Double Summer Bonanza For Investors As DCB Bank Hikes FD & Savings Account Rates

DCB Bank has hiked interest rates on savings accounts and fixed deposits of less than Rs 2 Cr as a pleasant summer offer to investors. This is like a double bonanza for those searching for more than 8% returns on both their savings accounts and FDs. Yes, you read correctly. As a result of the modification, DCB Bank is now offering savings account holders a maximum interest rate of 8%, while fixed deposit holders can earn as much as 8.55% for elderly people and as much as 8.05% for the general public.

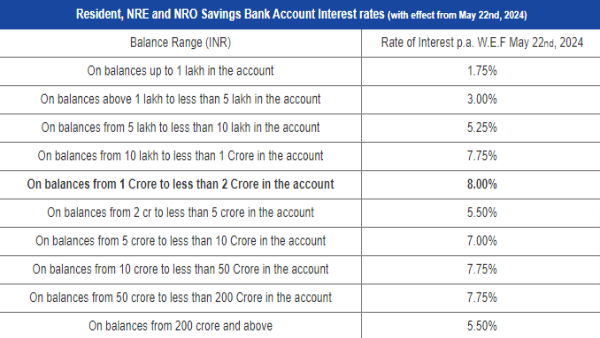

DCB Bank Savings Account Interest Rates

The bank offers an interest rate of 1.75% on balances up to Rs 1 lakh, whereas DCB Bank offers an interest rate of 3.00% on balances above Rs 1 lakh but less than Rs 5 lakh. Interest rates are being offered by DCB Bank at 5.25% for balances in the account between Rs 5 lakh and less than Rs 10 lakh, and 7.75% for balances between Rs 10 lakh and less than Rs 1 crore.

The highest interest rate on balances in the account between Rs 1 crore and less than Rs 2 crore is now 8%, while the return on balances between Rs 2 crore and less than Rs 5 crore is 5.50%. The bank offers an interest rate of 7.00% on balances in the account between Rs 5 crore and less than Rs 10 crore, while DCB Bank offers an interest rate of 7.75% on balances between Rs 10 crore and less than Rs 200 Cr. Currently, DCB Bank offers interest rates of 5.50% on account balances of 200 crore and more.

DCB Bank FD Rates

The bank is giving an interest rate of 3.75% on domestic term deposits under Rs 2 Cr that mature in 7 to 45 days, and 4.00% on those that mature in 46 to 90 days at DCB Bank. DCB Bank is providing a fixed deposit with a term of 91 days to less than 6 months at an interest rate of 4.75%, and a tenure of 6 months to less than 10 months at a return of 6.20%. Deposits that mature in 10 months to less than 12 months will now earn an interest rate of 7.25%, while deposits that mature in 12 months or less will earn 7.10%.

DCB Bank is giving an interest rate of 7.15% on fixed deposits maturing in 12 months 11 days to 17 months, while the bank will pay an interest rate of 7.75% on deposits maturing more than 12 months to 12 months 10 days. For a deposit duration of 17 months, 1 day to 18 months, 5 days, DCB Bank is giving an interest rate of 7.10%; for a tenure of 18 months, 6 days to less than 19 months, the rate is 7.40%. Deposits that mature between 19 and 20 months will provide an interest rate of 8.05%, while those that mature between 20 months and fewer than 700 days would yield a return of 7.40%.

The bank is paying an interest rate of 7.50% on term deposits maturing in 700 days to 26 months, and 7.55% on deposits maturing in more than 26 months to less than 37 months. For a term of 37 to 38 months, DCB Bank will pay interest at a rate of 7.75%; for a duration of more than 38 months but less than 61 months, the interest rate will be 7.40%. Fixed deposits that mature in 61 months will yield an interest rate of 7.65%, while those that mature in 120 months or more will provide an interest rate of 7.25%.

DCB Bank News

On Thursday, DCB Bank Limited declared that it has paid 9.99 crore to acquire a 5.81% shareholding in Annapurna Microfinance Private Limited. According to the bank's press release, DCB Bank and Annapurna Microfinance jointly unveiled the equity agreement.

Murali M. Natrajan, MD and CEO of DCB Bank said Annapurna and DCB Bank had a long and fruitful relationship since the microfinance institution's inception. "The initiative of acquiring a strategic equity stake in Annapurna further strengthens our business partnership. DCB Bank has a meaningful presence in microfinance segment, which helps to achieve its financial inclusion goals," he said, according to a report from PTI.

Click it and Unblock the Notifications

Click it and Unblock the Notifications