This Bank Revises Savings Account Interest Rates Post RBI Repo Rate Cut

The RBI slashed the repo rate by 25 basis points, from 6.50% to 6.25%, during the first Monetary Policy Committee (MPC) meeting of 2025 after the Union Budget. Since savings account interest rates are often linked with an external benchmark, such as the Reserve Bank of India's (RBI) repo rate, the RBI's decision to lower the repo rate is likely to cause banks to drop their savings account rates in order to adjust with the benchmark rate. Consequently, RBL Bank became the first bank in the nation to adopt this dynamic in order to lower interest rates on savings accounts following the RBI repo rate drop on February 7, 2025.

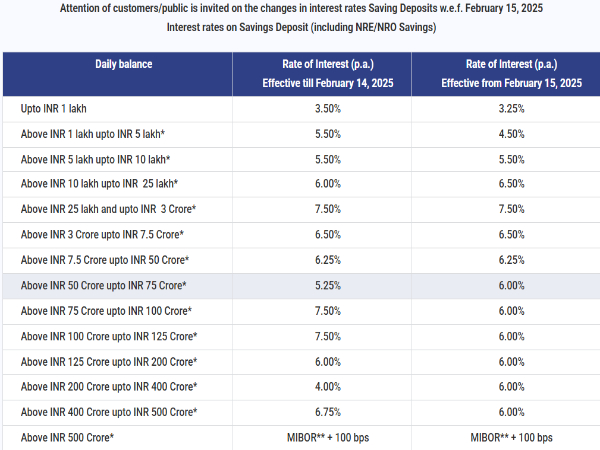

RBL Bank Savings Account Interest Rates

According to the bank's official website, RBL Bank has significantly lowered the interest rates on savings accounts, and the new rates will take effect on February 15, 2025. The bank has reduced interest rates on savings accounts with daily balances up to Rs 1 lakh by 25 basis points, from 3.50% to 3.25%, while RBL Bank has reduced interest rates on savings accounts with daily balances beyond Rs 1 lakh up to Rs 5 lakh by 100 basis points, or 1%, from 5.50% to 4.50%.

The bank kept its interest rates steady at 5.50% for savings accounts with daily balances above Rs 5 lakh to Rs 10 lakh. However, RBL Bank unexpectedly raised interest rates by 50 basis points, from 6.00% to 6.50%, for savings accounts with daily balances over Rs 10 lakh to Rs 25 lakh.

The bank continues to offer interest rates at 7.50% for savings accounts with daily balances over Rs 25 lakh and up to Rs 3 crore, whereas RBL Bank has maintained interest rates at 6.50% for savings accounts with daily balances over Rs 3 crore and up to Rs 7.5 crore. For savings accounts with daily balances of more than Rs 7.5 crore to Rs 50 crore, RBL Bank has maintained interest rates at 6.25%. However, for savings accounts with daily balances of more than Rs 50 crore to Rs 75 crore, the bank has increased interest rates from 5.25% to 6%.

The bank has reduced interest rates from 7.50% to 6.00% for savings accounts with daily balances above Rs 75 Crore to Rs 125 Crore, while RBL Bank has maintained interest rates at 6.00% for savings accounts with daily balances over Rs 125 Crore to Rs 200 Crore. The bank has raised interest rates from 4% to 6.00% for savings accounts with daily balances above Rs 200 crore to Rs 400 crore while lowering interest rates from 6.75% to 6.00% for savings accounts with daily balances over Rs 400 crore to Rs 500 crore.

RBL Bank News

Compared to the Rs 233 crore it reported for the same period previous year, the bank's standalone net profit for the December 2025 quarter was Rs 33 crore, an 86% drop. RBL Bank's net interest income (NII) rose 3% year on year to Rs 1,585 crore in the quarter under review from Rs 1,546 Cr in Q3FY24. RBL Bank has 2,011 touchpoints overall as of December 31, 2024, with 558 being bank branches and 1,453 being business correspondent branches.

Click it and Unblock the Notifications

Click it and Unblock the Notifications