Gold Rates In India Today, 2nd-Dec: 24K/100 Grams of Gold Falls By Rs 6,500; 1Kg Silver Dips Rs 500

Gold prices in India fell precipitously today, Monday, December 2, amid geopolitical concerns and a drop in the dollar index. Gold rates saw an abrupt fall ahead of impending US economic data for cues on the Federal Reserve's upcoming action on interest rates following a continual shift in Fed interest rate predictions for the month of December 24 and the strengthening of the US dollar.

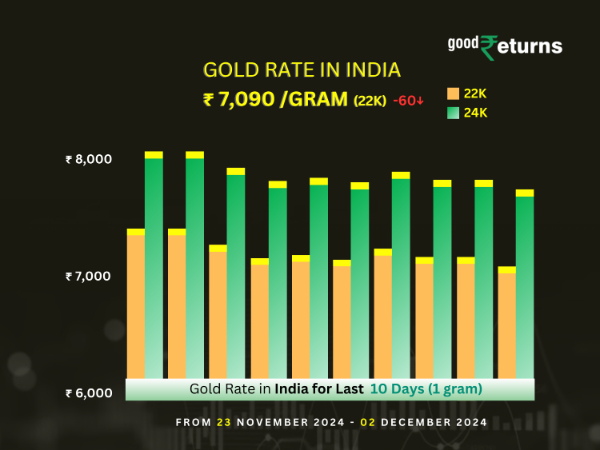

Gold Rates In India Today

In India, the current price of gold is Rs 7,735 per gram for 24-carat gold and Rs 7,090 per gram for 22 carat gold. In India, the price of 22k of 10 grams of gold plunged by Rs 600 to Rs 70,900 today from Rs 71,500 earlier, while the price of 22k of 100 grams of gold fell by Rs 6,000 to Rs 7,09,000 on Monday from Rs 7,15,000 earlier.

24k of 10 grams of gold in India stood at Rs 77,350 today which was Rs 78,000 earlier representing a drop of Rs 650 whereas 24k of 100 grams of gold in India dropped to Rs 7,73,500 on Monday which was Rs 7,80,000 yesterday representing a price drop of Rs 6,500.

While 18k of 100 grams of gold fell to Rs 5,80,100 on Monday, down by Rs 4,900 from Rs 5,85,000 yesterday, 18k of 10 grams of gold today hit Rs 58,010, down by Rs 490 from yesterday's price of Rs 58,500.

Spot Gold Today

A stronger US dollar put pressure on gold prices, which ended a four-session advance and fell Monday. As of 0204 GMT, U.S. gold futures slipped 0.8% to $2,658.80, while spot gold dropped 0.7% to $2,636.38 an ounce as per Reuters. Platinum declined 0.2% to $944.20, palladium dropped 0.3% to $975.44, while spot silver slipped 0.7% to $30.39 an ounce.

Silver Rates Today In India

In India, silver currently costs Rs 91,000 per kilogramme and Rs 91 per gram. The price of 10 grams of silver in India fell to Rs 910 on Monday from Rs 915 yesterday, while the price of 100 grams of silver fell to Rs 9,100 on Monday from Rs 9,150 yesterday. The price of one kilogramme of silver in India dropped by Rs 500 from Rs 91,500 yesterday to Rs 91,000 today.

MCX Gold Outlook Today

"Gold fell below $2,630 per ounce on Monday, ending a four-session streak of gains as the US dollar strengthened. Investors look forward to upcoming US economic data for clues on the Federal Reserve's next move on interest rates. Last week, data showed that progress in reducing US inflation has stalled, suggesting a more gradual pace in the Fed's rate-cut cycle. Currently, markets are implying a 65% chance of a 25bps rate cut at the Fed's meeting later this month, with only two more rate cuts priced in for all of 2025. The domestic yellow metal MCX Gold (Feb 2025 Contract closed positive last week The commodity is presently opening weak in morning trade . Its crucial supply zones around 76800/77000 levels which should act as resistance. On the downside, support for MCX Gold lies at 75500/ 76000 levels with a break below 75500 level can potentially drag prices toward 74000/73500 levels. Traders are advised to trade with strict stoploss as volatility may remain high due to ongoing geopolitical issues," said the research analysts of Way2Wealth Brokers Private Limited.

Gold Price Outlook Today

"As Gold prices have given around 30% returns this year, we will likely witness a bout of profit-booking by hedge funds and ETFs in December, which might put pressure on the prices. But amid geopolitical worries, prices will stay above $2500 (Rs 73000). We are likely to see consolidation and rangebound momentum in gold prices this week. Important support levels are around $2600 (~Rs 75500) and resistance is $2720 (~Rs 78500). Gold is in an uptrend until the prices are trading above $2550 ( Rs 74000). We are likely to see dip-buying until these levels are sustained," commented Dr. Renisha Chainani, Head Research - Augmont - Gold For All.

Disclaimer

The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications