From Titan - Cummins India: 3 Technical Trade Calls For The Week By Motilal Oswal

Based on technical analysis, the technical & derivatives team of Motilal Oswal Financial Services Ltd., a brokerage and distribution company, recommends buying three stocks this week. Cholamandalam Investment and Fin Co Ltd., Titan Company, and Cummins India have been selected by the research experts. The brokerage's exclusive stock recommendations and weekly charts are shown below.

Titan Company Share Price Target

BUY TITAN AT CMP: Rs 3530, STOP-LOSS: Rs 3420, TARGET: Rs 3750

Titan gave a range breakout on weekly scale after five weeks and formed a strong bullish candle. On daily scale the stock managed to surpass its crucial hurdle of 3450 zones and formed a double bottom price pattern which is a bullish price reversal pattern. It also managed to close above its short term moving averages and momentum indicator Relative Strength Index (RSI) is also moving northwards which indicates strength in the stock. Risk reward is quite favourable at the current juncture and thus we are recommending to buy the stock with keeping stop loss below 3420 levels on closing basis for a target towards 3750 zones.

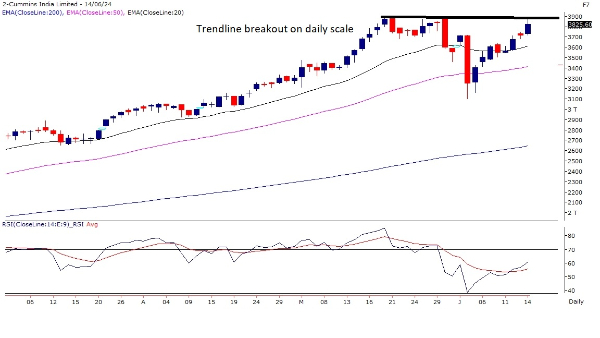

Cummins India

BUY CUMMINS INDIA AT CMP: Rs 3825, STOP-LOSS: Rs 3680, TARGET: Rs 4100

Cummins India is in overall uptrend and forming higher highs on monthly scale from the past seven months. On weekly scale the stock formed a strong bullish candle and negated the formation of lower highs after two weeks. On daily scale the stock is forming higher lows from the past few sessions and is on the verge of a trend line breakout. It is holding well above its short term moving averages and the stock is likely to scale new record high in coming sessions. Thus looking at the overall chart structure we are recommending to buy the stock with keeping the stop loss below 3680 levels on closing basis for a new high target towards 4100 zones.

Cholamandalam Investment and Fin Co

BUY CHOLA INVESTMENT AT CMP: Rs 1447, STOP-LOSS: Rs 1390, TARGET: Rs 1600

Chola Investment is in a strong uptrend and gave a consolidation breakout on monthly scale after eleven months. On weekly scale as well it gave classical Pole & Flag breakout and formed a strong bullish candle. On daily scale the stock is trading at life time high territory and structure of higher lows is intact from the past many sessions. The stock has been a huge outperformer in the financial space and is likely to scale new record highs. Thus looking at the overall chart structure we are recommending to buy the stock with keeping the stop loss below 1390 levels on closing basis for a new life time high target towards 1600 zones.

Disclaimer

The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications