Gold Gave Bumper Returns In 35 Out Of 45 Years, Explained In 5 Charts; Will Gold Price Hit Rs 1 Lakh Next Week

Gold Prices In India: Yellow metal has given bumper returns in 2025 so far, with the price of 10 grams of gold shy of the Rs 1,00,000 mark. Gold is a couple of thousands away from hitting Rs 1 lakh for the first time in its history. This week, gold touched back-to-back new record highs, with MCX gold nearing Rs 94,000 per 10 grams. Meanwhile, on Saturday, the gold price in India reached nearly Rs 96,000 mark and surged by over 3% in less than two weeks of April 2025. The outlook in gold looks promising.

Does gold have the potential to hit Rs 1 lakh by next week? It will be keenly watched! But before that, let's understand the historical performance of gold in India!

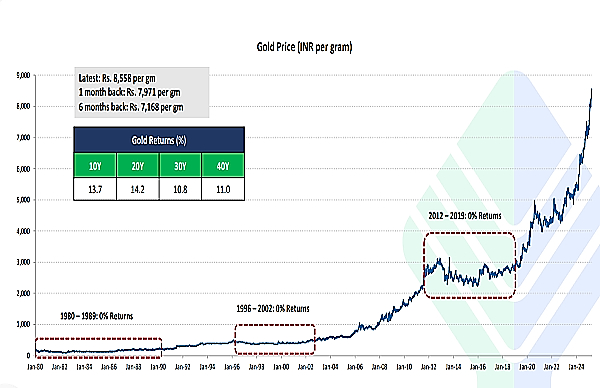

Gold Price in India History:

Data from FundsIndia revealed that gold has outperformed inflation between 1995 and 2024 by 2-4% on average. In 2024, gold returns ranged from 24% to 30%.

Source: FundsIndia

It said, "Gold returns have beaten inflation in the long term but go through long intermittent periods of subdued returns." Data showed that between 1980 and 1989, gold's return was flat, while a similar trend was seen in other periods such as 1996-2002 and 2012-2019.

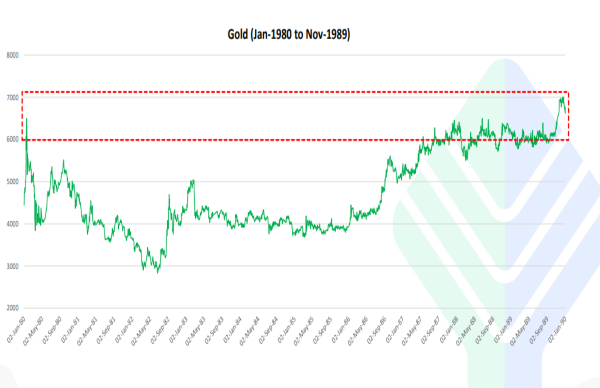

One of the interesting movements in gold that FundsIndia noticed is that, unlike the current back-to-back record rally, gold took longer durations to hit new peaks in the pre-Covid era.

Source: FundsIndia

For instance, between 1980 and 1989, it took gold 10 years to hit its 1980 peak once again.

After the 1980s, gold took at least 7 years to hit peak levels. Between 1996 and 2002, it took seven years to hit its 1996 peak once again.

A similar trend was seen between 2012-2019, when gold took another seven years to hit its 2012 peak once again.

