UCO Bank Trims Fixed Deposit (FD) Rates By 25 Bps: Details Inside

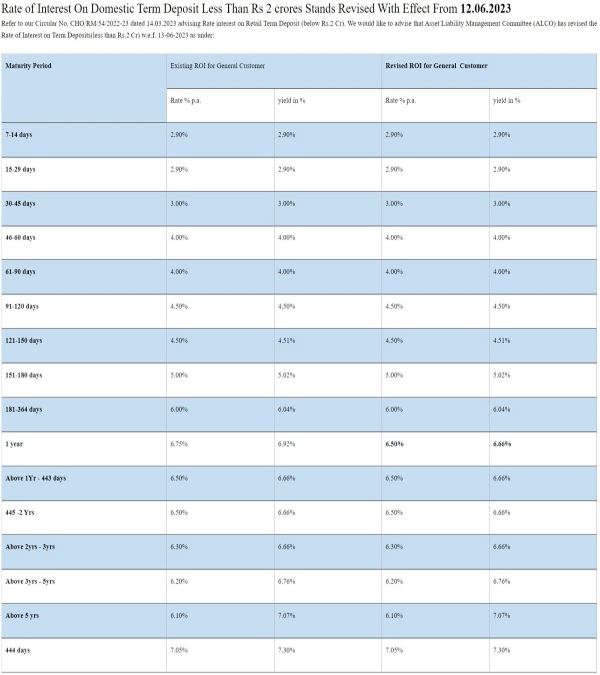

The public sector lender UCO Bank has revised its interest rates on fixed deposits of less than Rs 2 Cr. UCO Bank has reduced the interest rate on a one-year tenor by 25 basis points as a result of the modification made on 12.06.2023. UCO Bank is now offering interest rates between 2.90% and 6.10% on fixed deposits with maturities ranging from 7 days to 10 years. Customers can get a maximum interest rate of 7.05% on a tenor of 444 days.

UCO Bank FD Rates

On a tenure of 7 to 29 days, the bank will continue to offer an interest rate of 2.90% and on a tenure of 30-45 days UCO Bank is promising an interest rate of 3.00%. On deposits maturing in 46-90 days, UCO Bank will offer an interest rate of 4.00% and on those maturing in 91-150 days, the bank is promising an interest rate of 4.50%. UCO Bank will continue to offer an interest rate of 5.00% on a deposit tenor of 151-180 days and 6.00% on a deposit tenor of 181-364 days. On a tenure of 1 year, UCO Bank has trimmed interest rate by 25 bps from 6.75% to 6.50% whereas on tenors of above 1 year to 2 years, UCO Bank will continue to offer an interest rate of 6.50%. Deposits that mature within the next two to three years will earn interest at a rate of 6.30%, while those maturing in the next three to five years will earn interest at a rate of 6.20%. The bank will guarantee an interest rate of 6.10% on deposits maturing in more than 5 years, while UCO Bank will guarantee a maximum return of 7.05% for deposits maturing in less than 444 days.

Senior citizens will get an additional interest rate of 0.25% on tenure of up to 1 year and 0.50% on tenure of above 1 year, retired staff senior citizens will get additional rate benefit of 1.25% on tenure of up to 1 year and 1.50% on tenure of above 1 year whereas staff will get an additional interest rate of 1.00% on tenure of up to 1 year.

PAT for the bank climbed by 86.19% to Rs 581.24 crore in Q4FY23 from Rs 312.18 crore in the same quarter the previous year. In the quarter, net interest income (NII) grew by 19.34% to Rs 1,972.11 crore from Rs 1,652.38 crore in Q4 of FY22. The provisions made by UCO Bank soared to Rs 450.54 crore in Q4FY23 from Rs 332.42 crore in Q3FY23 and Rs 465.60 crore in Q4FY22. Gross non-performing assets (GNPA) dropped dramatically from 7.89% in Q4FY22 and 5.63% in Q3FY23 to 4.78% in Q4FY23. As of Q3FY23, Net NPA was 1.29%, down from Q4FY22's 2.70% and Q3FY23's 1.66%, respectively.

UCO Bank reported its highest annual net profit for FY23 at Rs 1,862.34 crore, up a staggering 100.30% from Rs 929.76 crore in FY22. The lender's net interest margin (NIM) for the fiscal was 2.87%, and it recorded its highest-ever NII of Rs 7,343.13 crore in FY23, up 13.44% from Rs 6,472.95 crore in FY22. The bank recorded its highest-ever level of worldwide deposits as of March 31, 2023, totaling Rs 2,49,337.74 crore, up 11.28% YoY. Also reaching a record high, the loan book climbed by 24.54% YoY to Rs. 1,61,629.45 crore.

Click it and Unblock the Notifications

Click it and Unblock the Notifications