How Increase In Securities Transaction Tax (STT) May Marginally Impact Trading Costs?

This year's Union budget has introduced several significant changes that are poised to impact the stock market and financial sector. The latest budget has introduced several significant changes that will impact the stock market and the financial sector.

STT adjustments

One of the key changes in this year's budget is the revision of the Securities Transaction Tax (STT). Specifically, the STT on the sale of options in securities has been increased from 0.0625% to 0.1% of the option premium. Similarly, the STT on the sale of futures in securities has risen from 0.0125% to 0.02% of the futures price.

The increase in STT is likely to affect trading costs, albeit marginally. For traders, these adjustments could translate into slightly higher transaction expenses, which may prompt a re-evaluation of trading strategies. Although these changes will have a manageable impact.

Angel tax removal

The removal of the angel tax is a significant relief for startups and small businesses. This move is expected to ease funding challenges as venture capitalists and other investors will face fewer tax barriers. Startups, which often rely heavily on angel investors, will benefit from a more conducive environment for raising capital.

LTCG adjustments

The budget also includes adjustments to Long-Term Capital Gains (LTCG) taxes, which are expected to improve the financial environment for both listed and unlisted companies.

It has introduced an additional tax deduction of Rs 25,000 for long-term capital gains and Rs 25,000 on salary. These adjustments are intended to offset some of the tax burdens and offer a slight financial relief.

Buy back shares

The new taxation policy on share buybacks, where income will now be taxed in the hands of the recipient at applicable tax slabs similar to dividends, represents a significant shift. This change is likely to deter companies from opting for buybacks as a preferred method of shareholder payouts.

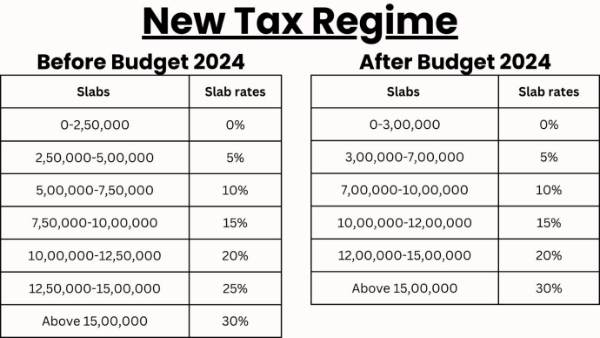

Income tax slabs

The changes in the new tax regime have increased the income threshold for the 0% tax rate from Rs 2.5 lakhs to Rs 3 lakhs and adjusted the subsequent slabs accordingly, making it beneficial for small taxpayers.

Foreign company tax rate reduction

The reduction in corporate tax rates for foreign companies is a strategic move aimed at strengthening the country's appeal as a global manufacturing hub and attracting higher levels of Foreign Direct Investment (FDI). By lowering the tax rate from 40% to 35%, the government aims to compete more effectively with other emerging markets and encourage foreign companies to establish operations and create jobs within India. This initiative aligns with broader economic goals, including positioning India as an alternative to China in global supply chains, thereby supporting long-term economic growth and industrial development.

Gold Prices

The reduced gold prices have already led to increased purchases and a surge in demand, evident from the crowded jewellery stores. This shift in consumer behaviour could signal a broader change in savings patterns, with more individuals considering gold as a viable investment to hedge against market volatility. Investors might increasingly turn to gold, potentially leading to a more pronounced shift in asset allocation strategies.

The budgetary shifts

The latest budget introduces a mix of changes that will affect various aspects of the financial sector. While the increase in STT may appear minor, these adjustments are balanced by changes in exemptions and, to some extent, the rationalization of transaction charges by exchanges for F&O trades, scheduled to take effect on October 1, 2024. However, in the long run, these changes are not expected to cause significant shifts in financial strategies or investment behaviour.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of GoodReturns.in or Greynium Information Technologies Private Limited (together referred as “we”). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications