Aequs IPO Allotment: How To Check Status Online? BSE, NSE, Kfin Direct Links; GMP Hints At 29% Premium Listing

Aequs IPO Allotment Status: The company is scheduled to declare its IPO allotment status on December 8. The status of the application can be reviewed on BSE, NSE, and Kfin Technologies. On Monday, the latest grey market premium (GMP) suggested at a little over a 29% premium listing, despite the IPO receiving more than 100 times subscription. Aequs has emerged as among one of the best IPOs of 2025. All investor categories showed a strong response for the Rs 921.81 crore public offer.

Aequs IPO Allotment Date:

The tentative date for announcing allotment status is expected on December 8. There are various methods to check application status with details like Demat account, PAN card number, application number, and IFSC code among others. The application status will be available on BSE, NSE, and Kfin Technologies.

Kfin Technologies is the registrar of the IPO.

Aequs IPO Allotment Status Kfin Technologies:

Firstly, visit Kfin Technologies IPO allotment status page. The direct link is mentioned below:

https://ipostatus.kfintech.com/

The next step is to select the IPO option, where you have to click on Aequs. Then either enter your application number or PAN card or Demat account number to take the process ahead. Click on SUBMIT lastly.

Aequs IPO Allotment Status BSE:

Investors should visit the IPO allotment status page on BSE. The direct links are below:

https://www.bseindia.com/investors/appli_check.aspx

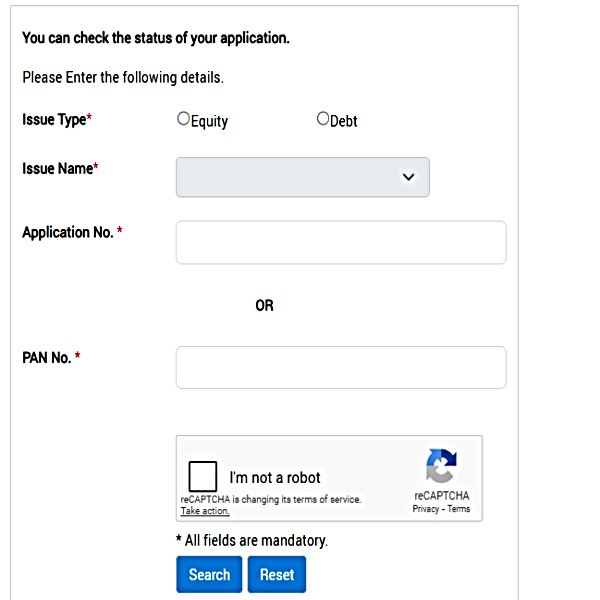

They will need to select issue type between Equity or Debt. For Aequs, the IPO type is 'Equity'. The next step is to select issue name which is 'Aequs'. On BSE, you will be required to mention either PAN or application number before clicking on SEARCH.

Aequs IPO Allotment Status NSE:

Here is the direct link to NSE IPO status page.

https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids

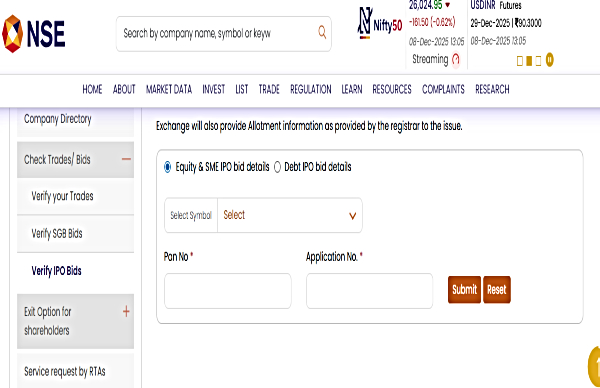

On NSE, you will first have to select 'Equity & SME IPO bid details' option and then select the company symbol which is 'AEQUS'. On this exchange, you will have to mention both PAN and application number before clicking on SUBMIT.

Aequs launched its IPO from December 3rd to December 5th, with issue size of Rs 921.81 crore and price bands ranging from Rs 118 to Rs 124. On the final day of the IPO, Aequs recorded robust oversubscription of 101.63 times.

Aequs received an impressive response from investors. The category of qualified institutional buyers (QIBs) oversubscribed 120.92 times, while the portion for retail individuals and non-institutional investors oversubscribed by 80.62 times and 78.05 times respectively. Aequs also reserved a portion of its IPO for employees, which was oversubscribed by 35.85 times.

Aequs IPO GMP Today:

Aequs IPO last GMP is Rs 36, last updated Dec 8th 2025 12:36 PM. With the price band of 124.00, Aequs IPO's estimated listing price is Rs 160 (cap price + today's GMP).The expected percentage gain/loss per share is 29.03%, as per Investor Grain.

The IPO's retail subject to SAUDA is at Rs 3,300, while the SMALL HNI subject to SAUDA is at Rs 46,200.

Aequs IPO Listing:

After the allotment status, Aequs will credit shares on December 9, alongside refund the money to those investors who could not make the cut. Following this, the IPO is expected to list on December 10.

According to Rajan Shinde, Research Analyst, Mehta Equities, Aequs is one of India's most advanced and fully integrated aerospace precision-manufacturing platforms. We think with a unique position as the only Indian manufacturer operating from a single SEZ with end to end aerospace capabilities that is spanning machining, forging, surface treatment and assembly, company offers high entry-barrier exposure to a globally outsourced industry.

Further, the analyst believes that Aequs' global manufacturing footprint across India, the U.S. and France enhances customer proximity and collaboration, enabling it to win and retain long-term contracts with global OEMs such as Airbus, Boeing, Safran Collins and Spirit AeroSystems, many of whom have relationships exceeding 15 years. By looking at the financials, While the company reported muted financial performance the revenue from operations growth of 18.8% in FY24 followed by a 4.2% decline in FY25, with losses driven largely by a slowdown in the consumer division and strategic business transitions. While the core aerospace segment continues to demonstrate strong and structural momentum.

Additionally, the analyst highlighted that given the strong customer stickiness, a diversified portfolio and JVs with global leaders like Magellan Aerospace, Aubert & Duval and Tramontina, we believe Aequs is well-positioned to capture the rising outsourcing trend in aerospace precision components. Its ability to leverage aerospace capabilities into high-volume consumer products further strengthens utilisation and margins.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of Goodreturns.in or Greynium Information Technologies Private Limited (together referred as "we"). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications