Indian Overseas Bank (IOB) Hikes Fixed Deposit (FD) Rates By 30 Bps

Indian Overseas Bank (IOB), a public sector lender, raised the interest rates on its fixed deposits of less than Rs 2 Cr. The bank released this notification on November 15th. In response to the adjustment, the bank hiked interest rates by 30 basis points, representing 6.80%, on terms of one year to two years (except 444 days), but reduced interest rates by 15 basis points on 444 days tenure.

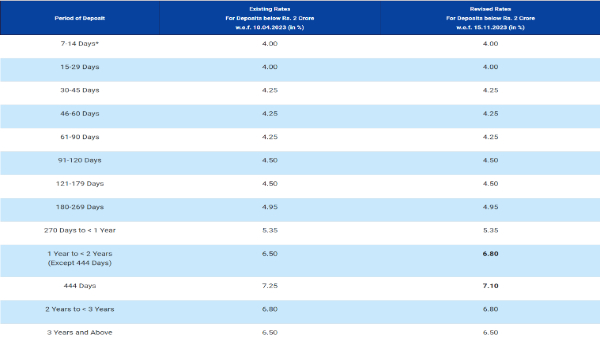

IOB FD Rates

The bank will continue to give 4.00% interest on fixed deposits that mature between 7-29 days, while IOB will continue to offer 4.25% interest on deposits maturing in 30-90 days. For a deposit tenure of 91-179 days, IOB will continue to give an interest rate of 4.50%, and for a term of 180-269 days, the bank will continue to offer an interest rate of 4.95%.

The interest rate on deposits maturing in 270 days to one year will remain at 5.35%, while deposits maturing in one year to two years (except from 444 days) will now provide a 6.80% return as opposed to 6.50% previously. Indian Overseas Bank will continue to give an interest rate of 6.80% on FDs that mature in two to three years, while the bank will continue to offer an interest rate of 7.10%, which was previously 7.25%, on those maturing in 444 days. Indian Overseas Bank will keep paying interest at a rate of 6.50% on deposits made for three years or longer. The interest rate on the IOB tax saver FD will stay at 6.50%.

"For Senior Citizen (aged 60 and above), additional Interest rate of 0.50% and for Super Senior Citizens (aged 80 years and above), additional Rate of 0.75% continues," mentioned Indian Overseas Bank (IOB) on its website.

For the quarter that ended on September 30, 2023, the lender's net profit was Rs 625 crore, a 24.75 per cent increase from Rs 501 crore during the same time the previous year.

In Q2 FY 24, IOB's operating profit was Rs 1,677 crore, compared to Rs 1,494 crore in the same quarter the previous year. Compared to the Rs 5,852 crore in Q2FY23, the total income in Q2FY24 was Rs 6,935 crore. In Q2 FY24, the bank's net interest income was Rs 5,821 crore, compared to Rs 4,718 crore during the same time the previous year. As of September 30, 2023, the total business had risen to Rs 4,82,006 crore from Rs 4,55,664 crore on June 30, 2023.

Click it and Unblock the Notifications

Click it and Unblock the Notifications