A Comparison on Tax Computation Between FY 2017-18 and FY 2018-19

The Union Budget 2018-19 may not have changed the tax slab but it will change the way your tax is computed. Read on to find out how.

There has been no change in tax slabs for the financial year 2018-19.

But there has been changes in the taxation and they are:

- A standard deduction of Rs 40,000 on taxable income in lieu of transport and medical expenses

- Education and healthcare cess increased to 4% instead of 3%.

This changes the way your income is computed as a resident of India. Is this good news?

Let us compare two individuals who are Indian residents below 60 years of age with salaried income. Individual A has a salaried income of Rs 5 lakhs per annum and Individual B has a salary of Rs 25 lakhs per annum.

Some notes before we start:

- Conveyance allowance and Medical allowances are not taxable upto a limit.

- For the year 2018-19, there will be no conveyance or medical allowance of Rs 19,200 and Rs 15,000 respectively that could earlier be reimbursed.

- Tax savings depends on tax slabs you fall under.

- The standard deduction allowable for salaried employees earning an annual income between Rs 75,000 and Rs 5 lakh was equivalent to Rs 30,000 or 40% of the income, whichever was lower. The limit was set at Rs 20,000 for those earning more than Rs 5 lakh.

- A standard deduction does not require any disclosures, investment proofs or bills.

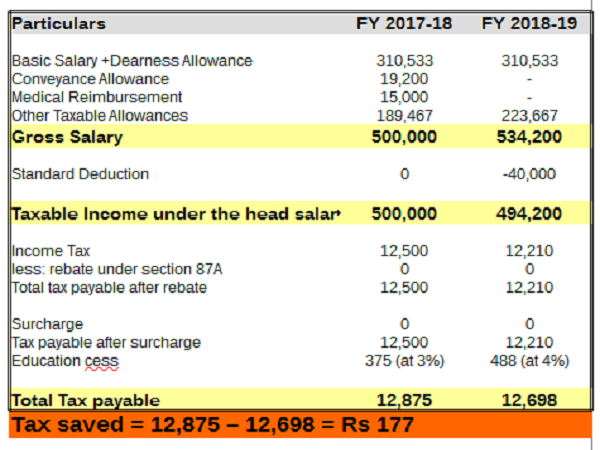

Individual A with Rs 5 lakh income:

We can see that it hardly impacts a taxpayer with less than Rs 5 lakh annual income.

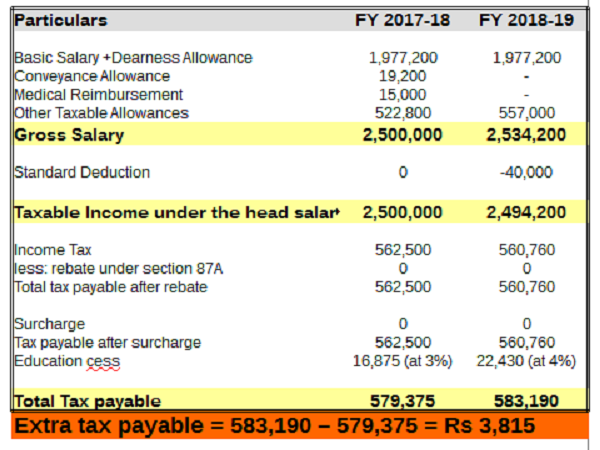

Individual B with Rs 25 lakh income:

The above table shows that the tax payable by the individual will be higher than before. The liability of tax payable will increase with increasing income after these changes.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of GoodReturns.in or Greynium Information Technologies Private Limited (together referred as “we”). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications