RBL Bank Revises Interest Rates On Fixed Deposits (FDs); Check New Rates

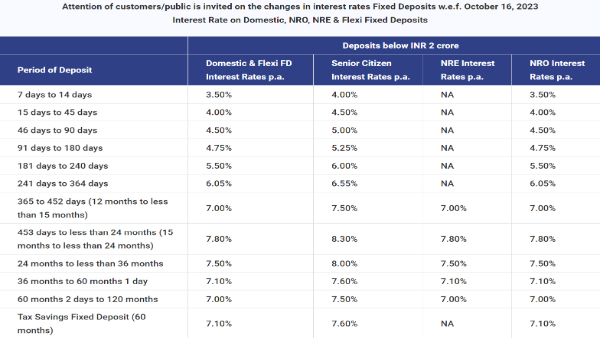

RBL Bank, a private sector lender, has changed the interest rates on fixed deposits under Rs 2 crore. After the adjustment, the bank currently offers a maximum return of 7.80% to the general public and 8.30% to elderly people on tenures of 453 days to less than 24 months (15 months to less than 24 months). The bank is offering interest rates on FDs with terms ranging from 7 days to 10 years that range from 3.50% to 7.00% for the general public and from 4.00% to 7.50% for elderly individuals. The new FD rates are in effect as of October 16, 2023, according to the bank's official website.

RBL Bank FD Rates

The bank is now offering an interest rate of 3.50% on deposits that mature in the next 7 to 14 days, while RBL Bank is currently providing an interest rate of 4.00% on deposits that mature in the next 15 to 45 days. The current interest rates offered by RBL Bank are 4.50% for FDs with a term of 46 days to 90 days and 4.75% for FDs with a duration of 91 days to 180 days. Deposits that mature between 181 and 240 days will earn interest at a rate of 5.50%, while deposits that mature between 241 and 364 days will earn interest at a rate of 6.05%.

The bank will pay 7.00% interest on FDs that mature in 365 to 452 days (12 months to less than 15 months), and 7.80% interest on FDs that mature in 453 days to less than 24 months (15 months to less than 24 months). For FDs with a duration of 24 to 36 months but no more than 60 months, RBL Bank will pay a return of 7.50% and 7.10%, respectively. A 7.00% interest rate will be paid on deposits that mature in 60 months, 2 days to 120 months, and a 7.10% interest rate will be paid on tax-saving fixed deposits that mature in 5 years.

"Senior Citizens (60 years to less than 80 years) are eligible for additional interest rate of 0.50% p.a. and Super Senior Citizens (80 years and above) are eligible for additional interest rate of 0.75% p.a. Senior Citizens/Super Senior Citizens rates are not applicable on Non Resident Fixed Deposits (NRE/NRO)," mentioned RBL Bank on its website.

On premature withdrawal of FDs, RBL Bank has mentioned on its website that "On premature full/partial withdrawal of the Fixed Deposit, interest shall be paid at the rate that was applicable on the date the deposit was placed and for the period for which the deposit is maintained with the Bank, subject to a penalty of 1% on such rate. However, there is no penalty for premature withdrawal of Fixed Deposits by senior citizens/super senior citizens."

The private sector lender RBL Bank recorded total deposits of Rs 89,774 crore for the quarter ended September FY24, up 13% YoY, while gross advances climbed to Rs 78,186 crore accordingly, up by 21% YoY during the quarter under review. CASA climbed to Rs 32,075 crore during the quarter ended 30th September by 12 per cent YoY. Advances in the retail sector jumped by 34% YoY and 8% sequentially, while advances in the wholesale sector expanded by 7% YoY in Q2FY24.

Click it and Unblock the Notifications

Click it and Unblock the Notifications