Want to be a millionaire? Invest as little as 2000 a month

Source: Bloomberg

G-sec Yield

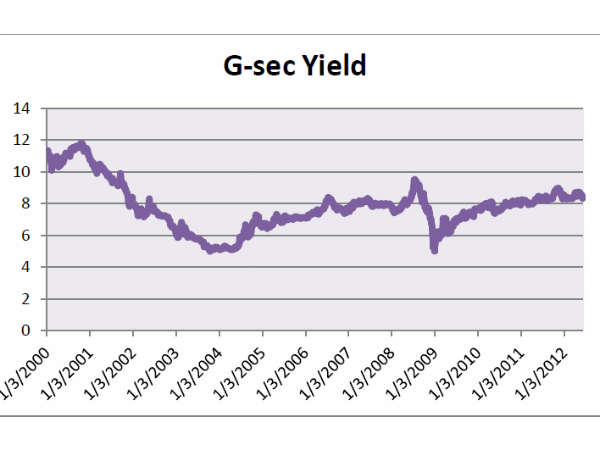

Chart 3: Showing the performance of 10yr G-Sec Yield

The above chart shows you the 10-year G-sec yield from the year 2000. The full name of G-Sec is Government Securities.

G-Secs are issued by the Government for raising a public loan or for other purposes as notified in the official Gazette. They consist of Government Promissory Notes, Bearer Bonds, Stocks or Bonds held in Bond Ledger Account. They may be in the form of Treasury Bills or Dated Government Securities.

Government Securities are mostly interest bearing dated securities issued by RBI on behalf of the Government of India. GOI uses these funds to meet its expenditure commitments. These securities are generally fixed maturity and fixed coupon securities carrying semi-annual coupon.

Since the date of maturity is specified in the securities, these are known as dated Government Securities, e.g. 8.24% GOI 2018 is a Central Government Security maturing in 2018, which carries a coupon of 8.24% payable half yearly. (Source: SBI DFHI Ltd)

There are other types of fixed income instruments available in the market, but I have taken Government Securities, since they are issued by the RBI on behalf of the Government of India and chances of losing money is very limited for Government Securities.

So, by investing into both the categories you are in a win-win situation, which will allow you to get the best from both the two markets.

STEP 3: START A SIP WITH INR 2000 IN THE TWO SELECTED FUNDS.

Well, nothing much left but to execute your SIP. You can buy SIPs online with Fundsupermart.com. As an existing Fundsupermart client, you have the privilege of being advised by your Client Investment Specialist. Each Fundsupermart.com client has a designated Client Investment Specialist who assists the client at every step of his transaction.

You are probably beginning to feel a little skeptical at how simple it is and whether it will work. Only two funds, one portfolio, a modest amount of INR 2000 monthly investment etc.

Well, then you have probably not heard about the Power of Compounding. Even if you invest a relatively smaller amount, you could make a very good return by utilising the power of compounding. What you need to have on your side is TIME. That's why they say, Invest Young.

Let us take our investment horizon to be of 240 months (20 years). We will invest INR 1000 each month in both funds. For the sake of simplification let us expect that BSE Sensex and the Debt market will return 12% and 8% annually respectively.

| Equity | Debt | |

|---|---|---|

| Monthly SIP | 1000 | 1000 |

| Period (months) | 240 | 240 |

| Rate of Returns- % | 12 | 8 |

| Total Investment Amount | 240000 | 240000 |

| Future value of Investments | 989,255.37 | 589020.42 |

| Appreciation | 749255.37 | 349020 |

By looking at the above table you can easily see that your modest SIP amount has given you a fair amount of return. A paltry amount of INR 1000 per month invested in an equity fund assuming it's return will remain in the range of 12% on an average throughout 20 years will give INR 749255 extra after 20 years. Similarly, INR 1000 invested in to a debt fund, assuming 8% returns will give 349020 extra after the same time horizon.

The power of compounding can make small investments become big with the passage of time. In this case the money that you have invested grows on an average of 12% and 8% on a year on year basis. The return made each year is compounded again in the next year. When the return is re invested, it earns further returns on the return and so on, helping your money to grow.

To know more about the Magic of Compounding click here.

Click here to learn why SIPs are the finest avenue to invest.

Remember, this is just a start for beginner investors who want to get in to the mutual fund industry. This portfolio will give you a taste of what to expect when investing.

This is a far better approach towards investing for beginners, rather than speculative investments made in equity markets. Start initially with a descent amount, get some experience, know how to invest profitably and be rich.

Want to know how to save and be rich? Click on the following link to know more: How to Save to Invest

Author: Debanjan Guha Thakurta, Fundsupermart.com

This article is for information purpose only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products /investment products mentioned in this article or an attempt to influence the opinion or behavior of the investors /recipients. Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Click it and Unblock the Notifications

Click it and Unblock the Notifications