Jammu And Kashmir Bank (J&K Bank) Hikes FD Rates By 70 Bps Effective From Today

A scheduled commercial bank and one of India's first private sector banks, Jammu and Kashmir Bank (J&K Bank), which was founded in 1938, has raised its interest rates on fixed deposits under Rs 2 crore. After the modification, the bank increased interest rates by up to 70 bps on a variety of deposit maturities and is currently providing 3.50% to 6.50% on deposits that mature in 7 days to 10 years. On a deposit tenure of 1 year to less than 2 years, the bank is now promising a maximum return of 7.10%. As per the official website of the bank, the new FD rates are effective as of October 11, 2023.

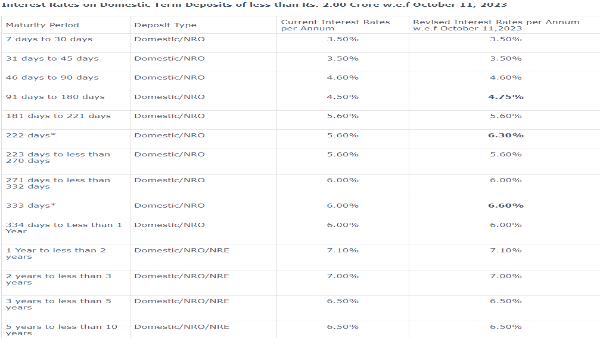

J&K Bank FD Rates

The bank will continue to give an interest rate of 3.50% on deposits maturing in the next 7 days to 45 days, while J&K Bank will continue to offer an interest rate of 4.60% on deposits maturing in the next 46 days to 90 days. J&K Bank increased interest rates by 25 basis points, from 4.50% to 4.75%, for deposits held for 91 to 180 days, although it will keep offering 5.60% for deposits held for 181 to 221 days.

Deposits that mature within 222 days will now earn 6.30% in interest, which is 70 basis points (bps) more than the previous rate of 5.60%. Deposits maturing in 223 days to less than 270 days will continue to earn 5.60% in interest. The bank will continue to give an interest rate of 6.00% on FDs that mature in 271 days to less than 332 days, whereas Jammu and Kashmir Bank (J&K Bank) has raised its interest rate on those maturing in 333 days by 60 basis points, from 6% to 6.60%.

The interest rates offered by Jammu and Kashmir Bank (J&K Bank) will remain at 6% for maturities spanning 334 days to less than a year and 7.10% for terms lasting a year to less than two years. Deposits that mature in 1 year to 2 years will continue to earn 6% interest, while those that mature in 3 years to 10 years will continue to earn 6.50% interest.

"The above rates are applicable for fresh deposits and renewal of maturing deposits for amounts less than Rs 2.00 Crores. The minimum contract period of NRE deposits is 1 year. Domestic Term Deposits of Senior Citizens of over 60 years of age shall continue to earn 0.50 % additional rate across all maturities," mentioned Jammu and Kashmir Bank on its website.

For the second quarter of FY24, the bank reported a 12.03 per cent year-on-year (YoY) growth in total business at Rs 2.18 lakh crore. The public sector lender's total deposits jumped 9.4% YoY to Rs. 1.27 lakh crore. In Q2FY23, CASA deposits were Rs 64,067.68 crore, which is a rise of 1.24 per cent. In the second quarter of the current fiscal year, gross advances climbed 15.88 per cent YoY to Rs 91,679.87 crore from Rs 79,113.07 crore in Q2FY23.

Click it and Unblock the Notifications

Click it and Unblock the Notifications