Why Hospital Room Rent Limits Are The Most Dangerous Clause In Indian Health Insurance?

Health insurance policies often impose specific limits on room rent, which can be structured in two main ways: a fixed amount cap and a percentage of the sum insured. A Fixed Amount Cap sets a pre-determined daily limit, such as Rs 3,000 or Rs 5,000. On the other hand, the Percentage of Sum Insured method typically allows for a cap of 1% to 2% of the total sum insured.

For example, if the sum insured is Rs 5 lakh, the room rent cap would be Rs 5,000 per day (1%). If a policyholder opts for a room with rent exceeding this cap, the insurer may apply a proportional deduction, affecting not only the room rent payout but also related expenses like doctor's fees and nursing charges, which are often tied to the room category chosen.

However, the room rent clause refers to the maximum amount the hospital will pay per day for your hospital room charges.

The room rent clause is one of the most misunderstood clauses of a health insurance policy. Many people assume it only limits the cost of the hospital room itself, but in reality, it is quite different. Many of the hospital costs are directly linked with the room you choose, such as Doctor's fees, Nursing charges, Operation theatre charges and surgery costs. If you choose a higher category room, these charges also go up. So, the 'Room Rent Clause' affects not just your room rent but your entire hospital bill.

"Room rent limits in health insurance are there to keep costs in check and avoid overuse of expensive rooms. This is to ensure that premiums stay affordable for everyone. They help avoid unnecessary spending on expensive hospital rooms. If you choose a room that costs more than the limit, you will need to pay the extra amount yourself, and sometimes this can also affect how much the insurer covers for other medical expenses. We will need to be mindful of these limits clearly and offer different plans to suit various needs. We need to find ways to tackle rising healthcare costs while making sure people get quality healthcare," said Mr. Shashi Kant Dahuja, Executive Director and Chief Underwriting Officer, Shriram General Insurance Limited.

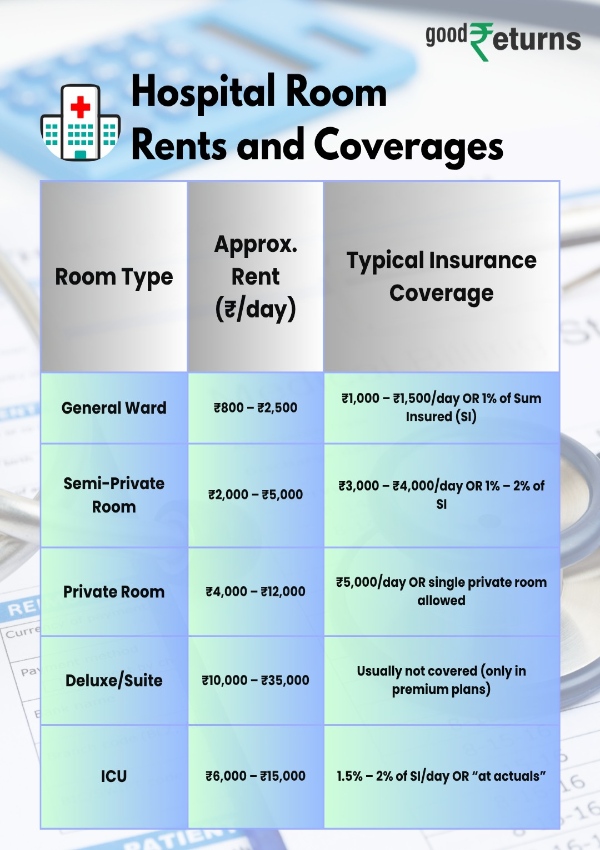

Hospital Room Types & Insurance Limits - At a Glance

Based on data gathered from IRDAI guidelines, Policybazaar, Niva Bupa, Star Health, Max Bupa, and Care Health, below is a summary of the different kinds of hospital rooms in India along with their regular rent ranges and insurance room rent limit structures.

Let's understand this with an example

A person has a health insurance policy with a sum insured of Rs 5 lakhs and a room rent limit of 1% of the sum insured (i.e., Rs 5,000 per day). Suppose they are hospitalised for five days due to surgery.

