India’s 115 Year Old Public Sector Bank Revises Savings Account Rates

Established in 1908 Punjab & Sind Bank is one of the well known public sector lenders with a market cap of Rs 21,505 Cr. The large cap state-owned bank has revised its savings accounts interest rates and now offers up to 5.00% which is more than leading banks like SBI, ICICI Bank, Bank of Baroda, HDFC Bank and much more.

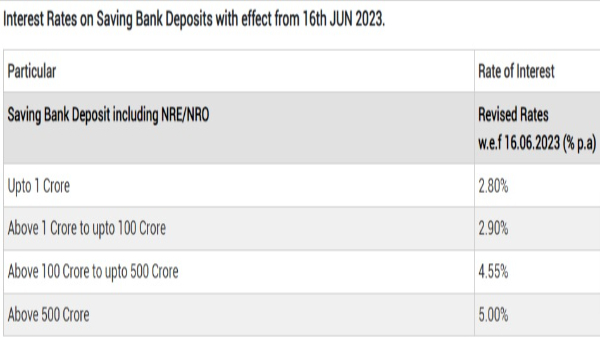

Punjab & Sind Bank Savings Account Interest Rates

With effect from 16th June 2023, the interest rates on saving bank deposits of Punjab & Sind Bank are in force.

On savings account balance of upto Rs 1 Crore, the bank is offering an interest rate of 2.80% and on savings account balance of above Rs 1 Crore to upto Rs 100 Crore, Punjab & Sind Bank is promising an interest rate of 2.90%. Savings accounts with available balance of above Rs 100 Crore to upto Rs 500 Crore will now fetch an interest rate of 4.55% whereas accounts with a balance of above Rs 500 Crore will now fetch a maximum interest rate of 5.00%.

Punjab & Sind Bank savings account can be opened by persons (Single or Joint names), HUF, Non Corporate Bodies, Clubs, Trusts, Societies, Associations, Schools, Executor(s) / Administrator(s), Government Bodies, Semi - Government Departments, Recognized PF Accounts etc.

One person may establish a deposit account in his or her own name as a single account, or multiple individuals can open a joint account in their own names.

Subject to transaction limitations, minors over the age of ten are also permitted to independently create and manage SB accounts. Deposits up to Rs. 49999/- per day are allowed, and withdrawals at the counter are limited to Rs. 50,000/- per cheque and Rs. 10,000/- each withdrawal slip every day.

source: Bank Website

In Q4FY23, the lender reported net profit growth of 22.43% QoQ and 32.03% YoY, totaling Rs 456.99 crore. In the quarter, the bank's net interest income (NII) fell by 1.97% YoY to Rs 683.78 crore. In comparison to 12.17% in Q4FY22 and 8.36% in Q3FY23, gross non-performing assets (GNPA) were 6.97% in Q4FY23. Net NPA was at 1.84%, down from 2.02% in Q3FY23 and 2.74% in Q4FY22. The bank has 1537 branches as of March 31, 2023, with 572 of those being rural, 281 semi-urban, 362 urban, and 322 metro, as well as 835 ATMs and 357 business correspondents.

Click it and Unblock the Notifications

Click it and Unblock the Notifications