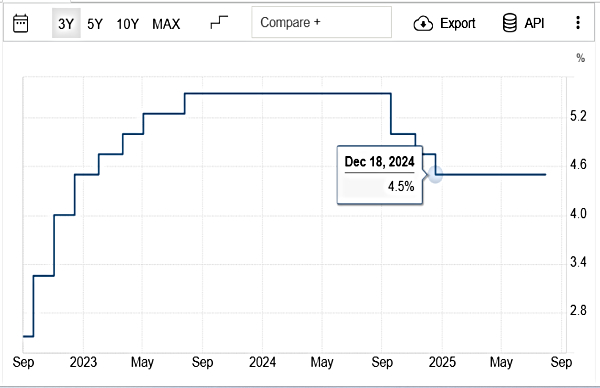

One of the biggest events of next week is the US Federal Reserve's policy outcomes on September 17. The FOMC members have voted status quo in key federal rates since December 2024, with chief Jerome Powell falling under the radar of President Donald Trump. The White House leader is demanding a big rate cut from the Fed; will Powell finally submit to his whims?

Economists are predicting a 25 bps cut in key federal fund rates on September 17, as per a poll of 25 economists conducted by GoodReturns.

Two out of 25 economists do not rule out the possibility of a 50 bps rate cut. While future rate cuts have mixed opinion. Economists at JM Financial predict 2 rate cuts in H2 of 2025, while Bank of America experts see a total of 75 bps rate cuts in H2.

Two economists from Morgan Stanley and JP Morgan are predicting four back-to-back rate cuts from the Fed, meaning a total of 100 basis points in the next four policies, starting from September 2025. However, economists at ING see a whopping 125 bps cut till March 2026.

"For Fed chair Jerome Powell, the risk management considerations may go beyond balancing employment and inflation risks, and we now see the path of least resistance is to pull forward the next cut of 25 bp to the September meeting," said Michael Feroli, chief US economist of JP Morgan.

At present, Fed rates have stayed at 4.25%-4.50% for a fifth consecutive monetary policy.

The current economic condition is crucial. The Fed is torn between elevated inflation and downside risk to the labor market, the latter overpowering the upside risk to price stability.

"Evidence of cooling consumer demand and a weakening jobs market is becoming more obvious. Inflation remains above target and tariffs are likely to keep it elevated in the near term, but the balance of risks is tilted towards the need for more support for the economy, starting with a 25bp cut on Wednesday, 17 September," said economists at ING.

Labor market a key major concern:

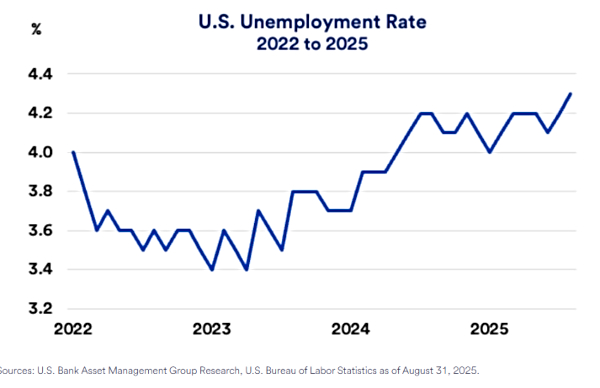

Data from the U.S. Bureau of Labor Statistics (BLS) shows that the U.S. economy added 22,000 jobs in August, below economists' estimates. Also, the unemployment rate rose to 4.3% in August. Despite a surge in consumer spending, the unemployment rate is the highest in 3 years.

The BLS's preliminary benchmark revision also highlighted that the US added 911,000 fewer jobs in the 12 months through March 2025, the steepest downward revision since 2000.

Also, the initial jobless claims have recorded an unexpected jump to 263,000, higher than economists' forecast of 235,000. This extraordinary surge of unemployed individuals for insurance claims is raising concern about the health of the US labor market.

"Initial jobless claims indicate companies have yet to meaningfully reduce workforces, which when paired with recently reported payroll figures, suggests we're in a 'slow hiring, slow firing' environment," said Bill Merz, head of capital markets research, U.S. Bank Asset Management Group.

US Inflation Stays Above Fed Target:

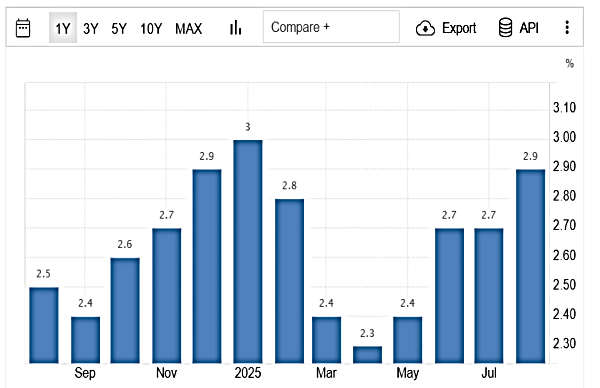

US consumer price index jumped to 2.9% in August 2025, higher than expected. Inflationary pressure is seen in consumer-facing categories like food, apparels and energy, which were notable.

Additionally, the full-fledged meaningful impact of tariffs is yet to be seen in US CPI. Hence, economists believe Fed will continue to suggest that inflation will remain elevated due to tariffs.

"With calls for policy easing from the US administration getting louder with every passing day, we expect the Fed to prioritise addressing the sluggishness in the labour market vs. firm inflationary pressures," said economists at JM Financial.

"The futures market is building in three rate cuts by the end of 2025, starting with a 25bps rate cut in September. We believe that it would be realistic to expect two more rate cuts by the end of 2025," JM's economists added.

During the July 2025 policy, the decision on key rates received mixed voting in FOMC. Fed governors Chris Waller and Michelle Bowman responded in-line with Trump's stance on the weak job market, signaling the need for policy easing. Last month, Powell also acknowledged the requirement for rate cuts.

50 Bps Rate Cut On September 17 On Cards?

According to ING, it is possible that the Fed chooses to lead off with a 50bp move, just as they did in September last year. It is likely that Chris Waller and Michelle Bowman vote for the larger cut, justifying it on the basis they felt the Fed should have loosened policy in July and the deteriorating jobs story since then means some catch-up needs to happen.

But Why Fed Could Cut Rates By 100-125 Bps Ahead?

Economists at ING are predicting a 25 bps rate cut on September 17, followed by 25 bps rate cut each in October, December, annuary and March policies.

Decoding the reason, ING explained that the 2-year treasury yields in the 3.5% area are fully braced for a series of rate cuts.

Lastly, economists here said the Fed would need to deliver a cumulative 100bp of cuts to take the funds rate below the 2yr yield, and realistically the 2yr yield at its current level anticipates a further 25bp in cuts on top of that (125bp in total). Then, to validate the 2yr yield valuation, the Fed would need to hold there for a year.

Click it and Unblock the Notifications

Click it and Unblock the Notifications