DCB Bank Revises FD Rates, Earn As High As 8% On These Tenures

DCB Bank has revised its interest rates on fixed deposits (FD) of less than Rs 2 Cr according to an announcement made on Wednesday. Upon the modification, interest rates for the general public will now range from 3.75% to 7.75%, while those for elderly people will range from 4.25% to 8.25% on maturities ranging from 7 days to 120 months. A maximum regular interest rate of 8% and 8.50% is currently being offered to senior citizens by DCB Bank on fixed deposit terms ranging from 700 days to 36 months. According to the official website of the bank, the new FD rates are effective as of 28th June 2023.

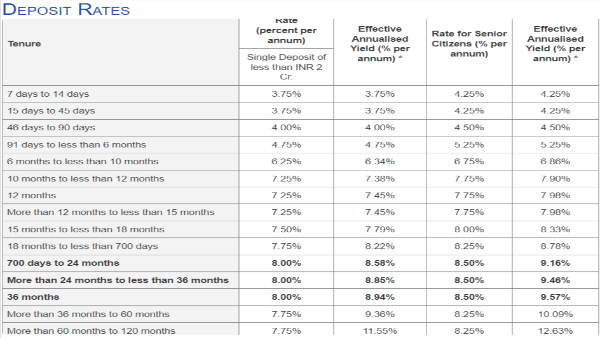

DCB Bank FD Rates

The bank is giving an interest rate of 3.75% on fixed deposits that mature in the next 7 days to 45 days, while DCB Bank is offering an interest rate of 4.00% on deposits that mature in the next 46 days to 90 days. The interest rate offered by DCB Bank is 4.75% for deposits held for 91 days to less than 6 months and 6.25% for deposits held for 6 months to less than 10 months. Deposits that mature in 10 to 15 months will now earn interest at 7.25%, while those that mature in 15 to 18 months will earn interest at 7.50%. The bank is now offering an interest rate of 7.75% on fixed deposits maturing in 18 months to less than 700 days, while DCB Bank is at present paying an interest rate of 8% on deposits maturing in 700 days to 36 months. A 7.75% interest rate will be charged on deposits that mature in a period of time between 36 and 120 months.

source:DCB Bank website

DCB Bank has recently announced the implementation of a new Direct Tax collection system integrated with the Government of India Income Tax Portal (TIN 2.0). Customers of DCB Bank can conveniently pay their Direct Taxes through three main channels: personal and business internet banking, branch visits, and make use of payment methods including cash, cheque, or demand draft. By registering an account on the e-filing site for the Income Tax Department, customers can use the tax collection platform and get a challan reference number with PAN/TAN information for their tax payments.

DCB Bank, Head Retail Banking, Mr. Praveen Kutty said, "DCB Bank provides taxpayers with a quick, secure and efficient direct tax payment facility. This online facility is convenient and enables taxpayers to submit the payment from the comfort of their home or office, resulting in substantial time and cost saving. The process involves the benefit of instant payment acknowledgement and the issuance of a challan receipt, all without incurring any charges. Our grateful thanks to the Central Board of Direct Taxes (CBDT), Government of India for their support in this endeavour."

As of the end of March 2023, DCB Bank maintained 427 branches in India with almost one million customers.

Click it and Unblock the Notifications

Click it and Unblock the Notifications