Performance of Top Crypto Assets In Early August: Key Insights For Investors

We continue to explore the world of crypto assets and its potential. The first half of 2024 was majorly positive for crypto with Bitcoin registering seven green monthly candles in a row in March. This was majorly driven by the adoption of crypto via spot ETFs for Bitcoin and Ethereum as well as the narrative behind the US Presidential elections. What awaits us in the second half of the year?

We, at Giottus, aim to decipher some of these for you leading into September. Today we cover the performance of top assets including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) while identifying narratives that have been doing well in the past few weeks. Let's get started.

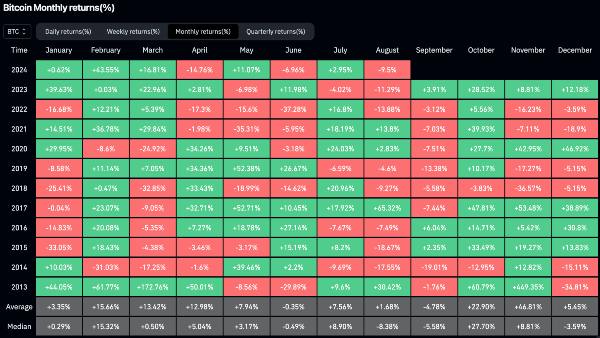

BTC down ~10% in August (so far)

August and September haven't been the strongest months for Bitcoin (and crypto) in the past 5 years. Bitcoin has shed considerably since the start of this month as fears of a sell-off by the US Government have the market reacting negatively. This is despite improved US macroeconomic indicators which have fuelled rallies in US stock indices.

Bitcoin has been rejected multiple times at $62,000 and is currently trading near $58,500. Its RSI is below 50 underscoring the bearish undertones. If this continues, a BTC retest of $56,000 and even $50,000 is on the cards before the end of this month. However, if BTC reclaims $60,000, it can push towards $62,000 and beyond to end the month on a positive note.

Bitcoin's dominance (BTC.D), the measure of how altcoins are performing, has broken out of its consolidation range and has successfully back-tested the zone this week. BTC.D looks strong to surge towards 60% this month if the trend continues. This means Ethereum, Solana, and other key altcoins will likely lag Bitcoin's performance in the coming days.

Ethereum in macro downtrend against Bitcoin

Ethereum has been on a macro downtrend against Bitcoin since its Merge in September 2022. This metric needs to get above 0.05 to break out of the trendline. However, we anticipate this to happen post-September when the US interest rate cuts arrive.

In dollar terms, Ethereum can break out of its ascending triangle and surge towards $3,000, provided Bitcoin reclaims $60,000 and consolidates above it.

From a monthly low of $2,850, Ethereum rallied to $3,500 ahead of its spot ETF debut in the US. However, in a typical case of sell-the-news event, ETH put in many red days immediately after and is currently trading near $3,200. This was aided by net negative flows from Greyscale's ETH ETF. However, we believe that this trend is abating and Ethereum can recover soon. Against Bitcoin, Ethereum is inching up to claim the critical 0.05 support zone in an ascending trendline.

Solana continues to perform well against Ethereum

Solana has had an impressive start to August and put in new all-time highs against Ethereum. It is currently consolidating below the key resistance zone (in yellow). In dollar terms, SOL must retake $150 and convert it to strong support to rally towards $165. Again, Solana's performance is dependent on Bitcoin and the larger market sentiment.

The key outperformers

Outside of the top 3, BNB, TRX, and TON are showing relative strength among large altcoins. We reiterate the emergence of AI, RWA (real world assets), and gaming as horses to back in this bull market. The tokens we suggest that investors track are: 1) AI tokens - FET, RENDER, and AIOZ; 2) RWA tokens - ONDO and PENDLE; and 3) Gaming: SUPER and NAKA. These plays are valid once Bitcoin shows strength while its dominance drops - altcoins can then rally well into September and October.

Retests of support zones likely

Prices are likely to consolidate and even back-test key resistance levels in the upcoming weeks. This usually is accompanied by volatility in the market. This might be a test of patience for short-term traders while long-term investors can look for ideal price zones to enter their positions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications