Jana SFB Revises Interest Rates On Retail Fixed Deposits; Senior Citizens Can Earn Up to 8.75%

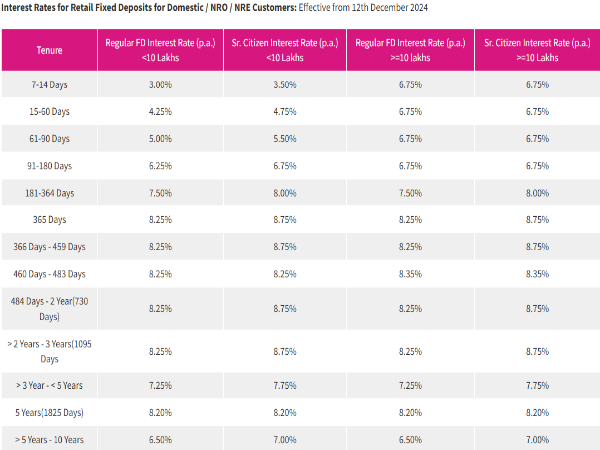

The interest rates on retail fixed deposits for domestic customers have been updated by Jana Small Finance Bank (SFB), the fourth-largest SFB based on AUM and deposit size. The most recent card rates, which go into effect on December 12, 2024, apply to accounts under Rs 3 crore. The bank is now offering a maximum interest rate of 8.25% to non-senior citizens and 8.75% to elderly individuals on a variety of tenures as a result of the modification.

Jana Small Finance Bank FD Rates

The bank is giving a 3.00% interest rate on fixed deposits that mature in 7-14 days, and Jana SFB will pay a 4.25% interest rate on those that mature in 15-60 days. For a fixed deposit period of 61-90 days, Jana SFB will pay an interest rate of 5.00%; for a fixed deposit tenure of 91-180 days, the interest rate will be 6.25%. Interest rates on domestic retail deposits that mature between 181-364 days will now be 7.50%, while those maturing in 365 days to 3 years will now be 8.25%.

Jana Small Finance Bank is now giving 7.25% interest on fixed deposits that mature in 3 to 5 years, and 8.20% interest on those that mature in 5 years (1825 days). Term deposits with maturities of five to ten years are now eligible for an interest rate of 6.50% from Jana Small Finance Bank.

"Senior Citizens shall not get an extra 0.50% interest for FDs (>=Rs 10 Lakhs) for tenures between 7 days to 180 days. Senior Citizens and Jana Bankers shall not get an extra 0.50% interest for 460 Days - 483 Days and 5 Years (1825 Days) tenures," mentioned Jana SFB on its website.

Jana Small Finance Bank Fixed Deposit Plus

In addition, Jana Small Finance Bank offers fixed deposit plus accounts, which provide higher interest rates than regular fixed deposits but prohibit premature withdrawals. Fixed deposits have a term duration of seven days to ten years, and a minimum deposit of Rs 15,00,001 is needed. On fixed deposit plus accounts, the bank has also revised its interest rates on 13th December 2024, the latest rates are covered below in brief for amounts of less than Rs 3 Cr.

The bank now pays 3.10% interest on fixed deposit plus accounts that mature in 7-14 days, while Jana SFB will now pay 4.35% interest on those that mature in 15-60 days. Deposits maturing between 61 and 90 days will now earn 5.10% interest from Jana SFB, while deposits due between 91 and 180 days will earn 6.60%. Jana Small Finance Bank fixed deposit plus accounts that mature in 181-364 days will now earn 8.10% interest, while those that mature in 365 days will get 8.35%.

The bank currently offers an interest rate of 8.45% on fixed deposit plus accounts that mature in one to two years, and Jana SFB will now give an interest rate of 8.35% on those that mature in two to three years. At Jana SFB, fixed deposit plus accounts that mature in three to five years will now earn 7.35% interest, while those that mature in five years (1825 days) to ten years will now earn 6.60%.

Jana Small Finance Bank reports that H1 PAT FY25 climbed by 25% year on year to Rs 267 crore. The fourth-largest small finance bank in India, Jana Small Finance Bank is a scheduled commercial bank that has been lending for more than 16 years and serves 12 million clients.

Click it and Unblock the Notifications

Click it and Unblock the Notifications