Scenario 1: Patient stays within room rent limit (Rs 5,000/day)

Room Rent: Rs 5,000/day x 5 = Rs 25,000

Doctor Fees: Rs 50,000

Surgery Charges: Rs 1,00,000

ICU Charges: Rs 25,000

Medicines & Consumables: Rs 50,000

The insurer will cover the entire bill since the patient stayed within the limit.

Total Bill: Rs 2,50,000 Insurance Payout: Rs 2,50,000 Out-of-pocket Expense: Rs 0

Scenario 2: Patient stays in a Rs 10,000/day room (exceeds limit)

In this case, because the room rent is double, all associated charges, except for medicines, will also increase proportionately.

Room Rent: Rs 10,000/day x 5 = Rs 50,000

Doctor Fees: Rs 100,000

Surgery Charges: Rs 2,00,000

ICU Charges: Rs 50,000

Medicines & Consumables: Rs 50,000

Total Bill: Rs 4,50,000

However, the insurer will argue, correctly, that had the patient chosen a room within the limit, the total cost would have been Rs 2,50,000. Hence, they will only reimburse up to that amount.

Total Payable: Rs 25,000 + Rs 50,000 + Rs 1,00,000 + Rs 25,000 + Rs 50,000 = Rs 2,50,000

Out-of-pocket Expense: Rs 4,50,000 - Rs 2,50,000 = Rs 2,00,000

Bottom line: When selecting a health insurance policy, always check the room rent limit. Choosing a policy with no cap, or at least a high limit, ensures that your hospital experience and claim payout align with your expectations. Overlooking this small clause can turn what you thought would be a fully covered treatment into an expensive shock.

Most customers in India only focus on things like sum insured, premium, claim settlement ratio and network hospitals when buying health insurance. But one small clause often gets missed, which can actually affect your claim experience a lot. It's called the room rent limit.

"Because hospitalisation costs in India are heavily dependent on the type of room you choose. Most hospitals categorize rooms into general wards, semi-private, private, deluxe, or super deluxe. Higher category rooms are priced higher due to charges for doctor visits, surgery fees, nursing care, and other medical services, even if the treatment itself is exactly the same. It's similar to how a business class ticket costs more than an economy class ticket for the same flight. It's just a way for service providers, whether airlines or hospitals, to identify customers willing to pay more for better comforts," said Pankaj Nawani, CEO, CarePal Secure.

This is the reason why insurers often impose a room rent limit. This is basically the most your insurance company is going to pay for your hospital room charges. Most times it's written as a fixed number (e.g., Rs 5,000 per day) or a percentage of your total sum insured (e.g., 1% of sum insured per day). Typically, there will be a specified limit, even for ICU admission.

"In health insurance, a proportionate deduction applies when you choose a hospital room that exceeds your policy's room rent limit. Since hospitals often charge more for the same treatment in higher-category rooms, insurers apply this deduction to keep claim payouts under control," Pankaj Nawani added.

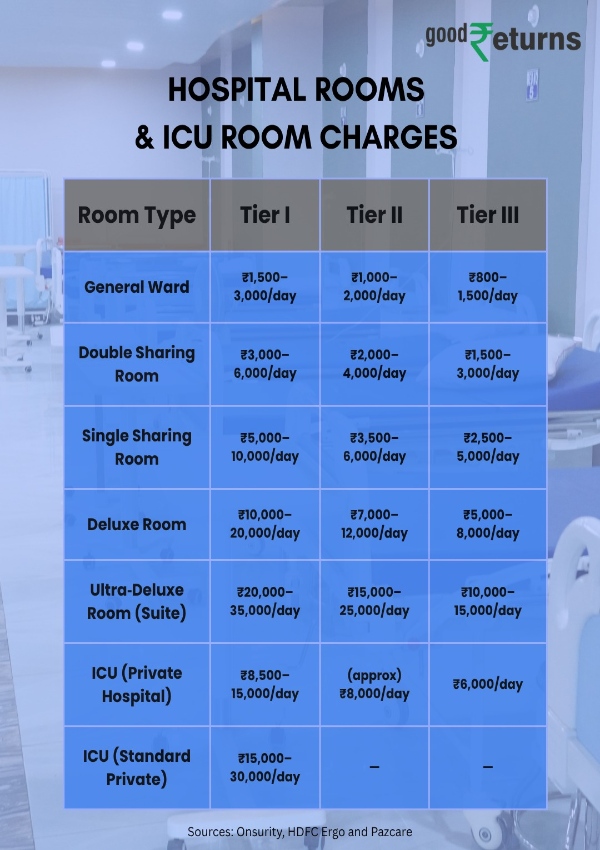

Average Hospital Room Rent Across India: Tier I, II, and III Cities Compared

Here is a well-organized summary of the average hospital room prices in India for different kinds of rooms and city tiers.

How Room Rent Sub-Limits Lead to Partial Claim Settlement?

As per Mr. Surinder Bhagat, Head - Employee Benefits, Large Account Practices, Prudent Insurance Brokers, in health insurance, it's not the surgery that hurts the most - it's the room rent". A small room rent limit drastically shrinks health insurance coverage, even if the total medical/hospital bill is within the sum insured. Sub limit on room rent triggers proportionate deductions across all expenses, leaving policyholders to bear significant out-of-pocket costs. For a comprehensive coverage, always opt for plans without room rent sub-limits.

Sub-limits matter: Room rent limits impact not just room costs, but all the associated hospital expenses - like Dr's fee, nursing charges, surgery costs etc

Proportionate deduction: If actual room rent exceeds the policy's limit, many other expenses are covered partially.

ICU cost is also affected; it is linked to room rent.

Retail health policies with room rent limits up to 1.5% significantly reduce actual claim coverage by 45%, especially for higher sum insured policies, despite claims being within the sum insured.

Why Your Rs 10 Lakh Health Cover May Not Be Enough?

For example, a policyholder with a Rs 10 lakh sum insured and a Rs 4,000/day room rent limit was admitted to a private hospital where the standard room rent was Rs 6,000. The insurer applied a 33% pro-rata deduction on the entire bill, including surgeon's fees and ICU charges. On a Rs 3.6 lakh bill, the customer received reimbursement of only Rs 2.4 lakh.

"When purchasing health insurance, most people focus on the sum insured or whether the policy covers critical illnesses and cashless hospitalization. However, one of the most overlooked and financially impactful clauses in Indian health insurance is the hospital room rent limit," said Nehal Mota, Co-Founder & CEO, Finnovate.

"This clause sets a daily maximum amount that the insurance will pay for your hospital room. While it may seem straightforward, it influences much more than just your choice of room. If you opt for a room with rent exceeding the allowed limit, your entire hospital bill can be subject to proportional deductions," Nehal Mota added.

This means you not only pay the extra room rent but also a significant portion of other expenses-such as doctor fees and surgical charges-out of your own pocket.

The Silent Clause That's Hurting Indian Patients Financially

One of the most dangerous and under-discussed clauses in Indian health insurance is the room rent limit. A quiet restriction that often catches policyholders off guard during hospitalization. On the surface, it seems simple: a cap on the per-day cost of your hospital room. But beneath that is the domino effect of differential costing where the same treatment ends up costing far more, just because of the room you chose.

"For instance, a knee replacement surgery in a general ward of a reputed Tier-1 hospital might cost Rs 2.5 lakh. Opting for a single AC room? The bill for the same procedure can rise to Rs 3.5 lakh. Not because the care improves, but because nearly every item such as the doctor's fees, OT charges, nursing gets proportionately marked up. Yet some insurance companies reimburse based only on your eligible room category, leaving patients to pay the inflated difference," said Ruchir Kanakia, Founder OneAssure.

"This practice isn't just financially draining; it's ethically flawed. It raises larger questions. When families choose a slightly better room for comfort or dignity, they aren't expecting to trigger a cost spiral," Ruchir Kanakia added.

For many, this clause quietly adds pressure at a time when they're least prepared for it. It's a gap in the system that deserves closer attention.

As per Arti Mulik, Chief Technical Officer, at Universal Sompo General Insurance, "when a patient is admitted, the first step is to check which room category the policy actually covers. That choice-shared, deluxe, private-also triggers the agreed-upon room rent ceiling. If someone opts for a lavish suite instead of the standard twin-sharing, the claim gets trimmed to fit the original band. The extra fare for that upgrade simply isn't part of the budget."

"Many of us feel reassured the moment we lock in a hefty Sum Insured and move on, but that impulse can backfire when the fine print bites. Room-rent caps, hidden sub-limits, and tiered category rules often sit in the background, quietly carving up the payout before a claim ever hits the desk. Learning those details up front turns what could be a surprise bill into a manageable line item, and that small effort shields your wallet in a crisis," Arti Mulik added.

Think of a plan where daily rent is capped at 1 percent of a 5-lakh sum insured. In such a case, the maximum room bill eligible for payment lands at 5,000 rupees. Anything beyond that ceiling lands on the insured, and the policy stays silent about covering the excess.

Decoding Health Insurance Room Types: Shared vs. Private Rooms

"Health insurance policies often specify the types of rooms available for hospitalization, which can include shared rooms, single private rooms, or policies with no cap on room type, typically found in premium plans. If a policy restricts the policyholder to shared rooms and they opt for a single private room or deluxe suite, the additional costs incurred will not be reimbursed. On the other hand, modern health insurance plans, particularly premium options, may offer no room rent limits or include a 'single private room' clause, allowing greater flexibility in room choice," commented Chetan Vasudeva, Senior Vice President of Business Development at Elephant.in, Alliance Insurance Brokers.

However, these policies generally come with higher premiums and are especially advantageous for those seeking treatment in higher-end hospitals or luxury care settings.

Intensive Care Unit (ICU) charges are typically higher than standard hospital expenses and often come with specific caps outlined in health insurance policies.

For instance, an insurer might set an ICU charge limit of Rs 10,000 per day or allow for 2% of the sum insured per day as the maximum reimbursement for ICU expenses. It is important to note that if the actual ICU charges exceed these stipulated caps, the policyholder will be responsible for covering the additional costs out of pocket.

"While understanding distinctions of health insurance policy is still comprehensive for policyholders, understanding the nuances of room rent capping can sometimes be difficult for a layman. It is thus important for the consumer to choose the room rent capping by clearly understanding the demarcations, do's and don'ts for hassle-free claim settlements," added Chetan Vasudeva.

Why Exceeding Your Room Rent Limit Can Cut Your Claim in Half?

For example, your policy allows Rs 5000/day in room rent, but you choose a room that costs Rs 7500/ day i.e. 50% more. This means that you won't just pay Rs 2500 (50%) more on room rent but you will end up paying approx. 50% of your entire bill out of pocket. This may put you under unexpected financial stress at a difficult time.

"To avoid this trap, you must choose a policy with no room cap limit or a significantly high room rent limit. In summary, the room rent limit in insurance is the maximum amount covered per day for hospital room charges. If you choose a room above this limit, insurers may apply proportionate deductions on the entire hospital bill. This can lead to high out-of-pocket expenses. To avoid this, opt for policies with no room rent cap or higher limits," said CA Foram Naik Sheth - KMP Wealth Management Solutions NPV Associates LLP.

The Unspoken Logic Behind Room Rent Caps in Insurance Policies

"Calling the room rent capping a dangerous clause is a case of wrong framing. The intent of the clause is to help control the cost of hospitalisation. The treatment costs, such as doctor fees, medicines and ICU charges, are linked to the patient's paying capacity. So, the charges are more if you opt for a higher category room," said Mr. Hari Radhakrishnan, Expert, IBAI (Insurance Brokers Association of India)

To discourage people from availing higher category rooms and thereby increasing the cost of treatment, they are asked to bear proportionate costs i.e., the insurer will pay in the proportion that a standard room rent bears to the luxury room rent for all treatment costs.

"The clause encourages the insured to be parsimonious so that the cost of treatment remains lower and his insurance premium also remains economical. This is in their own interest. However, this aspect has not been marketed or explained to the insuring public resulting in negativity," Hari Radhakrishnan added.

One of the reasons why health insurance premiums have gone through the roof is that the proportionate premium clause got demonised and removed from most policies, resulting in claim costs rising, and consequently premiums have also risen.

Individuals should opt for policies with no room rent limits and always confirm with their insurer/hospital what their policy covers before admission.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of GoodReturns.in or Greynium Information Technologies Private Limited (together referred as “we”). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications