Sukanya Samriddhi Yojana Calculator SBI: How Rs 12,500 PM Turns Rs 71,82,119 Corpus When Girl Child Turns 21

The government-backed India Post is offering a host of small savings schemes, with minimum investments as little as Rs 500. Among them is also the Sukanya Samriddhi Yojana account meant only for daughters of India. The scheme can be opened by guardians or parents right from the birth of their girl child. The deposits in SSY begin from Rs 250 to a maximum of Rs 1.5 lakh. Did you know if a parent invests Rs 12,500 per month, the earnings will be nearly Rs 72 lakh when the daughter attains 21 years of age.

Sukanya Samriddhi Yojana Benefits:

- The eligibility age to enter Sukanya Samriddhi scheme is immediately after the birth of the girl child till she attains the age of 10 years.

- The scheme allows minimum initial deposit of Rs 250 and subsequent deposits can be made in multiples of Rs 50, provided that at least Rs 250 is deposited in a financial year.

- But the maximum deposit limit in SSY is Rs 1,50,000. Any excess amount above Rs 1.5 lakh, will not earn any interest and will be returned.

- The tenure of the scheme is for 15 years from the date of the opening of account.

- The account can be managed by parents or guardians. However, in the case of guardians, the girl child once she turns 18 can take control of the account herself by submitting the necessary documents.

- There is tax benefit of up to Rs 1.5 lakh under section 80C of Income Tax Act, allowed on SSY accounts. However, this is not applicable if you are under the new income tax regime.

Sukanya Samriddhi Yojana Interest Rate 2025:

The current interest rate offered under SSY is 8.2% as of now. This is far better than interest earned on any traditional bank fixed deposits or other schemes. The rates could change in the coming future. The next announcement for small savings schemes interest rates is likely to be between January to March 2026.

According to guidelines, interest is calculated monthly based on the lowest balance in the account between the close of the fifth day and the end of the month. At the end of each financial year, this interest is credited to the account, with any fractional amounts rounded to the nearest rupee: amounts of fifty paisa or more are rounded up, while lesser amounts are disregarded.

Notably, the interest is credited at the end of the financial year regardless of any changes in the account office due to transfers, ensuring that the financial growth for the girl child remains consistent and secure.

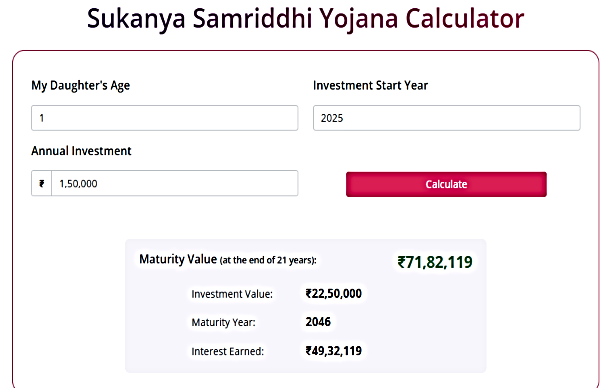

Sukanya Samriddhi Yojana Calculator SBI:

Using SBI's calculator for Sukanya Samriddhi, if a parent or guardian decided to open SSY account with a plan of investing Rs 1,50,000 per annum, right after their girl child becomes 1-year old. This will translate to Rs 12,500 per month every year.

Their investment value would be Rs 22.50 lakh over the 15 years of tenure. But their interest earned would be Rs 49,32,119. This will take the total corpus value to Rs 71,82,119. For instance, if the account is opened in December 2025, the maturity period will end in 2046.

Your investment bagged a whopping 219.20% returns on the value of Rs 22.50 lakh.

It needs to be noted that you cannot invest beyond Rs 1.5 lakh in an SSY account. And also, the current example is based on 8.2% rate. The performance could change ahead depending upon future rates.

Sukanya Samriddhi Yojana Withdrawals:

The account will mature once your girl child becomes 21 years old. However, early closure is permitted under specific circumstances, particularly if the account holder intends to marry before reaching maturity.

For withdrawing before maturity, the account holder must submit an application along with a declaration on non-judicial stamp paper, duly attested by a notary, and provide proof of age confirming that they will be at least eighteen years old on the marriage date. Notably, this early closure can only occur within a one-month window prior to the intended marriage and must be completed within three months post-marriage.

Also, any account holder can apply for a withdrawal of up to fifty percent of the balance at the end of the preceding financial year, specifically for educational purposes. This withdrawal is permissible only after the account holder turns eighteen or completes the tenth standard, whichever comes first.

Additionally, premature closure is permitted during an unfortunate event of the account holder's death, the account can be closed immediately upon submitting an application along with the death certificate issued by the competent authority.

How To Open Sukanya Samridhhi Account At SBI, Other Banks?

It needs to be noted that only one account can be opened per girl child. Parents can open a maximum of two accounts for each of their children. However, there is an exception allowed for more accounts in case of twins or triplets. The account can be transferred to anywhere in India.

Documents Required To Open Sukanya Samridhhi Account:

- Sukanya Samriddhi Account Opening Form

- Birth certificate of girl child

- Identity proof (as per RBI KYC guidelines)

- Residence proof (as per RBI KYC guidelines)

You have to visit the post office or a bank branch for opening the bank account.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of GoodReturns.in or Greynium Information Technologies Private Limited (together referred as “we”). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications