BSE Sensex today ended the day with the gain of 142 points to 80,664 and Nifty soared 84 points to 24,586 in trade today on Monday amid gains registered in pharma, oil& gas stocks. Nifty Bank surged 177 points to 52,455 and Nifty Midcap rose 490 points to 57,664 on July 15, 2024.

In the opening session HCLTECH, ULTRACEMCO, SHRIRAMFIN, ONGC and TATAMOTORS were the top 5 gainers whereas the top 5 losers in the Nifty 50 index were ASIANPAINT, TATASTEEL, COALINDIA, TATACONSUM and HDFCLIFE.

Major companies including Jio Financial Services, HDFC AMC, HDFC Life Insurance Company, and Bank of Maharashtra are set to release their Q1 results today, therefore Q1 earnings will be a significant focus today. Globally, data from Japan's macroeconomic statistics, the US retail sales figures, and China's GDP and Industrial Production (IIP) figures might influence market mood. The Nifty50 and Sensex hit all-time highs of 24,592.20 and 80,893.51, respectively, before ending the last week at 24,502.15 and 80,519.34. The Indian benchmark indices enjoyed a strong week by gaining 0.65% for the Sensex and 0.73% for the Nifty50.

LIVE Feed

Jul 15, 2024, 3:27 pm IST

Hindustan Zinc Contributes Rs 13,195 Cr To Exchequer In FY24

Vedanta group firm Hindustan Zinc Ltd (HZL) on Monday said it has contributed Rs 13,195 crore to the exchequer in the last financial year, representing about 46 per cent of its total revenues. In FY 2023-24, Hindustan Zinc's total contribution to the exchequer stood at Rs 13,195 crores, the Vedanta group firm said in a regulatory filing. With this, HZL's cumulative contribution to the exchequer over the past five years stood at Rs 77,803 crore. "As our businesses grow, so will these numbers. At Hindustan Zinc, we are committed to continuing to do business with a purpose in a manner that is sustainable, transparent and creates value for all our stakeholders," Hindustan Zinc Chairperson Priya Agarwal Hebbar said.

Jul 15, 2024, 2:58 pm IST

Hindalco To Sell Land Parcel To Birla Estates' Subsidiary Ekamaya Properties For Rs 595 cr

Hindalco Industries on Monday said it will sell a land parcel at Kalwa, in Maharashtra to Ekamaya Properties Pvt Ltd, a wholly-owned subsidiary of Birla Estates Pvt Ltd for Rs 595 crore. On July 12, 2023, the company had said that the Board of Directors had approved a proposal for sale of a land parcel situated at Kalwa, Maharashtra, to Birla Estates Private Ltd. "... The aforesaid transaction shall now be entered into with Ekamaya Properties Pvt Ltd, a wholly-owned subsidiary of Birla Estates Pvt Ltd (instead of Birla Estates Pvt Ltd)," Hindalco Industries said in a regulatory filing on Monday.

Jul 15, 2024, 2:57 pm IST

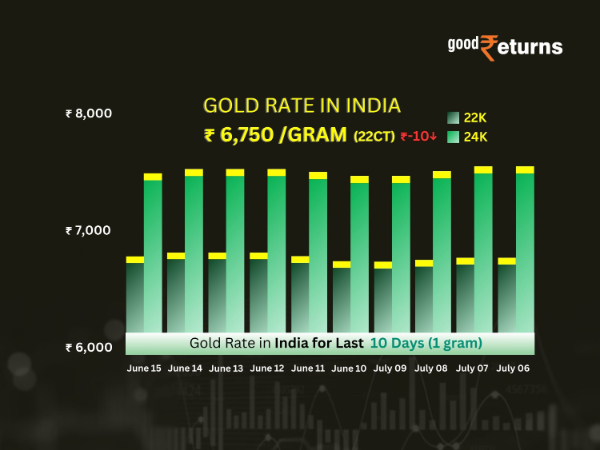

Gold Price Falls In India: 24K/100 Grams Gold Slips After Rising By Rs 12,600 In 10-Days

Gold prices in India on Monday witnessed decline after witnessing sharp rally in last 10-days. Meanwhile, US gold rates declined on July 15 as traders are awaiting comments from Federal Reserve and economic data for more clarity on US Interest rate trajectory. 22k gold prices today slipped by Rs 100 to Rs 67,500/10 grams and 100 grams of 22 carat yellow metal prices today slipped by Rs 1000 to Rs 6,75,000 in India on July 15, 2024. 24k gold prices today in India fell by Rs 110 to Rs 73,640/10 grams and 100 grams of 24 carat precious metal prices became cheaper by Rs 1100 to Rs 7,36,400 in the country on July 15.

Jul 15, 2024, 2:55 pm IST

Big Update On Gold Prices: Top Jewellers Agree To Adopt “One Nation One Rate” Policy

Leading jewelers across India have given their nod to adopt “One Nation One Rate (ONOR)” policy for gold, according to a report published in ET Now. According to the report. ONOR initiative seeks to standardize gold price across the country and has the backing of Gem and Jewellery Council (GJC).

Earlier, Gem and Jewellery Council sought opinions from renowned jewellers of India with a unanimous agreement on implementing a single gold rate across the nation. Meanwhile, an official statement on the latest development is likely to be made in the upcoming meeting to be held in September, added the ET report.

According to Prithviraj Kothari, Managing Director at RiddiSiddhi Bullions Limited (RSBL) said, “a single gold rate will guarantee that all customers are treated equally and receive jewelry at the same price regardless of their location. Having a single rate across the country will make the gold market more efficient. The majority of major jewellers in India have agreed to adopt a "One Nation One Rate (ONOR)" policy for gold. The ONOR initiative aims to standardize gold prices across the nation and marks a significant step towards a more transparent and equitable gold market in the nation. An official announcement regarding this is anticipated during the September meeting.”

Jul 15, 2024, 2:06 pm IST

Lupin Receives EIR From USFDA For Gujarat Facility

Lupin, a global pharmaceutical company, has received the Establishment Inspection Report (EIR) from the United States Food and Drug Administration (US FDA) for its manufacturing facility in Dabhasa, Gujarat. This follows the inspection conducted from April 8 to April 12, 2024, which concluded with no observations and resulted in an inspection classification of "No Action Indicated" (NAI).

Jul 15, 2024, 2:03 pm IST

MRF Announces Price Hike Effective July 18

MRF has announced a price hike effective July 18, with truck tire prices set to rise by approximately 2%, and passenger car and radial tire prices increasing by 3-7%. However, there will be no price increase for two-wheeler tires. Following this announcement, shares of competitors JK Tyre, Ceat, and Apollo Tyres have rallied, gaining between 5-15%.

Jul 15, 2024, 1:56 pm IST

IFL Enterprises Board To Discuss Bonus Shares And Dividend On July 31

On July 31, IFL Enterprises' management will consider issuing bonus shares to existing shareholders. Additionally, they will discuss declaring a dividend of up to 100% on each equity share for the financial year 2023-2024.

Jul 15, 2024, 1:43 pm IST

Hindalco To Sell Land In Kalwa, Maharashtra To Ekamaya Properties

Hindalco Industries has entered into an agreement to sell land located in Kalwa, Maharashtra, to M/s. Ekamaya Properties Private Limited, a wholly-owned subsidiary of M/s Birla Estates Private Limited.

Jul 15, 2024, 1:43 pm IST

USFDA Issues Procedural Observations To Suven Pharma After Inspection

Suven Pharma's wholly-owned subsidiary, Casper Pharma in Hyderabad, underwent a surveillance inspection by the United States Food & Drug Administration (US FDA) from July 8 to 12. Following this inspection, the US health regulator issued a Form 483 containing two procedural observations. In related news, Suven Pharma has also acquired a 51% stake in Sapala Organics.

Jul 15, 2024, 1:42 pm IST

Apollo Micro Systems Secures Make II Project From Indian Army

Apollo Micro Systems has been awarded a Make II project by the Indian Army for the procurement of a Vehicle Mounted Counter Swarm Drone System (VMCSDS) (Version I) under the Make II category of DAP-2020.

Jul 15, 2024, 1:42 pm IST

Ganesh Housing Corporation Shares Drop 6% On Weak Q1 Earnings

Ganesh Housing Corporation shares fell 6% after reporting a 29% decline in Q1 net profit to Rs 114 crore, compared to Rs 161 crore year-on-year (YoY). Revenue dropped 21% to Rs 214 crore from Rs 270 crore YoY, and EBITDA decreased 31% to Rs 149 crore from Rs 216 crore YoY. The company's margins also narrowed, standing at 69.6% compared to 80% in the same period last year.

Jul 15, 2024, 1:01 pm IST

Jupiter Wagons Secures Rs 800 Crore Through QIP

Jupiter Wagons has successfully completed its qualified institutional placement (QIP), raising Rs 800 crore. The QIP was met with robust demand, attracting a total of Rs 2,800 crore, which is 3.5 times the size of the placement.

