Chandigarh Man Finds Reliance Shares Worth Rs 11 Lakh – How To Claim Deceased Holder’s Stock?

In an unexpected turn of events, a Chandigarh resident recently uncovered Reliance Industries Limited (RIL) shares purchased in 1988. According to estimates by netizens, these shares could be worth around Rs 11 lakh in today's market.

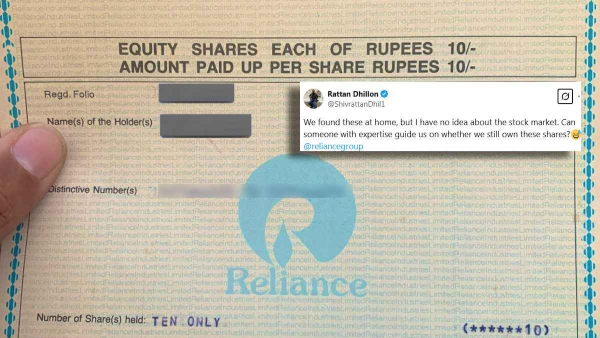

The discovery came to light when Rattan Dhillon, a car enthusiast from Chandigarh, shared pictures of the documents on X, formerly Twitter. The documents revealed that the original shareholder, now deceased, had purchased 30 equity shares at Rs 10 each.

Dhillon wrote, "We found these at home, but I have no idea about the stock market. Can someone with expertise guide us on whether we still own these shares?"

The post quickly gained traction among stock market enthusiasts, who responded with their assessments.

Several users calculated that after three stock splits and two bonuses, the holding had grown to 960 shares, with an estimated value ranging between Rs 11 and Rs 12 lakh.

A few years ago, a similar case made headlines when a man claimed to have discovered 20,000 shares of MRF, originally purchased by his grandfather in the 1990s. As MRF shares soared to Rs 65,000 per share, the man's newfound wealth was estimated at Rs 130 crore.

Can You Claim Forgotten Shares?

If you stumble upon forgotten shares, can you claim them directly? The process depends on whether a nominee has been designated for the account.

Scenario 1 - If A Nominee Is Assigned

If the account holder had designated a nominee, the nominee must initiate the transfer process by submitting a form with their details along with a certified death certificate of the deceased shareholder. This form can be obtained from the relevant depository participant or downloaded from their website. Once the submitted documents are verified, the shares are transferred to the nominee's depository participant account.

However, if there are multiple legal claimants to the shares, the transfer process may become complex and require legal intervention.

Scenario 2 - If No Nominee Is Assigned

If the deceased shareholder did not assign a nominee, the process becomes more intricate. The bank or financial institution handling the shares must review all previously owned documents to determine the rightful owner.

The first document they will look for is the deceased holder's will. A will provides clear instructions on asset distribution. If a will is not available, the claimant must obtain a succession certificate from the court, which legally establishes their right to inherit the shares.

The Importance Of Legal Clarity

To avoid disputes, the most practical approach is for all legal heirs to discuss and agree on how the shares should be distributed. This internal agreement should then be taken to the court for approval to facilitate a smooth transfer of ownership. Each heir will need to submit a legal affidavit to the court, confirming their claim.

Proactively assigning nominees or preparing a will can save heirs from legal complications and ensure the seamless transfer of investments in the future.

Click it and Unblock the Notifications

Click it and Unblock the Notifications