How To Maximize Returns With Systematic Transfer Plans (STPs)?

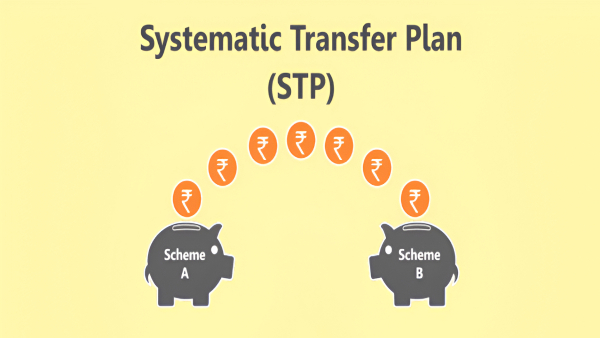

STPs are an effective tool for investors who want to take advantage of the potential returns of equity funds while reducing the risks connected with lump-sum investments. STPs involve transferring a fixed amount from one mutual fund scheme to another at regular intervals, and they can be a game-changer for your investment strategy.

This article will explore how you can set up and leverage STPs for maximum returns.

Choosing the Right Funds

The first step in setting up an STP is selecting the two mutual fund schemes. Typically, the source scheme is a liquid mutual fund that provides stable returns at low risk, where you can invest a lump sum.

The target scheme, on the other hand, is often an equity-oriented mutual fund where you'll make regular transfers. This strategic choice ensures that your investments happen at different points in time, reducing the impact of market volatility.

Defining STP Parameters

Once you've chosen your source and target schemes, it's time to determine the amount you want to transfer from the source fund to the target fund. Your decision should be based on your financial objectives and liquidity requirements.

Additionally, you'll need to specify the frequency of transfers, which can be weekly, monthly, quarterly, or half-yearly. Deciding the duration of the STP is essential, as it indicates how long you'll continue making regular transfers.

Registering the STP

With your STP parameters in place, you can easily register the plan. There are two primary methods for doing this. First, you can register your STP online through the mutual fund platform. Alternatively, you can opt for the traditional approach by filling out a physical STP form and submitting it to the fund house, registrar, and the transfer agent's office.

STPs offer several benefits, and here's why they're a valuable addition to your investment strategy:

Risk Mitigation: By spreading your investments over time, STPs minimise the risk of timing the market. You won't have to worry about making a significant investment all at once, which could lead to unfavourable outcomes if the market is in a downturn.

Rupee-Cost Averaging: STPs allow you to take advantage of rupee-cost averaging. When markets are down, your fixed amount buys more units; you purchase fewer units when markets are down. Over time, this strategy can lead to better overall returns.

Disciplined Investing: STPs enforce a disciplined approach to investing. They remove the emotional aspect of investment decisions and ensure that you adhere to your financial plan regardless of market volatility.

Financial Goal Alignment: STPs are an excellent tool for accomplishing specific monetary objectives, such as retirement savings, house ownership, or supporting your child's education. Aligning your investments with these goals keeps you focused and motivated.

Final Thought

Systematic Transfer Plans (STPs) are a versatile and effective investment strategy. When carefully selecting source and target funds, defining transfer parameters, and registering STPs, you create a robust tool for your financial arsenal.

STPs offer the advantage of consistent investing while minimising market risks. By thoughtfully deploying STPs, you can position yourself for economic growth and stability over time. Take the step to explore STPs today and set yourself on a path toward consistent wealth building.

The views and opinions stated in the content belong to Chakrivardhan Kuppala, Co-founder and Executive Director at Prime Wealth Finserv Pvt. Ltd.

Disclaimer

The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications