Why GenZs Are Using Credit Cards To Build Businesses Without Opting For Loans?

India's Gen Z population has emerged as a formidable force in the entrepreneurial landscape in 2024 with about 25% of the young professionals venturing into several businesses and nearly two-thirds of these enterprises turning profitable within their first year, according to a joint report by KPMG India and NASSCOM.

That is a significant shift in the world of finance. Unlike previous generations, Gen Zs (born between 1995 and 2010), are increasingly turning to personal loans and credit cards to fund their business endeavours, breaking all conventional norms. TransUnion CIBIL reports that 41% of first-time borrowers in India are from the Gen Z cohort, indicating a growing comfort with formal credit systems.

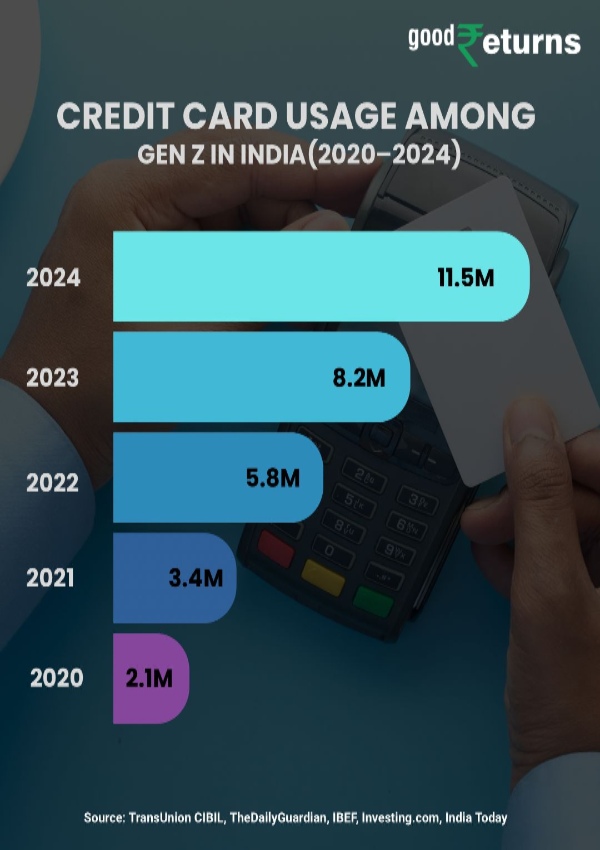

Credit Card Usage Among Gen Z in India (2020-2024)

From around 2.1 million in 2020 to an estimated 11.5 million in 2024, India's Gen Z credit card usage has grown significantly.

Notably, personal loans constitute about 40% of Gen Z's borrowing, often utilized for business-related expenses such as marketing, inventory, and technology upgrades. Digital lending platforms have further facilitated this trend. Gen Z accounts for 20-25% of loans disbursed through digital channels, highlighting their preference for quick, accessible financial solutions.

The average age for availing the first credit product has dropped to 21-22 years, underscoring an early start in financial planning.

All Is Well Then? Let's Find Out

As per Fundbook Founder Manish Aggarwal, however, this aggressive credit utilization is not without risks. Nearly 40% of Gen Z individuals are grappling with unsustainable debt levels, often due to aspirational spending and easy access to credit. The Reserve Bank of India has expressed concerns over the rapid rise in unsecured lending, emphasizing the need for financial literacy and prudent borrowing practices.

About 9% of Gen Z in India took the plunge into entrepreneurship, but only a small portion saw real profits in 2024. To get their ventures off the ground, nearly a quarter of young professionals turned to credit. Instead of going the traditional business loan route, most leaned on personal loans and credit cards.

Around 40% of their borrowing came from personal loans, while credit card use continued to rise thanks to easier access and flexible repayment options. Formal MSME loans weren't as popular, as they're typically taken up later in one's career. However, the ease of credit also came with risks.

"Credit trends in India, particularly among Gen Z, have shown notable year-on-year (YoY) changes in 2024. Credit card defaults within this demographic touched approximately 1.8%, rising from around 1.4% in 2023-marking a sharp YoY increase of nearly 28.6%," said Kundan Shahi, Founder of Zavo- loan.

Similarly, stress in small-ticket digital loans (those under Rs 50,000) has surged, with over 25% of such loans showing signs of repayment stress in 2024, compared to an estimated 18% in the previous year, reflecting a YoY increase of about 39%.

"In terms of the broader credit landscape, India's total credit card debt jumped by 18% YoY to Rs 2.88 trillion in 2024 from about Rs 2.44 trillion in 2023. The number of credit card members in India has doubled since 2017, rising from about 36 million to over 72 million in 2024, with a compound annual growth rate (CAGR) of about 10.4% over the period," added Kundan Shahi.

This rise coincides with a long-term expansion in credit card usage and the shift highlights how convenience, speed, and access are shaping Gen Z's approach to funding over conventional loan products.

A quiet shift is underway in how young Indians are launching businesses. Unlike previous generations that depended on savings, family capital, or bank loans, today's Gen Z founders are using an unconventional tool to get started: credit cards.

