Gold Rate 2025: Beyond All That Glitters, Motilal Oswal’s Manav Modi Explains How To Strategise Investment

Gold rate in India has taken a surprising turn since September, just when many were expecting some consolidation after its elevated levels seen in the first half of 2025. This powerful surge hasn't just been limited to gold; silver has marched alongside it, reaching an all-time high. The gold rally this year is unlike anything seen in the past 10-15 years, and those anticipating a reversal may be disappointed, according to Manav Modi, Analyst Precious Metals at Motilal Oswal Financial Services Ltd.

In an exclusive interview with GoodReturns, Manav Modi breaks down what's fueling the surge, why it pays to ride the FOMO wave early, and what signs could signal the rally's end. Don't miss his sharp insights on where gold goes next.

Gold has seen a historic rally this year, marked by sharp highs. What makes the current price movement in the second half of 2025 different from previous decades?

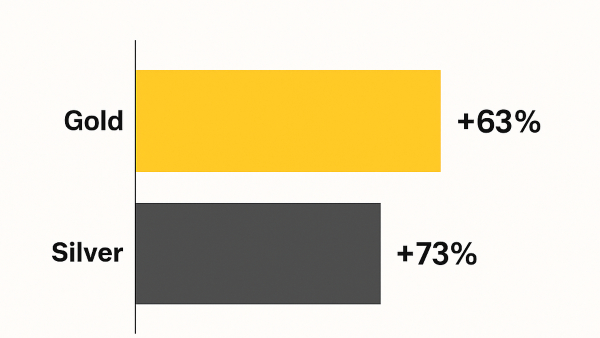

"Gold this year has given fantastic returns. Both gold and silver have given more than 60% returns. On the domestic front, we have the support of rupee depreciation as well, but overall momentum has been very strong. In the first six months of 2020 to 2023, the rally was purely on the back of the geopolitical tension that used to ease off, and then we used to see some sell-off, some profit booking, and year-end would be on a positive note."

There has been no zone for consolidation this year as geopolitical tensions have been sidelined and other factors have taken a front seat, noted Modi.

What Factors Are Fueling Gold Price Rally?

"One big factor is US President Donald Trump taking an oath, because tariff volatility has been absolutely crazy. Along with the tariff, there is US growth tension triggered by US shutdown, and US Fed rate cut expectations are now increasing. Domestic ETFs AUM's are rising month-on-month basis. Additionally, dollar index's flat performance is also working for bullion"

"All factors are working together, and if one is fading, then the other is pushing the prices high. So that is what is working differently for gold this time."

What is your outlook for gold and silver prices for immediate basis, and 2026?

On Comex, our immediate target for gold is $4,200 per ounce. From the short to medium term, $58 to $60 is very much achievable on Comex for silver in 2025. From a six-month to one-year perspective, we could see $4,500 coming in gold. On the domestic front, that will be equal to 1,40,000 and 1,50,000."

What geopolitical developments could potentially halt or reverse the current gold price rally?

There are two or three things that, if they happen simultaneously, can halt the gold price rally, according to Modi.

"We are looking at scenario building. One factor is the recent ceasefire between Israel and Hamas. If similar developments occur with Russia-Ukraine or other geopolitical issues like the US-China tariff tensions ease, the risk premium on gold and silver would significantly reduce."

"Secondly, rate-cut expectations play a role. If the US Fed rate cut expectations once again switch to a pause, it could cap the immediate rally, especially since, as US Fed Governor Jerome Powell noted, any rate cuts will be data-dependent. Thirdly, inflows matter. If ETF purchases or central bank buying stop or pause, that would act as a major headwind, limiting the rally."

Domestic silver ETF prices are much higher than international rates. When is this gap likely to narrow?

The main reason behind this disparity is acute shortage of silver in the domestic as well as global market, observed Modi.

"The waiting period for silver is more than eight to 10 days, and we have Diwali and the wedding season around the corner. So that demand has surged, and prices have surged. But there is no supply of silver. Three to four mines of copper have shut, so that supply sentiment has inched higher," explained Modi while adding that the festive season has aggravated the situation.

"There could be an artificial holding that could have happened, and overall, the supply shortage is creating this premium and difference in the market. Once the Diwali season is over, maybe people will once again could roll over their positions from the future. There could be a narrowing down of this premium and parity, and we could see this is off. But, silver shortages are a serious problem as of now. It could take one or two months for the overall scenario to ease off."

Don't Miss The Profit Booking

As gold is witnessing a historic rally, Manav Modi advises long-term investors, with significant exposure to to the precious metal, to consider profit booking. However, the strategy may differ for new investors.

"If you're a long-term investor with a horizon of one to two years and have exposure to gold,one strategy can be to consider some profit booking. Maybe, a partial profit booking from the current position. Now, if we get a dip, say of 5% or 7% correction from here, that dip once again can be used as a buying opportunity for both gold and silver."

For a fresh investor in the precious metals market, Modi warns of some caution as the present levels are very elevated. "Even though we are on a missing-out-on fear, we should not rally or join the bandwagon, because a lot of times, like today as we speak, we were hitting new circuits and new highs on silver. And now we are again Rs 8,000-9,000 down from day's high. These kinds of swings are a sign of a tug-of-war between bulls and bears. When this happens, market participants should be very cautious in terms of investing, because who will win, a bull or a bear? You don't know."

"So if a bear wins, definitely the correction will be a bit steep. So wait for that correction to happen. Wait for prices to settle. As of now, the parity and premiums are also very elevated. Wait for that to settle," he added. As gold touches historic highs, Modi's advise is loud and clear; book profits smartly, not hastily.

Click it and Unblock the Notifications

Click it and Unblock the Notifications