RBL Bank Hikes Savings Account Interest Rates Up To 150 Bps: Details Inside

The private sector lender RBL Bank has hiked interest rates on savings bank deposits. RBL Bank has surprisingly hiked savings account interest rates by 50 basis points. According to the bank's official website, the new savings account interest rates will take effect on Monday, August 21, 2023.

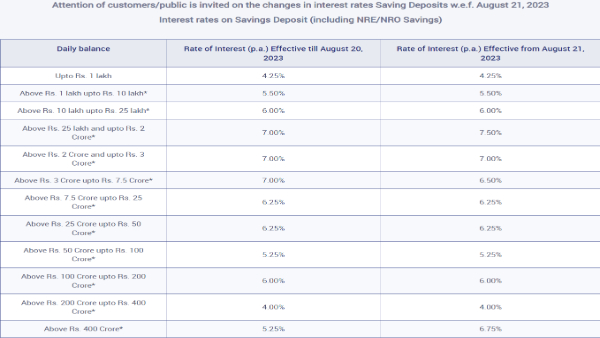

RBL Bank Savings Account Interest Rates

The bank will continue to give an interest rate of 4.25% on savings account balances up to Rs. 1 lakh, while RBL Bank will continue to offer an interest rate of 5.50% on deposit balances beyond Rs. 1 lakh and up to Rs. 10 lakh. RBL Bank will keep its savings account interest rate at 6.00% for balances over Rs. 10 lakh and up to Rs. 25 lakh, but it has increased it by 50 basis points, from 7% to 7.50%, for balances over Rs. 25 lakh and up to Rs. 2 crore.

On savings account balance of above Rs. 2 Crore and upto Rs. 3 Crore, the bank will continue to offer an interest rate of 7.00% and but RBL Bank has trimmed interest rate by 50 bps from 7.00% to 6.50% on savings account balance of above Rs. 3 Crore upto Rs. 7.5 Crore. RBL Bank will continue to offer an interest rate of 6.25% on savings account balances of above Rs. 7.5 Crore upto Rs. 50 Crore and 5.25% on deposit balance of above Rs. 50 Crore upto Rs. 100 Crore. Savings accounts with balance of above Rs. 100 Crore upto Rs. 200 Crore will continue to offer an interest rate of 6.00% and 4.00% on balance of above Rs. 200 Crore upto Rs. 400 Crore. RBL Bank has hiked interest rate by 150 bps from 5.25% to 6.75% on savings account balance of above Rs. 400 Crore.

The savings bank account balances receive interest payments on a quarterly basis. As a result, savings bank interest determined on a daily product basis will be paid at intervals of three months on the last day of June, September, December, and March of each year. Meanwhile, DCB Bank has announced an interest rate hike on savings accounts and fixed deposits of less than Rs 2 Cr effective from 17th August. DCB Bank is now offering a maximum return of 7.75% on a savings account balance of Rs 10 crore to less than Rs 200 Cr. Whereas on FDs maturing in 700 days to 36 months, the bank is offering a maximum return of 7.75% for the general public and 8.50% to senior citizens following the revision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications