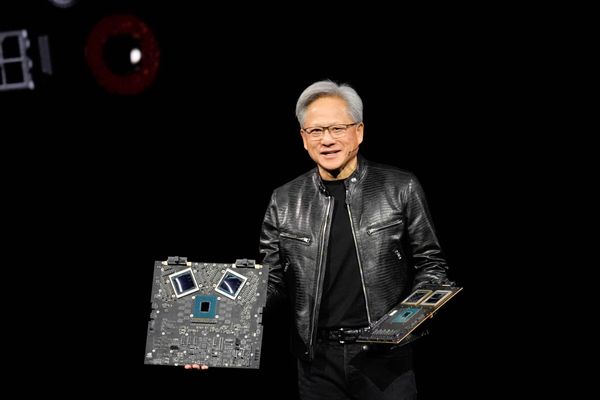

Nvidia Share Price Hits $183 as Market Cap Soars to $4.47 Trillion; Outshines Microsoft and Apple

Nvidia Corp has attained a market capitalisation of $4.47 trillion, representing over 8% of the S&P 500's total value. This achievement marks a significant rise in its share price and solidifies its leading role in the tech sector, driven by the demand for its GPUs.

Nvidia Corp. has solidified its position in the U.S. stock market, achieving a market capitalisation of $4.47 trillion as of Tuesday. This figure represents over 8% of the S&P 500's total market value, marking the highest weighting ever for a single stock in the index's history. Nvidia's share price increased by 0.52% to $183.10 per share, boosting its presence in the S&P 500 to unprecedented levels.

The S&P 500 itself saw a rise of 72.31 points, or 1.13%, closing at a record high of 6,445.76 with a market cap of $53.66 trillion on Tuesday, partly driven by Nvidia's ongoing rally. The company's rapid growth is attributed to the soaring demand for its graphics processing units (GPUs), which are essential for artificial intelligence applications worldwide.

Nvidia's Market Position

In terms of market share within the S&P 500, Nvidia now surpasses tech giants Microsoft and Apple Inc., which have market caps of $3.93 trillion and $3.41 trillion respectively, ranking them second and third by index weight. Alphabet and Amazon complete the top five with market caps of $2.46 trillion and $2.36 trillion respectively.

The technology sector continues to dominate the S&P 500, holding an overall index weight of 34%. This is followed by financials at 13.8% and consumer discretionary sectors at 10.4%. Nvidia's impressive performance has been a significant contributor to this dominance.

Nvidia Share Price Performance

Over the past month, Nvidia's share price has climbed by 7%, while it has surged by 41% over three months and increased by 37% year-to-date. In comparison to last year, the stock has risen by an impressive 58%, driven by strong demand for its GPUs that power AI applications globally.

In contrast, the S&P 400 index has shown more modest gains: up by 3% in one month, increasing by 9.5% over three months, and achieving a 10% rise so far in 2025. On an annual basis, this index has delivered returns of 19%, highlighting Nvidia's exceptional performance against broader market trends.

Investors should note that these insights reflect individual analysts' or broking companies' views and recommendations rather than those of Mint itself. It is advisable for investors to consult certified experts before making any investment decisions based on this information.

Click it and Unblock the Notifications

Click it and Unblock the Notifications