IDFC First Bank Revises Bulk FD Rates, Now Earn As High As 7.60%

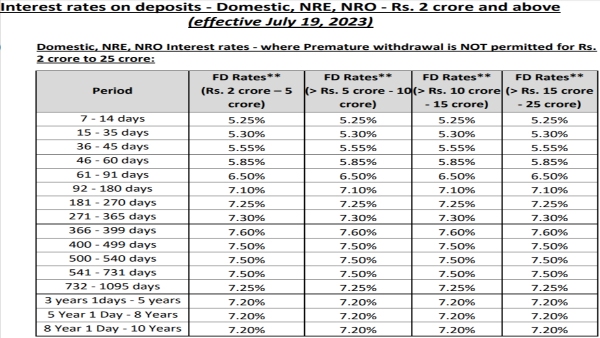

IDFC First Bank has revised its interest rates on fixed deposits - Domestic, NRE, NRO - Rs. 2 crore and above. The revised interest rates are applicable on Domestic, NRE, NRO deposits where Premature withdrawal is not permitted for Rs. 2 crore to 25 crore. As per the official website of the bank, the new bulk FD rates are effective as of July 19, 2023. Following the revision the bank is offering interest rates ranging from 5.25% to 7.20% on deposits maturing in 7 days to 10 years. On a deposit tenor of 366 - 399 days, the bank is promising a maximum return of 7.60%.

IDFC First Bank Bulk FD Rates

The bank is guaranteeing an interest rate of 5.25% on bulk deposits that mature in the next 7 to 14 days, and IDFC First Bank is promising an interest rate of 5.30% on deposits that mature in the next 15 to 35 days. The interest rate promised by IDFC First Bank is 5.55% for deposits held for 36 to 45 days and 5.85% for deposits held for 46 to 60 days.

Deposits that mature between 61 to 91 days will now earn 6.50% interest, while those maturing in 92 to 180 days will now earn 7.10% interest. On bulk deposits maturing in 181 - 270 days, the bank is offering an interest rate of 7.25% and on those maturing in 271 - 365 days, IDFC First Bank will pay an interest rate of 7.30%. A deposit tenor of 366 to 399 days will earn an interest rate of 7.60%, while a deposit tenor of 400 to 731 days will earn an interest rate of 7.50%. Deposits that mature in 732 days - 1095 days will earn interest at 7.25%, while those that mature in 3 years, 1 day to 10 years will now earn interest at 7.20%.

"Incentive for Senior Citizens will be at an additional spread of 0.50% over the rate of deposit for the respective tenor and will not be available for NRE or NRO Fixed Deposits," said IDFC First Bank on its website.

"In connection with the declaration of the Unaudited Standalone and Consolidated Financial Results of the Bank for the quarter ended June 30, 2023. In this regard, we would like to inform you that the meeting of the Board of Directors of the Bank will be held on Saturday, July 29, 2023, inter-alia, to consider and approve the Unaudited Standalone and Consolidated Financial Results of the Bank for the said period, which shall be subject to Limited Review by the Joint Statutory Auditors," said IDFC First Bank in a stock exchange filing.

The provisional numbers from IDFC First Bank for the first quarter of FY24 have been made public. Loans and advances made by the bank grew by 24.5% YoY, while deposits made by customers climbed by 44.4% YoY. According to the regulatory filing, the loans and advances of IDFC First Bank were Rs 1,71,420 crore in the June 2023 quarter, up 24.5% from Rs 1,37,663 crore in Q1FY23. Additionally, customer deposits climbed 44.4% to Rs 1,48,508 crore in Q1FY24 compared to Rs 1,02,868 crore in Q1FY23, while its CASA deposits climbed by 26.7% YoY. The CASA ratio was 46.5% in Q1 FY24 compared to 49.8% as of March 31, 2023.

Click it and Unblock the Notifications

Click it and Unblock the Notifications