Gold Prices At All-Time-High, Where Are They Headed From Here?

Gold prices in India raced to touch an all-time-high on Monday morning, extending its record run from last week after increased bets for the US Federal Reserve to cut rates sooner than previously anticipated boosted the safe haven demand.

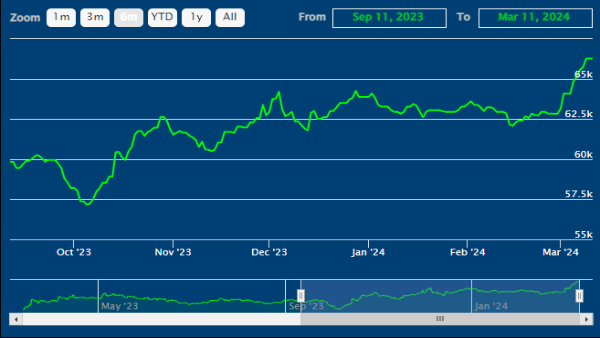

The yellow metal (24 carat) price for 10 grams has jumped nearly 3.5 percent to Rs 66,270 in the first 11 days of March after falling slightly since January. 22 carat price of gold is Rs 60,750 up - again a record high.

This spike in gold prices after a silent period comes following the US central bank's chair Jerome Powell's comment that the Fed is "not far" from getting decent confidence that inflation is heading to the Fed's 2% target to be able to initiate interest-rate cuts.

The Spot Gold is priced at $2,178.62 per ounce as of Monday.

"The timing of the next moves from central banks remains the key market driver for gold. Any news of sooner-than-expected rate cuts could lift up bullion prices, while further hawkish rhetoric could be a bearish catalyst for gold," said Carlo Alberto De Casa, analyst at Kinesis Money.

Weekly & Monthly Graph of Gold Price in India

"Also, the geopolitical situation needs to be monitored carefully, with the demand of gold as a safe haven investment that could increase in case of escalation of tensions in the Middle East."

US money market traders are now pricing in a nearly 75% probability of a June rate cut by the Fed from 5.25-5.50 percent, compared with around 63% on February 29, the CME's Fedwatch Tool showed.

Reduced interest rates give support to the yellow metal prices as they cut back the opportunity cost of holding bullion. Low rates also weighs on the US dollar making bullion less expensive for international buyers.

It is interesting to see that India ranks 9th in the overall gold reserves in the world with 803.58 tonnes of gold currently while the US ranks 1st with 8,133.46 tonnes, according to the world gold council website.

While gold prices have spiked substantially in the past few days, silver prices have steadied after falling nearly 2.5 percent in January and February.

The white metal was trading at Rs 7,560 per 10 gm slightly up from Rs 7,500 early in March. That was primarily due to a weakening US dollar led by lower-than-expected private job gains.

Traders will widely monitor the US economic indicators and any further hints from the Fed about easing monetary policy. The Reserve Bank of India will likely follow foot steps of the Fed and lower repo rate in the later part of 2024.

Currently market awaits the US inflation (CPI) data to get fresh cues about the Fed rate trajectory. The US consumer price index is scheduled to release on Tuesday.

Click it and Unblock the Notifications

Click it and Unblock the Notifications