Ashish Kacholia Portfolio: Balu Forge Proposes Capacity Expansion With Rs. 21.03 Lakh Investment

The stock market has favourably performed towards Balu Forge Industries Ltd (BFIL) after a 1.97% rise noticed on Tuesday that raised the company's share price to Rs 818.35 from the previous Rs 802.50 closing. The picture is pretty astounding considering that the stock price has risen a whopping 429.50% since its 52-week low which was at Rs 154.55 marking it to be a multibagger.

So this also meant that the company was in a position to acquire 7-Axis CNC machining technology as a way of further improving its production capabilities. At the time of the arrival of the new machinery, the firm had a total rated machining capacity of Rs 32000 tons and a machinery usage rate of 75 per cent. Although this is always dependent on the moves of the marketplace, expansions will more or less be in place by 2025.

Starting off with a first machine that cost Rs 21.03 Lakh, BFIL aims to increase the number of machines under this initiative gradually expanding its internal operations to cover a wider array of components. All these additions are a way for the company to become a key supplier across many industries including aerospace, railways, and oil. By virtue of the new technology acquired, complexities in design will automatically be resolved increasing cut-down material wastage while increasing precision.

According to the results released by BFIL, it performed exceptionally well in Q2FY25 witnessing a growth in its revenues as it reported a 60.1% increase in its net sales, net profits also performed remarkably and grew by 106.9% during the stated periods.

When comparing H1 FY25 with FY24, sales grew by 58.3% with net profits rising by more than 105% after posting a total of 82.28 crores.

Comparing the annual reports of FY24 with FY23, BFIL's net revenue posted a 14.2% increase as net sales stood at 326.64 crores along with an increase of 30.4% in profits.

Two major investors Ashish Kacholia and Bengal Finance & Investment Pvt Ltd own a total of 1.82% and 1.74% of shares of the company whereas the registered foreigners more than quadrupled their stake from 8.51% to 10.43% from June to September 2024.

BFIL sits at a market cap of over 8,900 crores and holds an impressive 25% return on equity rate with their other highlights being a ROCE of 30%, their share price more than quadrupled in the last two years and grown an astonishing 1225%.

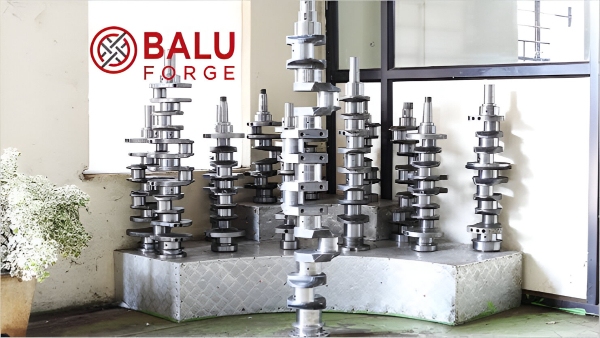

Balu Forge Industries Ltd commenced its activities in 1989. The Firm's core specialization and focus is in manufacturing and selling fully finished and semi-finished forged components. The company has entire Offloading facilities and infrastructure including that of machining. The firm therefore has the capability of producing components from 1 kg to 1000 kg that meet the emission and energy requirements of new vehicles.

Balu also caters to a wide variety of businesses including defence, oil & gas, railways and marine and has a total of 80 countries under its umbrella as part of its global business network. This firmly cements BFIL's leadership stance in the forging sector.

Click it and Unblock the Notifications

Click it and Unblock the Notifications