Start Investing With Just Rs. 1,000; Amazon Pay Launches Fixed Deposits; Everything You Need To Know

Amazon Pay, which is known in India for its UPI-based payment services, has now expanded into the investment segment, letting users invest in fixed deposits (FDs) directly through its app.

This new feature by Amazon Pay will allow existing and new users to invest in FDs without opening a separate savings account, which is very convenient for first-time and small investors.

Partner banks and NBFCs

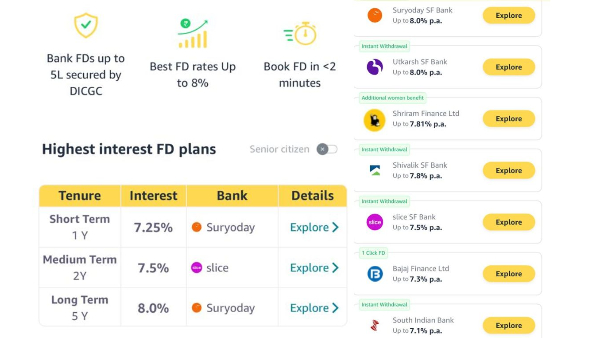

Amazon Pay has tied up with multiple banks, small finance banks & NBFCs to offer fixed deposit products on its platform.

Its bank and SFB partners include Shivalik Small Finance Bank, Suryoday Small Finance Bank, South Indian Bank, Utkarsh Small Finance Bank and Slice. On the NBFC side, Amazon Pay has partnered with Shriram Finance and Bajaj Finance.

How to invest through the Amazon Pay app: Step-by-Step Guide

As per information shared on the Amazon Pay website, users can invest in fixed deposits by following the below steps:

Step 1: Open the Amazon app and go to the Amazon Pay section.

Step 2: Select the Fixed Deposit option.

Step 3: Choose a partner bank or NBFC and preferred tenure for the fixed deposit.

Step 4: Enter the investment amount. To carry out the transaction

The process is entirely digital and paperless.

Minimum investment, interest rate and all benefits of Amazon Pay FD

One of the major features of the service is the low minimum investment requirement. Users can start investing in fixed deposits on Amazon Pay with as little as Rs. 1,000, without the need to open a new savings account with any partner banks and institutions. With this feature, Amazon Pay is expected to attract users looking for a simple, low-risk investment option.

According to Amazon Pay, investors can earn a maximum of up to 8% interest per annum on fixed deposits booked through the app, depending on the tenure and the financial institution chosen.

Additionally, the fixed deposits placed with its partner banks are covered under the Deposit Insurance and Credit Guarantee Corporation (DICGC). Under the current framework, deposits are insured up to Rs. 5 lakh per depositor per bank, offering regulatory protection to investors.

However, deposits with NBFC partners are not covered under DICGC insurance, and investors are advised to assess risk-return profiles before investing.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of Goodreturns.in or Greynium Information Technologies Private Limited (together referred as "we"). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications