Nvidia Becomes World’s Most Valuable Company as Investors Bet Big on AI Future; Tech Giant’s Shares Soar 4.33%

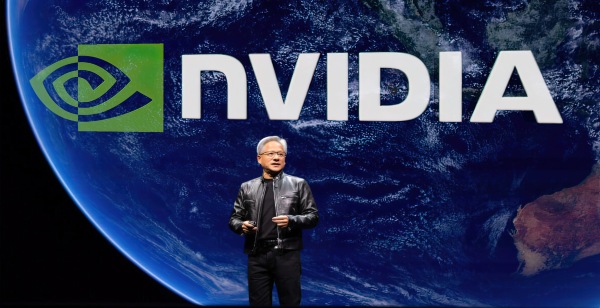

Nvidia Corporation surged to a new record high on Wednesday, once again becoming the most valuable publicly traded company globally. The rally in its stock was fueled by sustained investor enthusiasm around artificial intelligence (AI) and further boosted by CEO Jensen Huang's unveiling of the company's latest innovations during its annual shareholder meeting.

Nvidia Share Price

Shares of the semiconductor giant climbed 4.33% to close at $154.31, pushing its market capitalization to approximately $3.77 trillion. This sharp rise allowed Nvidia to surpass Microsoft Corporation, whose valuation reached $3.66 trillion after its shares increased modestly by 0.44% during the same session.

Tech Giants Battle for Market Cap Supremacy

Over the past year, the top position in global market capitalization has rotated among Nvidia, Microsoft, and Apple Inc., reflecting intense investor interest in technology giants. Apple shares also saw gains on Wednesday, rising 0.63%, which lifted the iPhone maker's market cap to roughly $3.01 trillion.

The renewed momentum in Nvidia's stock price reflects a broader resurgence in investor appetite for AI-focused companies. Over the last few years, enthusiasm around AI has triggered significant rallies across the semiconductor and broader tech sectors.

Speaking at Nvidia's annual shareholder meeting on Wednesday, CEO Jensen Huang reiterated Nvidia's central role in powering the ongoing transformation of the computing industry, emphasizing that the world is still in the early phases of building out AI infrastructure on a global scale. His remarks helped reinforce confidence among investors about the company's long-term growth prospects.

Adding to the bullish outlook, financial services firm Loop Capital increased its price target for Nvidia shares to $250, up from a previous target of $175, while maintaining a "Buy" rating. The firm pointed to Nvidia's strategic positioning to capitalize on what it described as a "Golden Wave" of AI adoption, according to a report by Reuters. This upgrade further contributed to the positive sentiment surrounding the stock.

Strong Track Record of Nvidia Share Price Growth

Nvidia's performance over the past few years has been exceptional. As of mid-2025, the stock has already posted a gain of approximately 17%. This follows a remarkable 170% increase in 2024, which itself came after an even more staggering 240% rally in 2023. These extraordinary gains underscore Nvidia's central role in the AI revolution and investor belief in its long-term potential.

Despite these steep price increases, Nvidia's valuation appears relatively reasonable in the context of its earnings growth. The company is currently trading at roughly 30 times analysts' projected earnings over the next 12 months, according to data from LSEG.

This price-to-earnings (P/E) ratio is notably below Nvidia's five-year average of around 40, suggesting that earnings growth has kept pace with or even outstripped the rapid appreciation in its share price. This dynamic may further reassure investors about the sustainability of Nvidia's current valuation.

Click it and Unblock the Notifications

Click it and Unblock the Notifications