DICGC Insured SFB Revises Savings Account Rates, Now Get Up To 7.50%

ESAF Small Finance Bank (SFB) has revised its interest rates on savings accounts. The bank made this announcement on Saturday and is now offering up to 7.50% returns on savings bank deposits. As per the official website of ESAF SFB the new savings account interest rates are effective as of 01st July 2023 which customers should be aware of.

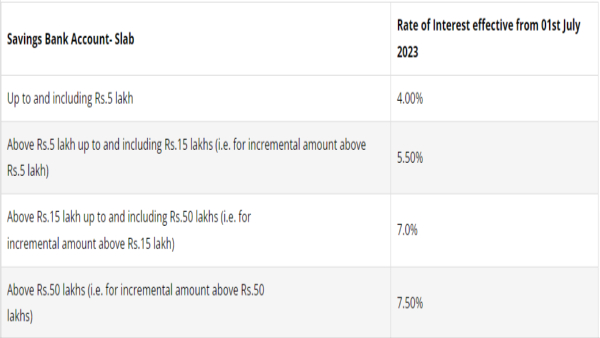

ESAF SFB Savings Account Interest Rates

On savings account balances of up to and including Rs.5 lakh, the bank is offering an interest rate of 4.00% and on above Rs.5 lakh up to and including Rs.15 lakhs, ESAF SFB is promising an interest rate of 5.50%. ESAF SFB is promising an interest rate of 7.0% on savings account balance of above Rs.15 lakh up to and including Rs.50 lakhs and an interest rate of 7.50% on savings account balance of above Rs.50 lakhs.

According to ESAF SFB, interest rates on savings bank accounts will be calculated according to end-of-day balances and credited to accounts once a month. Rates of interest are subject to periodic modification.

For the fiscal year that ended on March 31, 2023, ESAF Small Finance Bank reported a rise in net profit of more than four times, reaching Rs. 302.33 crore. From Rs 2,927.40 crore to Rs 3,137.45 crore, the total CASA jumped by 7.18 percent. Compared to the fourth quarter of the previous year, when the net profit was Rs 37.41 crore, the net profit was Rs 101.38 crore in Q4FY23.In FY23, Gross NPA and Net NPA dropped from 7.83 percent and 3.92 percent, respectively, to 2.49 percent and 1.13 percent, respectively.

A year before, the bank made a profit of Rs 54.73 crore. In comparison to FY22, when total business was Rs 25,155.76 crore, it climbed by 23.22 percent to Rs 30,996.89 crore in FY23. For the fiscal year that ended on March 31, 2023, deposits climbed 14.44 percent, from Rs 12,815.07 crore to Rs 14,665.63 crore. As of March 31, 2023, Gross Advances grew by 16.38 percent, from Rs 12,130.64 crore to Rs 14,118.13 crore. Operating profit climbed by 81.70 percent to Rs 893.71 crore for the fiscal year from Rs 491.85 crore. To reach Rs 1,836.34 crore, the Net Interest Income increased by 60.08 percent.

Meanwhile, IDFC First Bank announced interest rates revision on savings accounts and fixed deposit (FD) on 1st July 2023. In accordance with the modification, the bank is now allowing savings bank deposits to earn a maximum return of 7% and fixed deposit accounts can earn as high as 7.50%.

Click it and Unblock the Notifications

Click it and Unblock the Notifications