This Bank Offers Up To 9% Standard Return & 9.50% To Senior Citizens On FDs

Unity Small Finance Bank (SFB) revised its interest rates on fixed deposits (FDs) of less than Rs 2 Cr on October 9th after the RBI Monetary Policy Committee opted to maintain the status quo on the repo rate and left the key policy repo rate unchanged at 6.5% for the fourth meeting. Following the modification, the bank is allowing a maximum return of 9.00% for the general public and 9.50% for elderly individuals, resulting in returns for them on a tenure of 1001 days that outperform inflation.

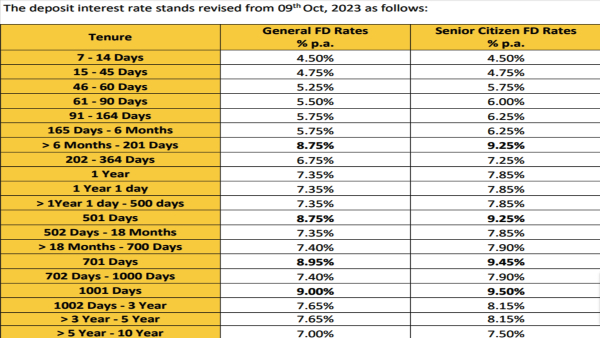

Unity Small Finance Bank FD Rates

The bank is now giving an interest rate of 4.50% on deposits that mature in the next 7 to 14 days, while Unity SFB is now offering an interest rate of 4.75% on deposits that mature in the next 15 to 45 days. Unity SFB is now providing interest rates of 5.25% for deposits made between 46 and 60 days and 5.50% for deposits made between 61 and 90 days. Deposits with maturities between 91 and 6 months will now earn interest at a rate of 5.75%, while deposits with maturities between 6 months and 201 days will now earn interest at a rate of 8.75%. The bank is now offering an interest rate of 6.75% on FDs maturing in the next 202-364 days, while Unity SFB is currently offering an interest rate of 7.35% on FDs that mature within the next 1 Year to 500 days. Unity SFB is now giving an interest rate of 8.75% on 501-day deposits, while the bank is currently offering an interest rate of 7.35% on 502-day deposits that last for 18 months. Deposits that mature in 18 months and 700 days will earn interest at a rate of 7.40%, while those that mature in 701 days will earn interest at an 8.95% rate.

The bank is giving an interest rate of 7.40% on FDs that mature in 702 days to 1000 days, while Unity SFB is guaranteeing a maximum return of 9.00% on FDs that mature in 1001 days. On a deposit tenure of 1002 days to 5 years, Unity SFB promises a return of 7.65%, and on a tenure of 5 years to 10 years, a return of 7.00%.

"For premature withdrawal of fixed deposit and recurring deposits, a premature penalty of 1.00% shall be charged to the rate applicable for the period the deposit has remained with the bank, or the contracted rate, whichever is lower," mentioned Unity Small Finance Bank (SFB) on its website.

Click it and Unblock the Notifications

Click it and Unblock the Notifications