Millennials & Gen Zs Are Skipping Gold In The 2025 Wedding Season; What Are They Buying Instead?

Our super-cautious parents have always advised us to invest in gold, considering it a reliable asset during times of need. So buying & storing gold during weddings or certain festivals became a tradition. In Indian weddings, gold was not only used for ornamental purposes; it was seen as a form of financial security passed down from one generation to the next. However, this age-old tradition is slowly taking a back seat as gold prices have skyrocketed in recent months.

Thirty years ago, gold was priced at around Rs. 4600 per 10 grams. If we adjust that for inflation today, it comes to about Rs 28,747, still far below the current market price. As of 2025, gold has surged over 30% in 2025 alone, and it recently crossed Rs.1 lakh per 10 grams, making it extremely unaffordable for middle- and lower-income households.

While diamonds have always been out of reach for this cluster of the population, gold & silver remained the preferred metals for the average Indian family. But now, even that is slipping out of budget, pushing young couples and families to reconsider this age-old custom.

During the 2024-2025 wedding season in India, an estimated 48 lakh weddings took place, and the demand for gold during that period was massive. Gold prices are already rising because of other major factors like geopolitical tensions and the recent trade war in the United States. This high demand only added to the rising gold prices. Not just gold, silver metal rates also climbed to unprecedented highs across India.

This extraordinary rise is fuelling a new trend in the market where the financially informed youth population is now looking beyond precious metals. They are either opting for practical investments or skipping heavy jewellery altogether.

A Shift From Pure to Affordable Jewellery

According to a recent report by the World Gold Council, global gold demand rose by approximately 1% year-on-year in the first quarter of 2025. However, on the flip side, demand for gold jewellery dropped significantly, falling to 380 tonnes, declining 21% year-on-year.

The report said that gold jewellery demand fell sharply because of the record-high prices, with volumes reaching their lowest level since the COVID-19 disruption in 2020.

Jewellery retailers are seeing a shift in consumer buying patterns in gold and silver jewellery purchases in the 2024-25 wedding season in India.

"While the tradition of gifting gold and diamond jewellery during weddings remains strong, the quantity of gold being purchased has noticeably decreased. Earlier, families would buy 100-gram sets, but now the preference has shifted to lighter sets of 50-70 grams. Middle-class families are finding it increasingly difficult to make new purchases as gold prices continue to surge. The overall weightage has come down, and there is a significant rise in old gold being exchanged rather than spending on entirely new pieces." said Vastupal Ranka, Director of Ranka Jewellers & Rare Jewels.

Lower carat gold has now entered into the picture and is taking the limelight. Young buyers from both big cities and smaller towns are looking for budget-friendly jewellery options that they can afford without burning their pockets and compromising on aesthetics.

"Lightweight jewellery is in higher demand, with 14k and 18k gold becoming more popular, as families try to manage their budgets by opting for lower caratage. This trend clearly reflects how rising prices are impacting wedding season jewellery purchases." Vastupal Ranka further explained.

Not a Hit for the Affluent Segment: Millionaires Are Still Investing in Gold

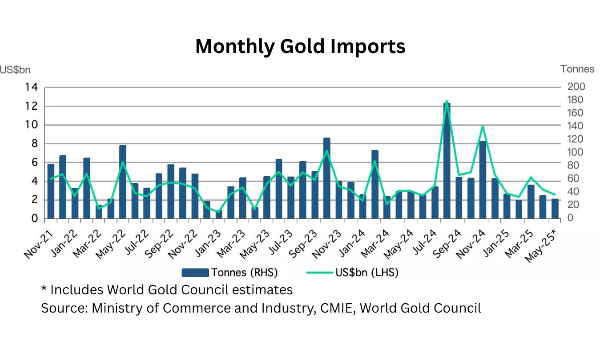

"The rich and the wealthy people are still investing in gold today as people in this segment have always viewed jewellery as a luxury adornment; the only difference is that the fluctuations in rates are causing some confusion among people. If we look at the official data, in 2023 and 2024, gold imports in the country increased by 30-35%. During that time, exports ranged from 750 to 800 tonnes, with an increase of approximately 50 to 60 tonnes. This outcome is due to the fact that millionaires are still investing in and purchasing gold." said Rajesh Rokde, Chairman, All India Gem and Jewellery Domestic Council

A Shift in Investment Patterns: From Gold Jewellery to Smarter Financial Choices

There's a visible shift in investment preferences among people these days. Instead of spending several lakhs on gold jewellery, many individuals, especially millennials and Gen Zs, are choosing alternate investment options like mutual funds or fixed deposits or even using the funds for other priorities like buying a home.

One trend that is growing at a fast pace is gold ETFs for those who are focusing on long-term investment. As we know, gold ETFs come with the added convenience of instant liquidity; it is a very smart alternative. In fact, there has been a sharp rise in gold ETF inflows, as the World Gold Council reported. The total investment demand more than doubled to 552 tonnes in Q1, rising 170% year-on-year, which is the highest since Q1 of 2022.

Moreover, other financial instruments like SIPs are also seeing record growth in recent years. According to a report by the Association of Mutual Funds in India (AMFI), India's mutual fund industry saw a total investment growth of 23% in just one year to Rs. 65.74 lakh crore. What's more, the money coming in through SIPs alone went up by 45%, which means that more people now prefer regular, planned investments to build their wealth over time.

Will The Common Man Get Relief From The Roaring Prices?

Since gold prices are creating new records every other day and inflation is severely impacting everyday essentials, the big question that everyone's asking is, will the gold prices decline anytime soon?

To this Rajesh Rokde suggested, "I will not deny that some people feel gold prices might decline, but considering the current geopolitical situation, that doesn't seem likely. As we know, based on Israel's geographical condition, it is surrounded by enemy nations, creating a potential scenario for world war. The Russia-Ukraine conflict and the India-Pakistan issue are major factors contributing to the instability in the stock market."

"At the same time, the U.S., Russia, and China are all competing to establish themselves as superpowers, resulting in confrontations on trade and political fronts. This is another reason the market remains volatile. The policies of Trump from the U.S. are globally unacceptable, which is increasing the trend of de-dollarisation. U.S. debt is rising, and all of this indicates that global powers are trying to undermine each other's economies rather than strengthen them. This is giving gold a significant boost, and signs suggest that gold will continue to remain strong in the future as well." He further added.

Gold May Shine, But Priorities Are Changing

Yellow metal is definitely shaking the budget for Indian families and is no longer the only choice. There are options, and people are going for those that fit in their budget. People are ditching sentiments and making informed financial decisions. However, it will be interesting to see how the changing pattern affects the bullion industry because the average Indian is now chasing better and affordable investment options, which are the real gold standard for this generation.

Click it and Unblock the Notifications

Click it and Unblock the Notifications