Jul 15, 2024, 12:45 pm IST

India's Wholesale Inflation Climbs To 3.36% In June

On Monday, July 15, the government released the wholesale price index (WPI) data for June, revealing a rise in wholesale inflation to 3.36%. Core inflation increased to 0.9% from 0.4% month-on-month. In comparison, wholesale inflation was 2.61% in May and 1.19% in April.

The prices of food articles increased by 2.96% and minerals by 1.47% in June 2024 compared to May 2024. Conversely, the prices of non-food articles (-0.32%), crude petroleum and natural gas (-0.57%), electricity (-1.67%), and mineral oils (-2.38%) declined in June from the previous month.

Jul 15, 2024, 11:40 am IST

Go Digit General Insurance Reported Overall Claims Settlement Ratio of 97% In FY 23-24

Go Digit General Insurance Limited (Digit Insurance), one of India’s leading new-age insurance companies, on Monday released the 10th edition of its Transparency Report titled "Navigating the Time Vortex in Insurance Realm". The report delves into different timerelated metrices like turnaround times (TATs) for cashless facility approval, hospital discharge approval, reimbursement claims settlement in health insurance; work approval and claims settlement in multiple insurance streams. The company for FY23-24 also reported overall Claims Settlement Ratio of 97%. In FY 23-24, Digit's Customer Happiness Team handled 1.3 million calls, an increase of 45% YoY. It also said that 92% customers received first-time resolutions (FTR), meaning the queries or issues were handled, actioned, and closed on the same call itself.

Jul 15, 2024, 10:57 am IST

MTNL Informs Exchanges Regarding Change In Management

Shri Ravi A Robert Jerard, DDG (SRI), DoT has been appointed as CMD of Mahanagar Telephone Nigam Limited (MTNL) for a period of six months w.e.f. 15.07.2024 to 14.01.2025, in place of Shri P.K. Purwar of Department of Telecommunications, (DoT) Ministry of Communications, Govt. of India. Shri P.K. Purwar ceases to be CMD of MTNL on 14.07.2024 on account of Non extension of tenure of Shri P.K. Purwar as CMD of BSNL beyond 14.07.2024.

Jul 15, 2024, 10:50 am IST

Gold Price Updates

The Yellow Metal Prices in India Declines Slightly.

Jul 15, 2024, 10:34 am IST

SRM Contractors Limited Receives New Project From NHAI

SRM Contractors Limited signs a new project with the National Highway Authority of India (NHAI) for 278 crores to upgrade and strengthen the NashriChenani section from Km. 0.00 to Km. 39.100 of NH-244 via Patnitop in the UT of Jammu and Kashmir under NH(O) on EPC mode for 24 months.

Jul 15, 2024, 9:59 am IST

Forex market outlook today by Anand James, Chief Market Strategist, Geojit Financial Services

INR: The Indian rupee edged higher on Friday, aided by a weaker dollar following U.S. inflation data that boosted expectations of Federal Reserve policy easing. However, dollar demand from importers limited gains. The rupee closed at 83.5350 against the U.S. dollar, up from 83.56 in the previous session, remaining largely flat week-on-week.

USD: The dollar rose on safety bids on Monday after an attempted assassination of former U.S. President Donald Trump, while the yen struggled despite suspected Tokyo intervention efforts. Asian trading was thin due to a Japan holiday. The dollar index was stable at 104.28. U.S. 10- year Treasury futures edged lower, indicating potential yield rises when trading resumes.

Jul 15, 2024, 9:54 am IST

Derivative outlook today by Anand James, Chief Market Strategist, Geojit Financial Services

Nifty weekly contract has highest open interest at 25000 for Calls and 24000 for Puts while monthly contracts have highest open interest at 25000 for Calls and 23500 for Puts. Highest new OI addition was seen at 25500 for Calls and 24400 for Puts in weekly and at 26000 for Calls and 24400 for Puts in monthly contracts. FIIs increased their future index long position holdings by 3.91%, decreased future index shorts by 3.45% and in index options by 25.93% increase in Call longs, 34.34% increase in Call short, 44.47% increase in Put longs and 32.51% increase in Put shorts.

Jul 15, 2024, 9:27 am IST

Nifty Technical Views By Anand James, Chief Market Strategist, Geojit Financial Services

For a few weeks now, we have been measured in our bullish expectations, by first limiting the upside objectives to 24400-500 and then extending it to 24720-800 only, hoping to ride on the exuberance of the constituent stocks, which have been taking turns to push the index higher. Meanwhile, Nifty has not had many runaway upsides, ensuring that it did not veer too far away from the 20 day moving average. For the next fortnight, if any such single day move exceed1% or above, then they are highly likely to be followed by a sharp turn lower. Also to be noted is that MACD histogram is near zero, signaling a fall. It could as well be pointing to a flat consolidation phase for an extended period, if not a drop. Towards this end, we shall place our downside marker at 24350 below which 24130-23760 will be exposed.

