Union Budget 2024-25: From Income Tax To GST - Top Measures To Be Announced On The Taxation Front

The Union budget for FY 2024-25 was presented on 1st February 2024 but it was an interim budget as the country was headed for the general elections. The interim budget was more of a vote on accounts and no major policy decisions were announced.

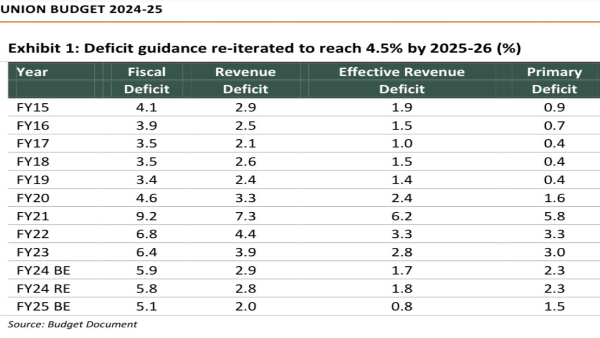

After the general elections, the NDA government is back in power. Formation of Government indicates continuity in policy making. Mrs Nirmala Sitharaman has once again been entrusted with the responsibility of the finance ministry. Her previous term was impressive. India is currently the fastest-growing economy amongst the peer economies as well as the developed world. Despite their third term, the NDA government has stayed away from populism. They have been prudent in expenditure and revenue collection has been robust.The fiscal deficit is on a downward trajectory and well on course to achieve the Government of India's target of 4.5% of GDP by the end of FY 2025-26

In this backdrop, Part II of the Union Budget for FY 2024-25 will be presented by Finance Minister Mrs Nirmala Sitharaman in the second fortnight of July 1024. The exact date of presentation of the budget has not been communicated by the Government so far.

While presenting the full budget for FY 2023-24, the Finance Minister highlighted several headwinds, particularly from the global front. To spur growth in a post-COVID environment, economies across the globe had embarked on a massive fiscal expansion, resulting in higher inflation. Central banks world over, increased the interest rates to counter rising inflation. India too suffered as a consequence and mounted a serious response to combat inflation. However, a country like India cannot compromise on economic growth for long. Hence balancing growth and inflation was a huge challenge.

Today when we look back, India has done a tremendous job in taming inflation and maintaining a decent growth rate at the same time. The Indian economy recorded one of the highest growth rates in the world at 8.2% in FY 2023-24 while the last recorded inflation rate was at 4.75% lower than all estimates.

The Finance Minister would be reasonably happy when she looks back at these numbers at the time of the presentation of the union budget. The challenges have been firmly dealt with and the results have been impressive. She can now focus on efforts to further improve the GDP growth rate, keep fiscal deficit at or below targeted levels, improve India's ease of business rankings, generate more employment and take more people out of poverty.

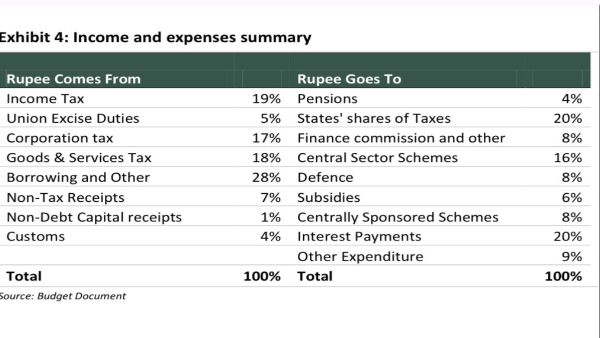

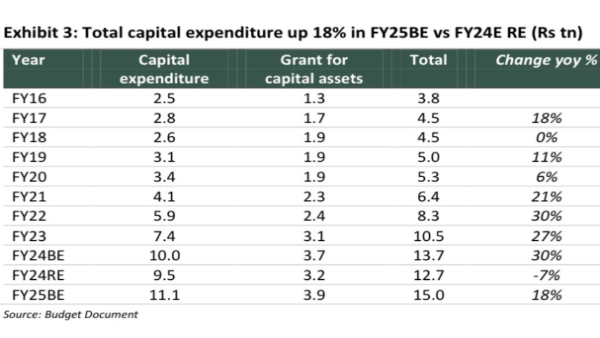

As per the estimates presented in the interim budget this year in February, central government expenditure in FY 2024-25 is pegged at INR 47,65,768 Crores. Capital expenditure is estimated at 11.1 lac crore, an increase of 18% over the previous year. The fiscal deficit is estimated at 5.1% of GDP in FY 2024-25 and 4.5% by FY 2025-26.

We feel that the numbers presented above are reasonable and achievable. The current government has developed a habit of over-achieving projected numbers in recent years and we expect nothing less in the current year.

There is a perception that the budget can be populist this year to take care of electoral concerns. We don't think this would be the case. There would be schemes announced to alleviate poverty and reduce the agrarian crisis.

We also believe that the budget would place special attention on new-age technology like artificial intelligence and semiconductors. Skilling individuals, promoting entrepreneurship and strengthening MSME would be other critical areas of emphasis.

We expect the following measures to be announced on the taxation front:

Income Tax:

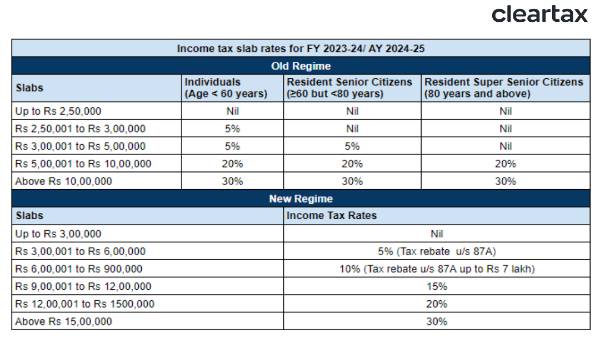

Focus of FM would be on the new tax regime. Previous efforts to popularize the new tax regime over the older one have not yielded the desired results so far. We expect the current income tax slabs to be rationalized under the new tax regime. The probability of zero tax for income slabs up to 5 lacs is a distinct possibility. This means that tax-paying citizens will have to pay lower taxes for the income earned as compared to the previous year.

There would be either no change or negative changes in the old tax regime. The endeavour would be to try to shift more taxpayers to the new tax regime.

Corporate Tax:

The corporate tax structure in India is now competitive at a global level, especially for new manufacturing companies. Overall corporate taxes range from 15% to 30%. plus surcharges.

We do not expect any changes in the corporate taxes in the upcoming budget.

GST

We do not expect any rationalization of GST rates in the forthcoming budget.

GST rates are decided by the GST council and that is communicated on a periodic basis. Hence any meaningful announcements are neither expected nor warranted,

Overall, since the implementation of GST in India, the structure has been simplified and we are headed toward a reduction in the slab rates. More items would be included in the lower tax slabs going forward. The tax rates may also be rationalized with fewer tax rates. This budget can throw light on the same.

The budget can also highlight the government's resolve to include petrol and diesel prices under the ambit of GST which could have a positive impact on inflation and reduce the financial stress of the citizens of the country.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of GoodReturns.in or Greynium Information Technologies Private Limited (together referred as “we”). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications