List of Banks Revised Fixed Deposit (FD) Rates In July

The repo rate has been kept unchanged at 6.5% by the Reserve Bank of India (RBI) since February. The decision for the benchmark repo rate will be made on August 10 by the governor of the RBI, Shaktikanata Das, who chairs the monetary policy committee (MPC).

On June 8, the Reserve Bank of India (RBI) announced that it will maintain its primary policy rate, the repo rate, at 6.5 per cent. The following banks updated their fixed deposit interest rates in July even though the RBI struck pause for the second time in a row and the repo rate was 6.5% in June.

Bank of India

On July 28, 2023, Bank of India (BOI) altered its interest rates for fixed deposits under Rs 2 Cr. The bank offers interest rates between 3% and 6% on deposit terms ranging from 7 days to 10 years. BOI is now giving a maximum return of 7.25% on deposits with a 400-day tenor (Monsoon Deposit). For all tenors of three years and longer, senior citizens would receive 75 bps in interest in addition to the current 50 bps rate on their retail TDs (less than Rs. 2 Cr.). While Super Senior Citizens would receive an additional 40 bps in interest over and above the current 50 bps on their retail TDs (less than Rs. 2 Cr.) for all tenors of 3 Years & Above, or 90 bps.

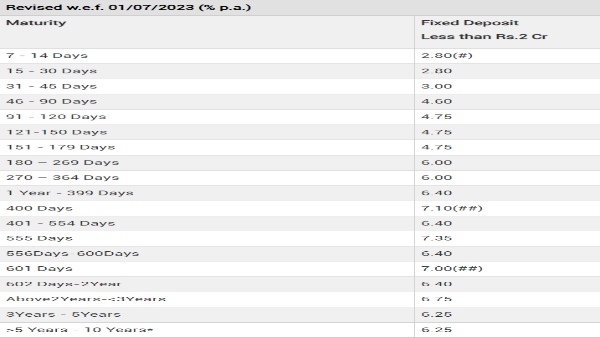

Punjab & Sind Bank

On 1st July 2023, Punjab & Sind Bank made an announcement of interest rate revision on fixed deposits of less than Rs 2 Cr. PSB is promising interest rates ranging from 2.80% to 6.25% on tenors of 7 days to 10 years. On a tenor of 400 days, customers will get a maximum return of 7.10%. On term deposits of less than Rs. 2 crore, senior citizens would get an additional interest rate of 0.50% over and above the rates specified above for term deposits on maturity tenors of 180 days & above. While Super Senior Citizens (80 years and above) would receive an additional 0.15% in interest on certain periods, such as 400 days, 555 days, and 601 days for term deposits under Rs. 2 crore.

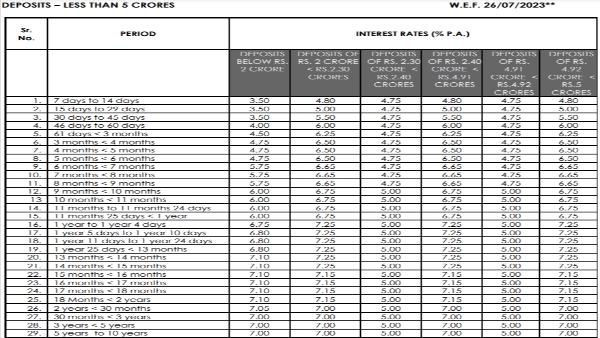

Axis Bank

On 26th July, Axis Bank revised its interest rates on fixed deposits of less than Rs 2 Cr. On tenors of 7 days to 10 years, Axis Bank is now promising interest rates ranging from 3.50% to 7%. On a maturity period of 13 months to 2 years, Axis Bank is now offering a maximum return of 7.10%. On a deposit tenor of 6 months to 10 years, senior citizens will get additional interest rate benefits of 50 bps higher than the standard rates.

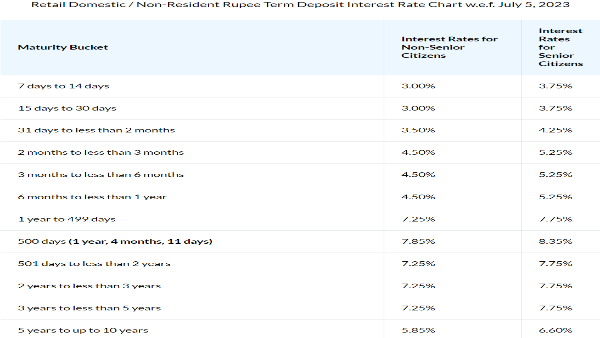

Bandhan Bank

On July 5, 2023, Bandhan Bank revised its interest rates on fixed deposits of less than Rs 2 Cr. On tenors of 7 days to 10 years, the bank is offering interest rates ranging from 3% to 5.85% for the general public and 3.75% to 6.60% for senior citizens. On a deposit tenor of 500 days (1 year, 4 months, 11 days), Bandhan Bank is now offering a maximum return of 7.85% for the general public and 8.35% for senior citizens.