With flexible repayment options, fast approvals, and easy access via fintech platforms, credit cards have become the go-to funding source for small business owners and side hustlers in their early twenties.

What once was just a way to shop or earn cashback is now powering everything from Instagram brands and dropshipping ventures to design studios and creator-led businesses.

The Credit Card As A Business Tool

For many Gen Z founders, their first "investor" isn't a VC or a bank-it's a Rs 1 lakh credit limit. This revolving line of credit is being used to:

- Buy inventory or raw materials

- Pay for software tools like Canva, Shopify, or domain hosting

- Run digital ads on platforms like Instagram or Google

- Manage cash flow between vendor payments and customer receipts

The appeal is clear: credit cards offer instant liquidity without paperwork or waiting periods. And if payments are managed within the interest-free period, they can be used like short-term, zero-cost working capital.

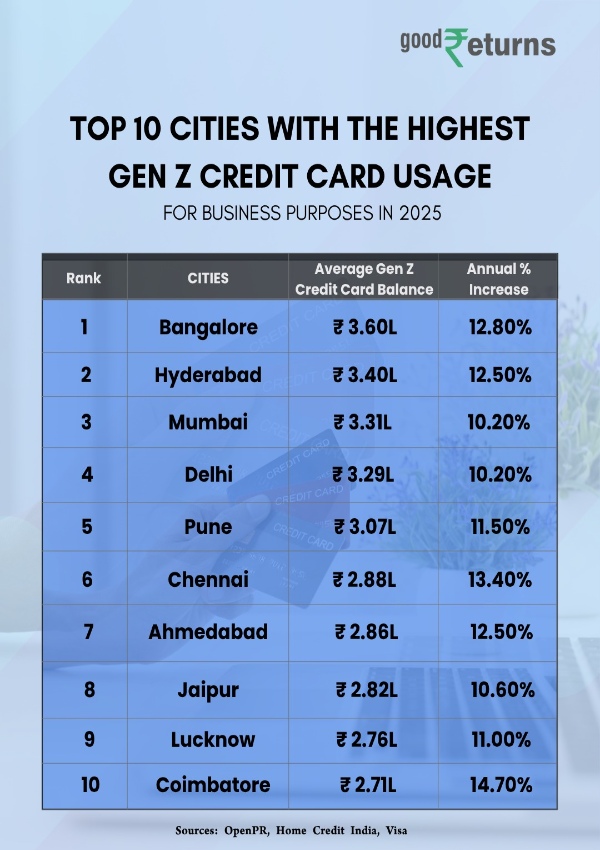

Top 10 Indian Cities With Maximum Gen Z Credit Card Usage in 2025

The following table lists the top 10 Indian cities where Generation Z, or those between the ages of 18 and 25, is most likely to use credit cards for both personal and professional purposes in 2025, according to recent research and surveys.

The Silver Lining: Hear It From The Horse's Mouth

Take Rahul Kumar, a 23-year-old from Bihar, who launched a mobile gaming recharge service after identifying gaps in how Indian users make digital payments. With limited resources, he funded the platform's early growth using his credit card-covering server costs, digital tools, and marketing. Today, his platform is gaining popularity among mobile-first users looking for simpler top-up options.

Another example is Rohan, a product designer turned entrepreneur. Facing a cash crunch while building a direct-to-consumer brand, he used his credit card to finance early production runs. By timing repayments with incoming customer payments, he scaled the business without touching his savings or seeking a loan.

Credit Works Better Than Loans? Maybe For Now

There are several reasons why younger entrepreneurs are leaning into this method:

Faster Access: Most fintech-enabled credit cards can be approved within minutes, versus weeks for small business loans.

No Collateral: Startups that are digital or service-based don't have physical assets to pledge as security.

Flexible Repayment: Credit cards offer 45-50 day interest-free periods and the ability to convert large spends into manageable EMIs.

Financial Independence: Using their credit allows young founders to retain full ownership and control over their businesses.

Additionally, successful use of a credit card helps build a strong credit score, making it easier to access formal financing when the business grows.

The Fintech Push Behind The Trend

A new wave of fintech companies is accelerating this shift by offering user-friendly credit products tailored for younger consumers. Startups like Slice, Scapia, and Walrus are building credit solutions that combine ease of use with rewards, payment flexibility, and real-time insights into spending.

Some of these platforms even allow users as young as 18 to start managing money, laying the foundation for smarter financial behavior early in their careers.

The Risk (and Discipline) Involved

Using credit as capital is not without risk. High interest rates can quickly become a burden if balances are not paid in full. And juggling multiple cards or relying on revolving debt without planning can impact credit health.

However, many Gen Z entrepreneurs are surprisingly cautious. They use reminders, budgeting apps, and calendar tracking to ensure timely repayments. A common practice is aligning repayment cycles with business revenue-essentially using the credit card as a bridge between upfront costs and incoming sales, as per Bhargav Errangi, Founder of POP.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of GoodReturns.in or Greynium Information Technologies Private Limited (together referred as “we”). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications