RBL Bank FD Rates Revised: Latest Interest Rates Effective From December 15; Now Get Up to 8.50%

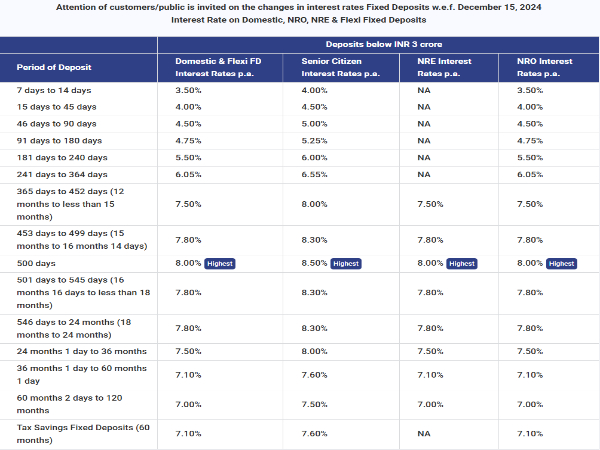

RBL Bank, a prominent private sector bank in India with a growing nationwide footprint, has changed the interest rates on fixed deposits under Rs 3 Cr. With effect from December 15, 2024, the revised rates apply to both new and renewal of existing fixed deposits. The alteration will result in a maximum interest rate of 8% for RBL Bank's non-senior citizens and up to 8.50% for senior citizen customers on term deposits that last for 500 days.

RBL Bank FD Rates

The bank will pay 3.50% interest on fixed deposits that mature in 7-14 days, while RBL Bank will pay 4.00% interest on those that mature in 15-45 days. RBL Bank offers interest rates of 4.50% for 46-90 day fixed deposit tenures and 4.75% for 91-180 day fixed deposit tenures. Domestic term deposits at RBL Bank that mature between 181 and 240 days will now earn 5.50% interest, while those that mature between 241 and 364 days will now earn 6.05%.

The bank will pay an interest rate of 7.50% on fixed deposits maturing in 365 days to 452 days (12 months to less than 15 months), while RBL Bank will pay an interest rate of 7.80% on those maturing in 453 days to 499 days (15 months to 16 months 14 days). For 500-day fixed deposit tenures, RBL Bank will pay a maximum interest rate of 8%; for term deposits maturing in 501-day to 24-month periods, the bank will pay an interest rate of 7.80%.

Domestic term deposits below Rs 3 Cr maturing in 24 months 1 day to 36 months will now fetch an interest rate of 7.50% and those maturing in 36 months 1 day to 60 months 1 day will now fetch an interest rate of 7.10%.

RBL Bank is currently giving an interest rate of 7.00% on fixed deposits maturing in 60 months 2 days to 120 months, and Tax Savings Fixed Deposits of 60 months will now earn an interest rate of 7.10% at RBL Bank effective from today.

"Senior Citizens (60 years to less than 80 years) are eligible for additional interest rate of 0.50% p.a. and Super Senior Citizens (80 years and above) are eligible for additional interest rate of 0.75% p.a. Senior Citizens/Super Senior Citizens rates are not applicable on Non Resident Fixed Deposits (NRE/NRO)," mentioned RBL Bank on its official website.

If the fixed deposit is withdrawn prematurely, either in full or in part, at RBL Bank, interest will be paid at the rate that was in force on the day of the deposit and for the duration that the deposit stays with the bank. There will also be a penalty of 1% on that rate. However, taking premature withdrawals from fixed deposits does not result in penalties for senior people or super senior citizens.

Following the exercise of their vested stock options under the bank's ESOP Schemes, eligible employees of RBL Bank and its subsidiaries were recently granted 11,300 equity shares with a face value of Rs. 10 each on December 13, 2024. This allocation has resulted in an increase in the bank's paid-up share capital from 60,77,56,894 equity shares of Rs. 10 each, totalling Rs. 607,75,68,940, to 60,77,68,194 equity shares of Rs. 10 each, totalling Rs. 607,76,81,940.

Click it and Unblock the Notifications

Click it and Unblock the Notifications