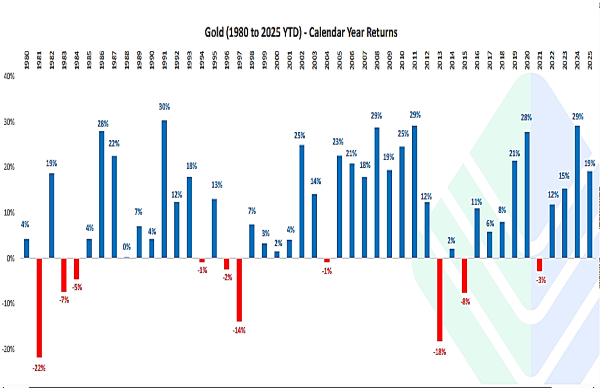

Source: FundsIndia

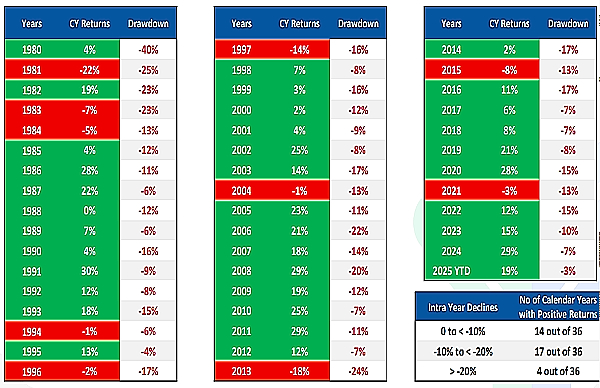

However, FundsIndia also pointed out that gold saw 10-15% temporary declines almost every year. In fact, only 16 out of the last 45 calendar years had intra-year declines of less than 10%.

Despite the intra-year decline of more than 10% almost every year between 1980 and 2025 year-to-date, 3 out of 4 years ended with positive returns!

Source: FundsIndia

Adding FundsIndia data revealed that 35 out of 45 years ended with positive returns - but even these positive years had 10-20% intra-year declines.

Source: FundsIndia

According to the brokerage, gold returns in Indian rupees are driven by gold price in dollars which are inversely correlated to US real yields and lastly the movement in USDINR.

Gold Prices In India:

Gold prices in India surged by over 3% in April so far, followed by over 6.1% gains in March, a nearly 3% climb in February, and more than 8.1% upside in January 2025. Despite, this week witnessing back-to-back new peaks, gold highest returns were seen in January 2025 in percentage terms.

10 grams in 24K is available at Rs 95,670 which is the new all-time high on Saturday, April 12. Further, 22K and 18K gold price stood at Rs 87,700 and Rs 71,760 per 10 grams, registering new lifetime high as well.

MCX Gold Price:

MCX gold price ended at Rs 93,887 per 10 grams on April 11th, after hitting new historic high of Rs 93,940 per 10 grams during the trading session. Gold price surged by 18-19% year-to-date.

Will gold price in India hit Rs 1,00,000 mark next week?

Brokerage Axis Securities said, "Gold surged past $3,200 for the first time on Friday, driven by a weaker dollar and escalating trade tensions." The brokerage recommends BUY gold at above Rs 93,800 for a target of Rs 94,200 to Rs 94,500, with stop loss at Rs 93,500 per 10 grams. The Rs 94,500 target, if touched, will be yellow metal's new high.

Also, Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities said, gold extended its record-setting rally, soaring by ₹1,500 to hit fresh lifetime highs near ₹93,500 on MCX, defying rupee strength as geopolitical tensions and tariff battles between the US and China escalated further. The reciprocal tariff actions have injected fresh uncertainty into global trade flows, prompting increased hedge positions in safe-haven assets like gold.

Despite domestic currency appreciation, the robust global cues and heightened economic concerns have kept sentiment strongly bullish for bullion. With momentum in favor of buyers, gold now eyes the resistance zone of ₹94,500-₹95,000, while ₹92,000 serves as an important support. Ongoing developments in the tariff dispute and investor positioning ahead of key global economic data will continue to drive price action, Trivedi said.

Disclaimer: The write-up is just for information purposes, and is not a recommendation to buy, sell or hold. We have not done fundamental or technical analysis and have no opinion on article mentioned. Neither, the author nor Greynium Information Technologies should be held liable for any losses. Please consult a professional advisor.

Click it and Unblock the Notifications

Click it and Unblock the Notifications