Senior Citizens Bank FD: Earn 9% Return On 1-Year Tenure Effective From This Week

Of all the small finance banks in India, Jana Small Finance Bank Limited (Jana Small Finance Bank) is one of the most prominent and has a nationwide presence. On January 02, 2024, the bank altered the interest rates it offers on fixed deposits under Rs 2 Cr.

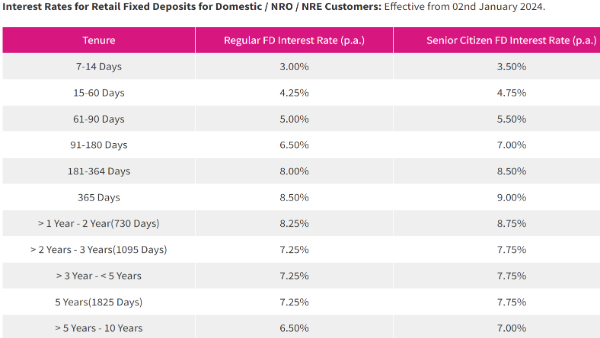

After the modification, the bank is now providing a maximum return on a one-year tenure of 9.00% for elderly persons and 8.50% for the general public. Following the modification, Jana Small Finance Bank (SFB) is now among the financial institutions providing the highest fixed-deposit returns to senior citizens in the nation.

Jana SFB FD Rates

The bank is now offering an interest rate of 3.00% on domestic retail term deposits maturing in 7-14 days, while Jana SFB is now offering an interest rate of 4.25% on those maturing in 15-60 days. With a deposit duration of 61-90 days, Jana SFB is now giving an interest rate of 5.00%, and with a tenure of 91-180 days, it is 6.50%. The interest rate for deposits maturing in 181-364 days is 8.00%, while the interest rate for deposits maturing in 365 days is currently 8.50%.

The bank is currently offering an interest rate of 8.25% on domestic retail term deposits maturing in 1 year to 2 years (730 days), and 7.25% on those maturing in 2 years to 5 years (1825 days) at Jana SFB. The interest rate on deposits maturing in five to ten years will now be 6.50%.

Resident senior citizens will get an additional interest rate of 50 bps higher than the standard rates across all tenures at Jana SFB. "Only Resident Indian Senior Citizens (of 60 years and above age) are eligible for the above mentioned Senior Citizen Interest rate specified. The special rates are applicable only for Resident deposits," mentioned the bank on its website.

"In case of premature withdrawal of the deposit, interest will not be paid at the originally contracted rate. In such cases interest will be paid at the applicable rate of interest for the duration which the deposit is maintained with us minus premature withdrawal penal rate as follows: FixedDeposit less than INR 200 Lakhs -0.5%, Fixed Deposits greater than or equal to INR 200 Lakhs - 1%," mentioned Jana Small Finance Bank on its website.

Customers of Jana Small Finance Bank, both new and old, are eligible to open fixed deposit accounts. These customers include individuals, minors, proprietorships, HUFs (Hindu Undivided Families), cooperative societies, registered and unregistered bodies, trusts, partnerships, non-governmental organisations, and private limited companies.

The market regulator SEBI gave Jana Small Finance Bank (SFB) permission in November 2023 to launch its initial public offering (IPO). A fresh issue of shares up to Rs 575 crore and an offer for sale (OFS) of up to 4,051,516 equity shares comprises the IPO. The OFS categorise comprises the following companies: Global Impact Funds, S.C.A., SICAR, Client Rosehill Ltd., CVCIGP II Employee Rosehill Ltd., Sub-Fund Global Financial Inclusion Fund, Growth Partnership II Ajay Tandon Co-Investment Trust, Growth Partnership II Siva Shankar Co-Investment Trust, and Hero Enterprise Partner Ventures.

Axis Capital Ltd., ICICI Securities Ltd., and SBI Capital Markets Ltd. are the book-running lead managers (BRLM) for the Jana Small Finance Bank Ltd initial public offering (IPO), while KFin Technologies Ltd. is the registrar. The bank had 754 banking outlets as of March 31, 2023, spread over 22 states and two union territories. Of those branches, 272 were located in rural regions. About 1.2 crore customers have received services from Jana Small Finance Bank since its foundation in 2008; as of March 31, 2023, 45.7 lakh of those customers were registered.

Click it and Unblock the Notifications

Click it and Unblock the Notifications