Mutual Fund Calculator: How Rs 10,000 Monthly SIP Creates Rs 1.13 Cr In 15 Years?

Systematic Investment Plans (SIPs) are a popular and effective way to invest in mutual funds, allowing investors to benefit from the power of compounding and rupee cost averaging. One compelling example is the SBI Small Cap Fund, which has shown the potential to generate significant wealth over time. This article explores how a monthly SIP of Rs 10,000 in the SBI Small Cap Fund can grow to Rs 1.13 crore in less than 15 years.

Understanding Small Cap Funds:

Small-cap funds are mutual funds that invest predominantly in companies with smaller market capitalization. These companies are generally in the growth phase and have the potential to become mid or large-cap over time. While they come with higher risk due to their volatile nature, they also offer higher growth potential.

Key Information:

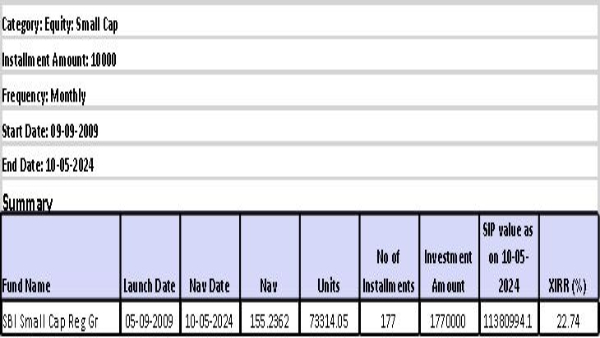

- Fund Category: Equity - Small Cap

- Installment Amount: Rs. 10,000 per month

- Frequency: Monthly

- Start Date: September 9, 2009

- End Date: May 10, 2024

- Number of Installments: 177

- Total Investment Amount: Rs. 17,70,000

- Net Asset Value (NAV) as of May 10, 2024: Rs. 155.2362

- Units Held: 73,314.05

- SIP Value as of May 10, 2024: Rs. 1,13,80,994.10

- XIRR (Extended Internal Rate of Return): 22.74%

- Fund Benchmark: S&P BSE 250 SmallCap Index

- Fund Manager: Srinivasan and Mr. Mohan Lal

Concentration:

| No. of Stocks: 56 | Top 10 Stocks: 30.51% | Top 5 Stocks: 17.57% |

|---|---|---|

| Top 3 Sectors: 41.95% | Portfolio P/B Ratio: 4.68 | Portfolio P/E Ratio: 34.15 |

SIP Investment Strategy:

A Systematic Investment Plan (SIP) allows investors to invest a fixed amount regularly in a mutual fund scheme, typically on a monthly basis. This approach helps in averaging the cost of investment and mitigating the impact of market volatility. A SIP of Rs. 10,000 per month in the SBI Small Cap Fund over the last 15 years is a classic example of the power of disciplined investing.

Performance Analysis Based on 10th May 2024.

Total Investment: Over the period of 14 years and 8 months, a total of Rs. 17,70,000 was invested through monthly SIPs of Rs. 10,000 each.

Investment Growth: The SIP value as of May 10, 2024, is Rs. 1,13,80,994.10. This substantial growth illustrates the power of compounding and disciplined investing over a long period.

XIRR (Extended Internal Rate of Return): The XIRR of 22.74% indicates the annualized return on the investment, considering the timing and amount of each SIP installment. This return significantly outperforms traditional investment options like Fixed Deposits, PPF, and even the NIFTY 50 TRI index.

Comparative Analysis with Other Investments:

To put the performance of the SBI Small Cap Fund into perspective, let's compare it with other common investment options over the same period:

- NIFTY 50 TRI: 12.47%

- Gold: 10.74%

- PPF: 7.70%

| Investment Option | Total Investment (Rs.) | Current Value Approx. (Rs.) | XIRR (%) |

|---|---|---|---|

| SBI Small Cap Fund | 17,70,000 | 1,13,80,994.10 | 22.74% |

| NIFTY 50 TRI | 17,70,000 | 44,56,031.89 | 12.47% |

| Gold | 17,70,000 | 38,11,107.52 | 10.74% |

| PPF | 17,70,000 | 27,19,606.09 | 7.70% |

Historical Performance Analysis:

Initial Years (2009-2014):

The period following the 2008 financial crisis saw significant market recovery. Small-cap stocks, which had been battered during the downturn, began to rebound strongly.

SBI Small Cap Fund leveraged this recovery, posting impressive returns. Despite occasional volatility, the fund's NAV (Net Asset Value) showed a steady upward trajectory.

By the end of 2014, a SIP investor who started in 2009 had seen substantial growth in their investment, benefiting from the lower initial valuations.

Mid Years (2015-2019):

During this period, the Indian economy experienced various reforms, including the implementation of GST and demonetization. These events caused short-term market disruptions but also paved the way for long-term growth.

Small-cap stocks, being more volatile, saw sharper fluctuations. However, the fund's diversified portfolio and astute stock selection helped it navigate these challenges.

The cumulative SIP investment of Rs. 10,000 per month for these years continued to grow, with the power of compounding enhancing the wealth creation process.

Recent Years (2020-2023):

The COVID-19 pandemic in 2020 led to a sharp market correction, but it was followed by a swift recovery driven by liquidity measures and economic revival.

SBI Small Cap Fund demonstrated resilience, quickly bouncing back and continuing its growth trajectory.

The cumulative effect of 15 years of disciplined SIP investments, even through market downturns, showed remarkable results.

Key Factors Behind Wealth Creation

Consistent Performance: SBI Small Cap Fund has consistently outperformed its benchmark, thanks to strong stock selection and a diversified portfolio.

Compounding Effect: The power of compounding over 15 years significantly enhanced the wealth created.

Economic Growth: India's economic growth and reforms provided a favourable environment for small-cap companies to thrive.

Market Cycles: The long-term investment horizon allows the fund to navigate through various market cycles, benefiting from the overall growth trajectory.

Risks and Considerations

While the SBI Small Cap Fund has delivered impressive returns, it's essential to consider the associated risks:

Market Volatility: Small-cap stocks are more volatile and can experience significant price fluctuations.

Liquidity Risk: Small-cap stocks may have lower liquidity, making it challenging to buy or sell large quantities without affecting the stock price.

Economic Factors: Small-cap companies can be more susceptible to economic downturns compared to larger companies.

Market Conditions: Such returns are heavily dependent on prevailing market conditions and the specific stock picks within the fund's portfolio.

Risk Factor: Small-cap investments are riskier, and while they can offer high returns, they can also experience significant volatility.

Risk Measures: This fund has been classified as having Very High Risk.

| Funds | Mean Return | Std Dev | Sharpe | Sortino | Beta | Alpha |

|---|---|---|---|---|---|---|

| SBI Small Cap | 23.06 | 12.05 | 1.48 | 2.49 | 0.62 | 3.75 |

| S&P BSE 250 SmallCap | 27.92 | 18.01 | 1.26 | 2.09 | -- | -- |

| Equity Small Cap | 26.39 | 15.53 | 1.38 | 2.42 | 0.82 | 2.67 |

Important Note: While past performance can provide insights, it is not indicative of future results.

Conclusion

A disciplined investment approach through a monthly SIP of Rs 10,000 in the SBI Small Cap Fund can potentially grow to Rs 1.13 crore in less than 15 years, assuming an average annualized return of 22.74%. While historical performance provides insights, it is essential to understand that mutual fund investments are subject to market risks, and past performance is not indicative of future results.

Investors should consult with experienced financial experts or mentors to tailor their investment strategies according to their individual needs and market conditions. With the right approach, the journey towards significant wealth creation can be both rewarding and achievable.

Click it and Unblock the Notifications

Click it and Unblock the Notifications