Jul 15, 2024, 9:05 am IST

Nifty & Bank Nifty Prediction By Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd

Technically, the Nifty index has crossed the barrier of 24,460 and almost tested short-term target of 24,600. The index must break through the 24,600-24,620 resistance level to trigger fresh bullish momentum. Until then, investors should consider buying on dips in the Nifty, with support near 24,170.

Technically, on a daily scale, the Bank Nifty index formed a doji candle near the 21-days EMA support. As long as the index holds above 51,750, a buy-on-dips strategy should be adopted in Bank Nifty. On the upside, 52,800 and 53,000 will serve as strong resistance levels.

Jul 15, 2024, 8:43 am IST

Bank Nifty Prediction By Ashwin Ramani, Derivatives & Technical Analyst, SAMCO Securities

Bank Nifty endured a volatile day, starting on a weak note, recovering sharply later before experiencing profit booking at the end only to close 8 point higher at 52,279. After forming a dragonfly doji pattern on 11th July, the Index formed a gravestone doji pattern on 12th July, indicating indecision. Significant call writing was observed at the 52,500 & 52,700 Strike in Bank Nifty. The call writers have massive positions built at the 52,500 Strike and the option activity at this strike will provide cues about Bank Nifty’s direction in the coming week.

Jul 15, 2024, 8:30 am IST

Nifty Outlook Today

Ashwin Ramani, Derivatives & Technical Analyst, SAMCO Securities said, “Nifty hit a new all-time high of 24,592 on Friday, 12th July. The 24,300 & 24,400 Strike saw significant put writing over call writing, which led to a sharp Intraday movement in Nifty. Strong put writing was observed at the 24,500 Strike in the Index. The put writers (1.62 lakh contracts) lead the call writers (1.58 lakh contracts) marginally at the 24,500 Strike and the option activity at this strike will provide cues about Nifty’s future direction.”

Jul 15, 2024, 8:18 am IST

Weekly Market Outlook By Vinod Nair, Head of Research, Geojit Financial Services

There is a mix of anxiety and excitement in the market due to the muted Q1FY25 earnings forecast and the expectation of a growth-oriented budget. On the other hand, the guidance of a strong GDP for FY25 evoked investor sentiment. On the global front, the release of softer-than-expected US inflation to a one-year lowa added fresh levers of optimism. This has raised the probability of a September US FED rate cut to 90%, which is evident in the fall of the dollar index.

We expect stock-specific moves to gain traction due to the ongoing earnings season; indeed, IT will be in the limelight due to the good start to the earnings and outlook. The good progress in the monsoon and expectations of an uptick in volumes aided FMCG stocks to outperform the main indices. In the week ahead, economic data like China GDP, EuroZone CPI inflation, ECB policy, and the US Fed chair speech will be watched carefully by investors to get cues on market momentum.

Jul 15, 2024, 8:10 am IST

HCL Tech Follows TCS with Strong Q1FY25 Earnings, Nifty IT Index Set for Continued Growth

Siddhesh Mehta, Research Analyst, SAMCO Securities said, “Following TCS’s robust earnings report, another leading Indian IT firm, HCL Technologies, surpassed Q1FY25 earnings expectations with a notable YoY increase of 7% and 21% in revenues and profits respectively. The robust performance of TCS propelled the Nifty IT index, which surged by 4.53% on Friday to end the week near its all-time high. With HCL Tech's impressive results, this upward trend is likely to continue and Monday could shape up to be another significant day for the Indian IT sector.”

Jul 15, 2024, 8:08 am IST

US Sees Dip, India's Rate Rises Prompting Higher Interest Expectations

Apurva Sheth, Head of Market Perspectives and Research, SAMCO Securities said, “In less than 24 hours’ time inflation numbers of two nations came in. First was US which saw a dip in inflation from 3.3% to 3% while second is ours which saw a rise from 4.75% to 5.08%. US Markets cheered the lower inflation print and celebrated with a new high in equities as 10 year bond yields cracked. Bond yields in our markets hardened a bit but it won't put off the rally in equities. It seems that RBI Governor is in no mood to blink first and with inflation print rising our interest will remain higher for longer.”

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Monday, July 15, 2024, 8:02 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications