Donald Trump’s “Big Beautiful Bill”: Top 10 Points On Whether It Helps Or Hurts Americans

U.S. President Donald Trump signed his "big, beautiful bill act" on July 4, 2025, which includes a sweeping tax and spending package that enacts major elements of his second-term agenda. This comes at a time when overall job growth has slowed and the world's largest economy has shrunk in the first quarter of 2025, suggesting lacklustre growth momentum.

The newly enacted legislation is expected to benefit many middle-class and wealthy families. However, it comes as a significant setback for low-income households, as several support programs catering to them have been reduced or eliminated. While public schools and, in some cases, preschool education continue to receive state funding, programs focused on early childhood development, particularly for the youngest children, remain largely dependent on federal support, which is now at risk.

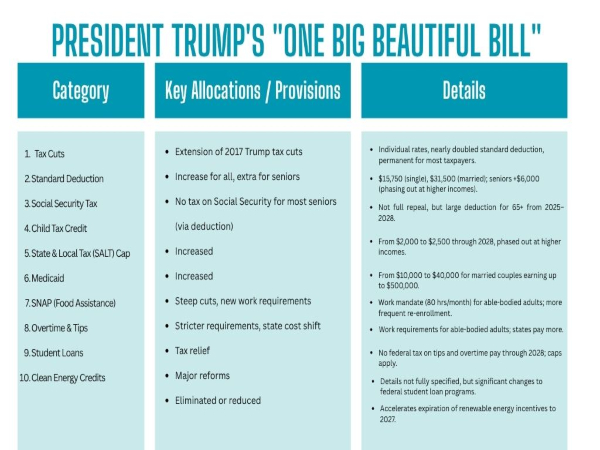

Top 10 Key Points From The Act

- Tax Cuts Made Permanent: The bill locks in the tax reductions from Trump's 2017 Tax Cuts and Jobs Act, making them permanent for both individuals and businesses. It includes about $4.5 trillion in tax cuts, with new deductions for tips, overtime, and auto loans, and increases the child tax credit to $2,200 from $2,000.

- Business and Manufacturing Incentives: Businesses can immediately write off 100% of equipment and research costs, and manufacturers benefit from expanded deductions and credits, especially for domestic semiconductor production.

- Social Security and Seniors: While Trump pledged to end taxes on Social Security income, widely known to take care of pensioners, the bill instead raises the standard deduction for seniors by $6,000 (phasing out at higher incomes) from 2025 to 2028.

- Medicaid and Welfare Cuts: Medicaid is a joint federal and state government program in the United States that provides healthcare coverage to eligible low-income individuals and families. It is a major source of health coverage, particularly for children, pregnant women, and individuals with disabilities.

The bill significantly cuts Medicaid and food assistance programs. Able-bodied adults without children must work at least 80 hours per month to qualify for Medicaid, and reenrollment is required every six months. These changes are projected to leave millions without health insurance.

- Border Security and Defense: It allocates $350 billion for border security, including the U.S.-Mexico wall and migrant detention, and boosts military spending.

- Consumer Financial Protection Bureau (CFPB): The CFPB's funding is nearly halved, raising concerns about reduced oversight of financial institutions.

Trump's Big Beautiful Bill

Other Provisions:

- Creates "Trump Accounts," a children's savings program with a potential $1,000 Treasury deposit.

- Increases the cap on state and local tax (SALT) deductions to $40,000 for five years.

- New excise taxes on university endowments and remittances sent abroad.

- Eliminates a $200 tax on gun silencers and certain firearms.

- Bars Medicaid payments to abortion providers for one year.

- Funds NASA's Artemis moon mission and Mars exploration.

- Raises the national debt ceiling by $5 trillion.

Fiscal Impact: The Congressional Budget Office estimates the bill will add about $3.3-$3.4 trillion to federal deficits over the next decade.

The legislation is highly controversial, praised for its tax relief and business incentives but criticized for deep cuts to social safety nets and its projected impact on the deficit and health coverage for millions

Click it and Unblock the Notifications

Click it and Unblock the Notifications