RBL Bank Hikes Fixed Deposit (FD) Interest Rates Effective From Today With Up To 8% Return On This Tenure

The private sector lender RBL Bank announced a rise in interest rates on fixed deposits of less than Rs 2 Cr. after achieving impressive performance in Q4 FY24. Following the FD rates revision, the bank is now offering senior citizens an 8.50% return and the general public a maximum of 8.00% return for a period of 546 days to 24 months (18 months to 24 months). The new fixed deposit interest rates go into effect on May 1, 2024, according to RBL Bank's official website.

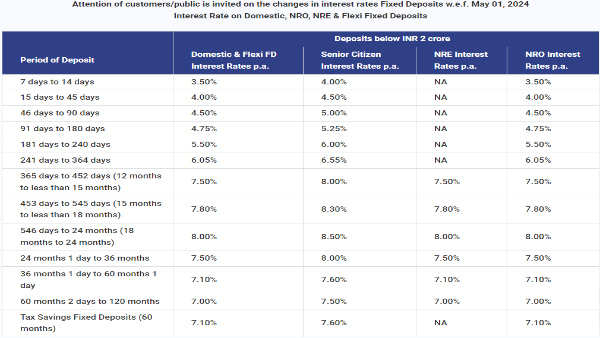

RBL Bank FD Rates

The bank offers an interest rate of 3.50% for deposits made between seven and fourteen days, while RBL Bank offers an interest rate of 4.00% for deposits made between fifteen and forty-five days. For FDs with a term of 46 to 90 days, RBL Bank is giving an interest rate of 4.50%; for deposits with terms ranging from 91 to 180 days, the rate is 4.75%. The interest rate for deposits maturing from 181 days to 240 days is 5.50%, while the interest rate for deposits maturing from 241 days to 364 days is currently 6.05%.

Fixed deposits with RBL Bank that mature between 365 and 452 days (12 months to less than 15 months) will provide a 7.80% return, while those having a term between 453 and 545 days (15 months to less than 18 months) would result in a 7.50% return.

RBL Bank will pay an interest rate of 8.00% on deposits maturing in 546 days to 24 months (18 months to 24 months), while the bank is currently offering an interest rate of 7.50% on deposits with a term of 24 months 1 day to 36 months. Fixed deposits at RBL Bank with maturities ranging from 36 months 1 day to 60 months 1 day will yield interest at a rate of 7.10%, while those with terms ranging from 60 months 2 days to 120 months would provide a return of 7%. RBL Bank is now offering an annualised rate of 7.10% on tax-saving FDs with a 60-month tenure.

"Senior Citizens (60 years to less than 80 years) are eligible for additional interest rate of 0.50% p.a. and Super Senior Citizens (80 years and above) are eligible for additional interest rate of 0.75% p.a. Senior Citizens/Super Senior Citizens rates are not applicable on Non Resident Fixed Deposits (NRE/NRO)," mentioned RBL Bank on its website.

In the quarter under review, the bank posted a robust net profit of Rs 353 Cr, up 30% from Rs 271 Cr in the same period last year. Net interest income (NII) for the bank climbed by 18% YoY to Rs 1,600 Cr in Q4FY24 from Rs 1,357 Cr in Q4FY23. In the same quarter of FY23, the bank's net interest margin was 5.62%, while in the quarter ended 31st March 2024, it reached 5.45%. Net total income for RBL Bank was recorded as Rs 2,475 Cr in Q4FY24, up 22% YoY from Rs 2,031 Cr in Q4FY23.

With a CASA Ratio of 35.2%, the bank's total deposits climbed by 22% YoY and 12% QoQ to Rs 103,494 crore. Deposits under 2 crore reached Rs 43,753 crore, representing 42.3% of total deposits, increasing 6% QoQ and 24% YoY. CASA experienced a 15% YoY growth to Rs 36,448 crore. As for asset quality, on March 31, 2024, the Gross Non-Performing Assets (NPA) ratio jumped from 3.37% to 2.65%, a 72 basis point increase in a year. RBL Bank reports that in only one year, its Net NPA ratio increased by 36 basis points, from 1.10% on March 31, 2023, to 0.74% on March 2024.

Click it and Unblock the Notifications

Click it and Unblock the Notifications