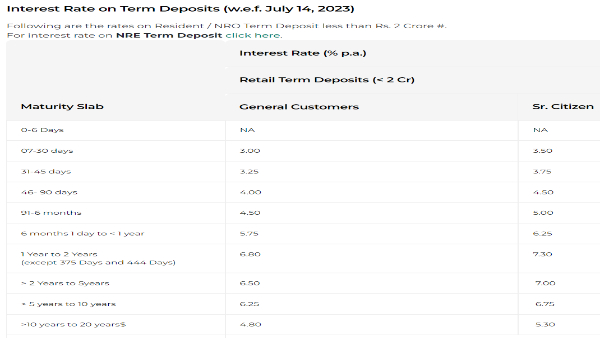

IDBI Bank

On July 14, 2023, IDBI Bank made an interest rate revision on fixed deposits of less than Rs 2 Cr. On a deposit tenor of 7 days to 10 years, the bank is now promising interest rates of 3% to 6.25% for the general public and 3.50% to 6.75% for senior citizens. On a deposit tenor of 1 Year to 2 Years (except 375 Days and 444 Days), non-senior citizens will get a maximum return of 6.80% and senior citizens will get a maximum return of 7.30%.

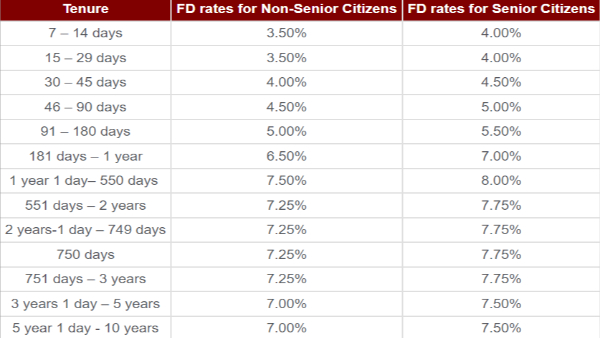

IDFC First Bank

On 1st July 2023, IDFC First Bank revised its interest rates on fixed deposits of less than Rs 2 Cr. On FDs maturing in 7 days to 20 years, the bank is promising interest rates ranging from 3.50% to 7.00%. On a deposit tenor of 1 year 1 day - 550 days, non-senior citizens will get a maximum return of 7.50% and senior citizens will get a maximum return of 8%.

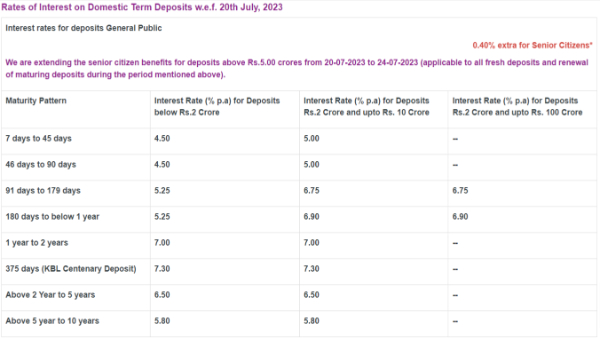

Karnataka Bank

On 20th July 2023, the private sector lender made an interest rates revision on fixed deposits of less than Rs 2 Cr. FDs maturing in 7 days to 10 years will now fetch interest rates ranging from 4.50% to 5.80%. On a deposit tenor of 375 days (KBL Centenary Deposit), Karnataka Bank is offering a maximum return of 7.30%. The bank offers an additional 0.40% above the regular rate for resident senior citizens solely for tenures of 1 to 5 years and 0.50% over the general rate for tenures of 5 to 10 years on domestic deposits.

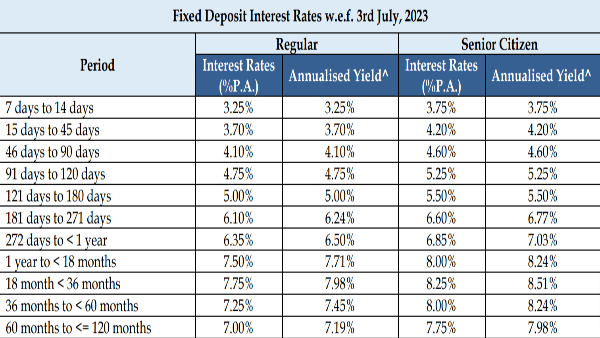

Yes Bank

On 3rd July, Yes Bank revised its interest rates on fixed deposits of less than Rs 2 Cr. Domestic fixed deposits maturing in 7 days to 10 years will now fetch standard rates ranging from 3.25% to 7.00% and 3.75% to 7.75% for senior citizens. On a deposit tenor of 18 months to 36 months, Yes Bank is now offering a maximum interest rate of 7.75% for the general public and 8.25% for senior citizens.

Click it and Unblock the Notifications

Click it and Unblock the Notifications