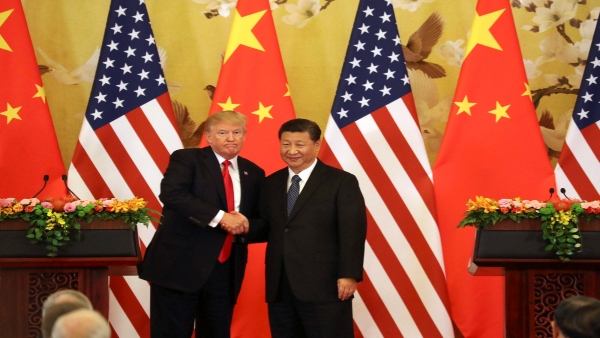

Clash Of The Titans: Who Stands To Lose More In The US-China Trade War - A Detailed Overview

In recent weeks, U.S. President Donald Trump has unleashed a wave of reciprocal tariffs targeting multiple countries. While many nations managed to secure a temporary 90-day reprieve through negotiations, one country was conspicuously excluded from the pause-China.

Rather than pursuing dialogue, Beijing chose confrontation, slapping a 125 per cent tariff on U.S. imports just a day after the White House confirmed that Chinese goods would now be subject to tariffs of at least 145 per cent.

Now, the world's two largest economies are locked in a full-blown, high-stakes trade standoff, with neither side showing signs of retreat.

What's At Stake In The Trade Standoff?

With sky-high tariffs now looming over both countries, economists warn of significant fallout. Market analysts estimate that U.S. exports worth $150 billion to China may evaporate in short order. In response, China's $440 billion in annual exports to the U.S. could decline by as much as 75 per cent over the next 18 months-unless a diplomatic breakthrough is achieved.

Leading economic indicators are already flashing red. Consumer confidence is slipping, inflation is rising, and capital spending is drying up. Experts caution that the prolonged trade war could push the U.S. into a mild recession by summer, eroding the country's long-standing dominance via its financial institutions and global economic influence.

Which Sectors Are Caught In The Crossfire?

The tech sector is particularly vulnerable. U.S. giants like Apple and Tesla rely heavily on Chinese manufacturing. Tariffs now threaten to slash their profit margins, giving Beijing potential leverage over the Trump administration.

China has targeted U.S. agricultural sectors, particularly poultry and soybeans. On March 4, Beijing revoked import approvals for three major U.S. soybean exporters, signaling a readiness to use agriculture as a pressure point in the ongoing trade feud. China, which accounts for half of U.S. soybean exports and nearly 10 per cent of poultry exports, holds substantial sway in these sectors.

The Chinese Economy: A Fragile Front

China is not immune to the consequences. According to the U.S. Trade Representative, the U.S. imported $438.9 billion worth of goods from China last year-equivalent to about 3 per cent of China's total GDP, which remains heavily export-driven.

In a recent report, Goldman Sachs warned that the latest tariffs could drag China's GDP growth down by up to 2.4 per cent. The firm projects just 4.5 per cent growth for 2025, well below the Chinese government's official 5 per cent target.

The economic strain is also being felt on the labor front. Goldman Sachs estimates that up to 20 million Chinese workers, roughly 3 per cent of the national labor force, are directly exposed to U.S.-bound exports. As a result, employment pressure is intensifying amid mounting domestic and global challenges.

This trade conflict also coincides with other economic hurdles for Beijing: deflation, a crisis-hit property sector, and elevated debt levels, all of which add to the urgency for a resolution.

Uncertainty Reigns

As both sides dig in, no one can say for certain who will blink first-or whether either side will back down at all. What is clear, however, is that the economic costs are mounting rapidly. With global supply chains, markets, and workers caught in the crossfire, the stakes couldn't be higher.

Click it and Unblock the Notifications

Click it and Unblock the Notifications