IDBI Bank Revises FD Rates, Offering Up To 7.65% On This Tenor

IDBI Bank has revised its interest rates on fixed deposits of less than Rs 2 Cr. Following the modification, the bank is now offering interest rates on deposits with terms ranging from 7 days to 10 years that range from 3.00% to 6.25% for the general public and 3.50% to 6.75% for senior citizens. The bank guarantees a maximum interest rate of 7.15% for the general public and 7.65% for elderly individuals on a deposit tenor of 444 days. According to IDBI Bank's official website, the revised FD rates go into effect on June 14, 2023.

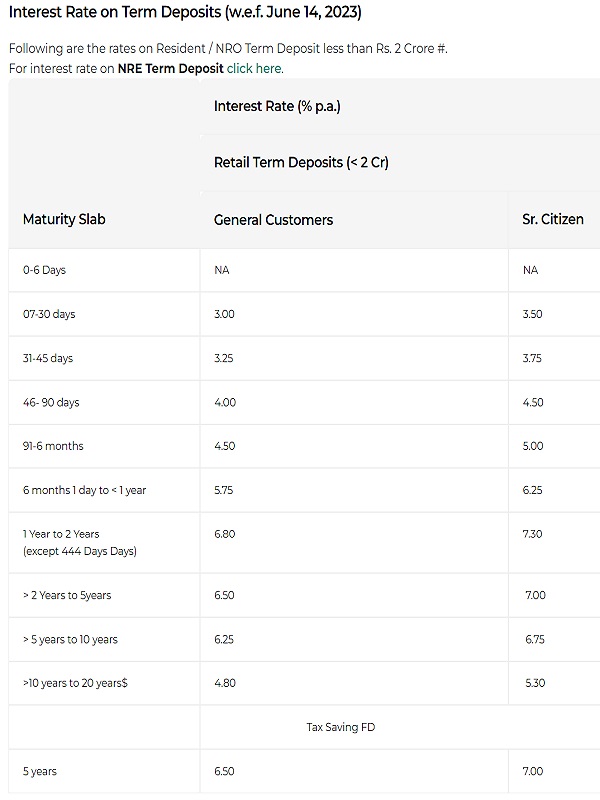

IDBI Bank FD Rates

On deposits maturing in 07-30 days, the bank is paying an interest rate of 3% and on those maturing in 31-45 days, IDBI Bank is offering an interest rate of 3.25%. IDBI Bank is offering an interest rate of 4.00% on a deposit tenor of 46- 90 days and an interest rate of 4.50% on a deposit tenor of 91-6 months. Deposits maturing in 6 months 1 day to 1 year will fetch an interest rate of 5.75% and those maturing in 1 Year to 2 Years (except 444 Days Days) will fetch an interest rate of 6.80%.

On deposits maturing in 2 Years to 5 years, the bank is offering an interest rate of 6.50% and on those maturing in 5 years to 10 years, IDBI Bank is now offering an interest rate of 6.25%. On a tax saving FD of 5 years, IDBI Bank is promising an interest rate of 6.50% for the general public and 7.00% for senior citizens.

IDBI Bank introduced the "Amrit Mahotsav FD" scheme of 444 Days on April 01, 2023. On this FD, the general public will get an interest rate of 7.15% and senior citizens will get an interest rate of 7.65%.

In the fourth quarter of FY23, IDBI Bank reported a net profit of Rs 1,133 crore, up a staggering 64% over the same quarter a year earlier. For the whole fiscal FY23, the institution reported a record-breaking net profit of Rs 3,645 crore. In Q4FY23, net interest income (NII), which was Rs 2,420 crore in Q4FY22, grew by 35% to Rs 3,280 crore. Furthermore, compared to Q4 of FY22, IDBI's provisions sharply increased to Rs 1,292 crore from Rs 823 crore. Gross NPA significantly decreased to 6.38% in Q4 FY23 from 20.16% in Q4 FY22 and 13.82% in Q3 FY23. The CASA of IDBI reached Rs 1,35,455 crore and as of March 31, 2023, its CASA ratio was 53.02%. Total CASA was Rs. 1,32,359 and CASA ratio was 56.77% as of March 31, 2022.

As of March 31, 2023, the bank's net advances were Rs 1,62,568 crore, up 19% YoY from Rs 1,36,955 at the end of March 2022.

Click it and Unblock the Notifications

Click it and Unblock the Notifications